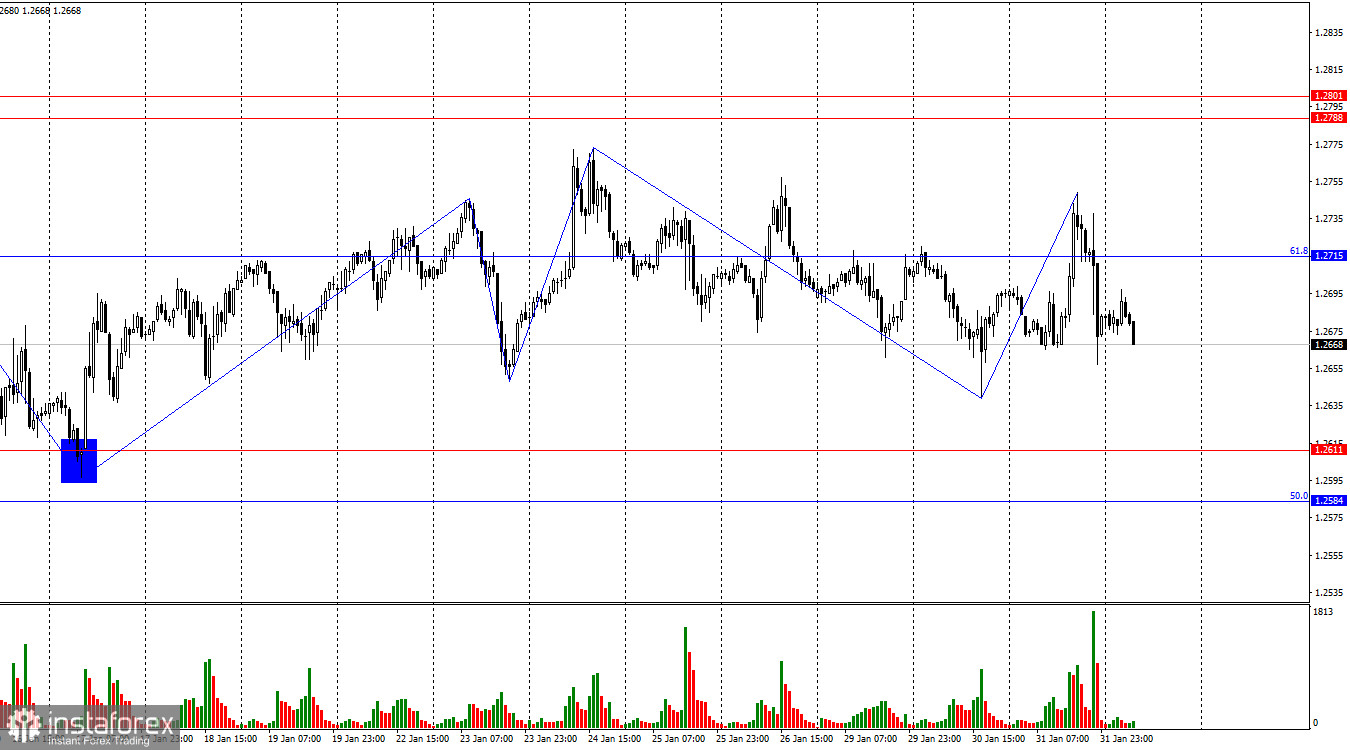

On the hourly chart, the GBP/USD pair on Wednesday rose to the corrective level of 61.8% (1.2715). However, after Jerome Powell's speech in the evening, it executed a reversal in favor of the US dollar and began a new downward process towards the support zone of 1.2584–1.2611. A bounce of quotes from this zone today will favor the British pound and new growth towards 1.2715. Consolidating the pair's rate below the support zone will finally end the one-and-a-half-month horizontal movement and allow us to anticipate a strong decline in the British pound.

The wave situation remains very ambiguous. Trends are currently quite short-term; almost all the time, we see single waves that alternate and are approximately the same size. The "bullish" sentiment among traders persists only due to the inability of the bears to close below the level of 1.2584. Thus, the sideways movement is maintained and will continue until the pair exits the zone of 1.2584–1.2801.

The information background on Wednesday was very strong. There was no news in the UK, but the ADP report in the US added strength to the bulls, and Jerome Powell's speech after the FOMC meeting supported the bears. The Federal Reserve Chairman took a fairly "hawkish" position, practically openly rejecting a rate cut by the FOMC in March. He noted that inflation is still too high, and the state of the economy is positive, allowing the regulator to keep the rate at its peak since 2001 for a longer period. Traders were expecting more "dovish" rhetoric, which led to the dollar showing growth.

However, the sideways movement persists, and today, everything will depend on the final statement of the Bank of England on the MPC. In it, traders will also look for hints on the timing of interest rate cuts.

On the 4-hour chart, the pair rebounded from the level of 1.2745 and continued the downward process towards 1.2620. No imminent divergences are observed with any indicator today, and quotes have exited the ascending trend corridor. The trend may continue to shift to "bearish," but this will take time and require significant efforts from the bears, especially the closure below the level of 1.2620. The sideways trend for the British pound is still visible to the naked eye.

