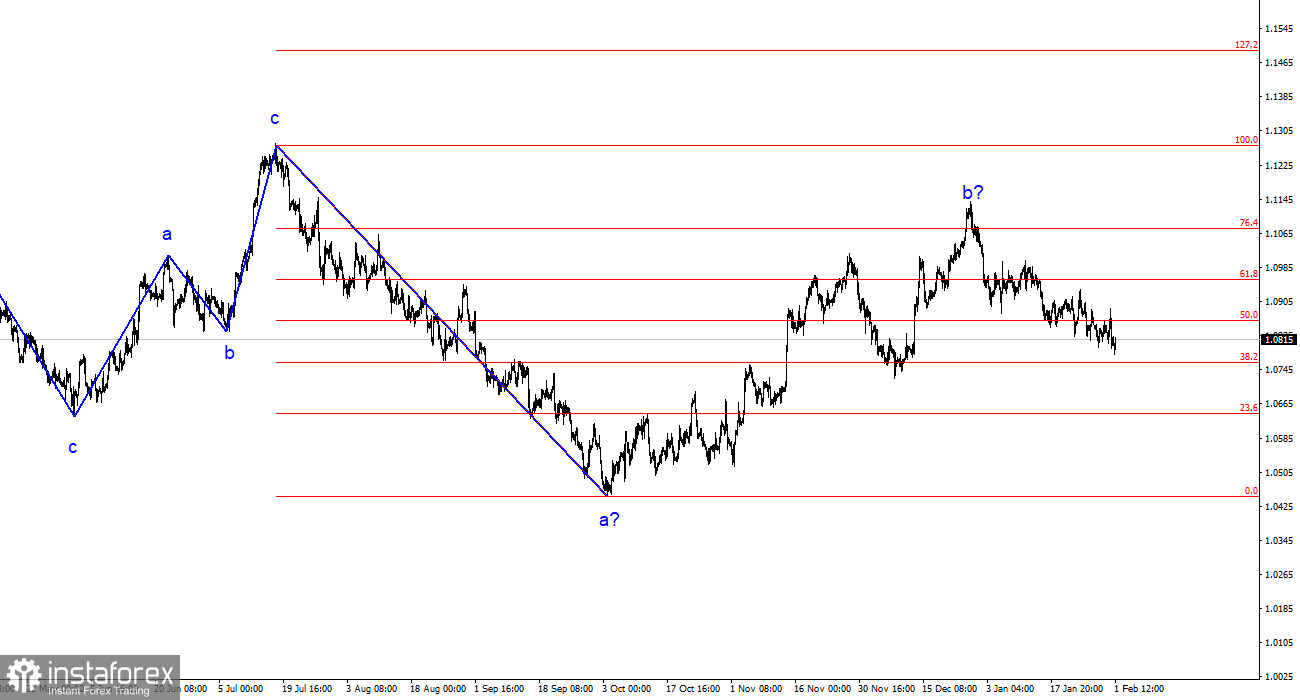

The wave analysis of the 4-hour chart for the euro/dollar pair remains unchanged. In the past year, we have observed only three wave structures that constantly alternate with each other. At present, the construction of another three-wave downward structure is continuing. The presumed waves 1 is completed, but wave 2 or b has become more complex three or four times, and there are no guarantees that it will not complicate further.

Although the news background cannot be considered "supportive of the European currency," the market regularly finds reasons to increase demand for the euro. Such a situation does not reflect the real picture in the currency market. The upward trend segment may resume, but its internal structure will become unreadable.

The internal wave analysis of the presumed wave 2 or b has changed. Since the last downward wave was disproportionately large, I now interpret it as wave b. If this is the case, wave 3 or c is currently being constructed, and the entire wave 2 or b is completed. The current pullback from the achieved highs looks convincing.

FOMC meeting and inflation in the EU

The euro/dollar pair decreased by 30 basis points on Wednesday and began recovering on Thursday. I did not see any significant movements that could be considered strong and important for the current wave pattern after the FOMC meeting, the inflation report in the EU, or the Bank of England meeting. By and large, the market continued to trade as it did before all the events above. The gradual decline of the European currency continues, with the euro losing about 20 basis points daily. At this pace, the targets will be reached later.

Last night, the FOMC summed up the results of this year's first meeting. At a press conference, interest rates remained unchanged