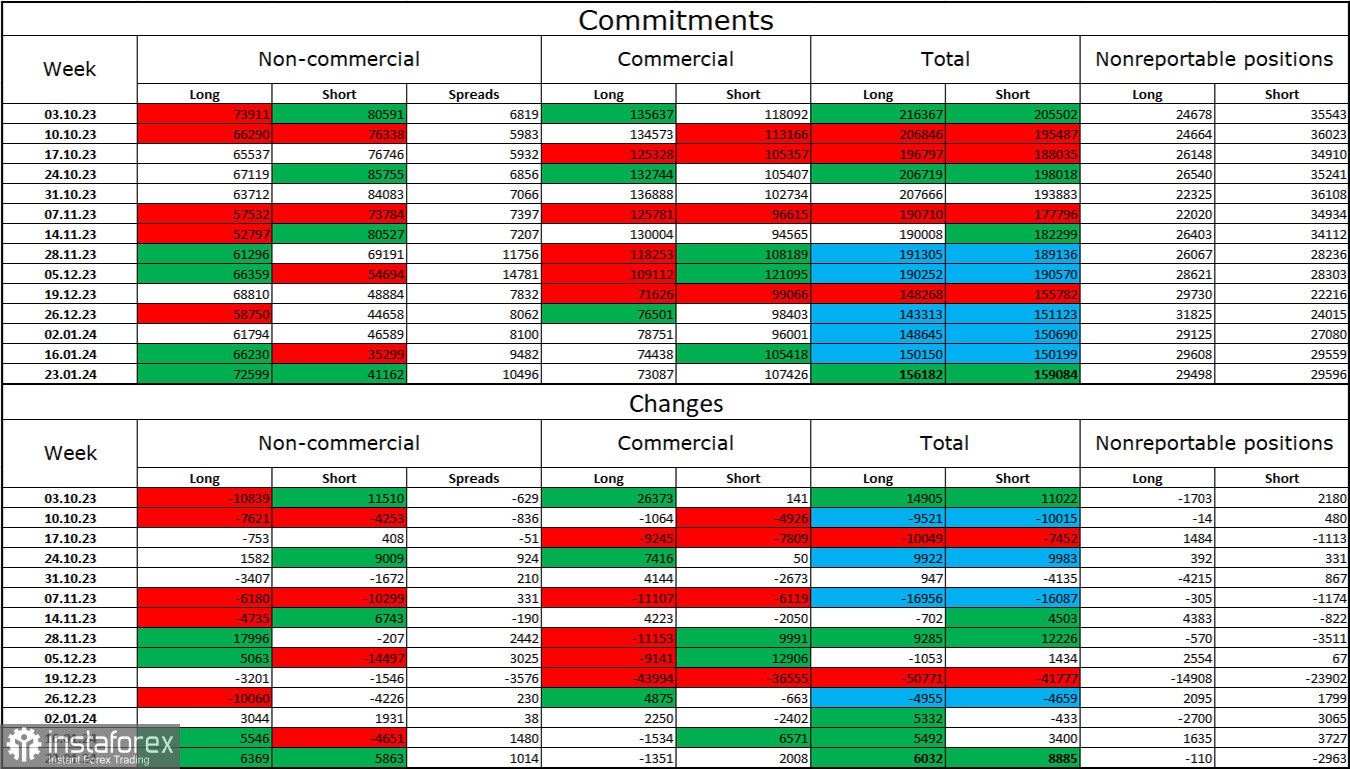

Commitments of Traders (COT) report:

The sentiment in the "non-commercial" trader category did not change over the past reporting week. The number of long contracts held by speculators increased by 6,369 units, and the number of short contracts increased by 5,863. The overall sentiment of major players shifted to "bearish" several months ago, but at present, bulls have a significant advantage. There is an almost twofold gap between the number of long and short contracts: 73 thousand versus 41 thousand.

There are excellent prospects for the British pound to decline. Over time, bulls will continue to unwind buy positions, as all possible factors for buying the British pound have already been exhausted. The growth we have seen in the last three months is corrective. For over a month, bulls have been unable to overcome the level of 1.2745. However, the bears are in no hurry to go on the offensive and cannot cope with the zone of 1.2584-1.2611.

News calendar for the US and the UK:

UK - Manufacturing Purchasing Managers' Index (09:30 UTC).

UK - Bank of England Rate Decision (12:00 UTC).

UK - Bank of England Monetary Policy Summary (12:00 UTC).

US - Initial Jobless Claims (13:30 UTC).

US - Manufacturing Purchasing Managers' Index (14:45 UTC).

US - ISM Manufacturing Purchasing Managers' Index (15:00 UTC).

The economic events calendar on Thursday includes several important entries in the US and the UK. The impact on the market sentiment of the information background today can be significant.

Forecast for GBP/USD and trader recommendations:

I will not consider selling the British pound today, as there are no signals, and the level of 1.2715 is being ignored. I do not see signals to buy either, but a rebound from the support zone of 1.2584 - 1.2611 may be one. In this case, purchases are possible with a target of 1.2715. Sales will be possible with a close below the support zone of 1.2584-1.2611, with targets at 1.2513 and 1.2453.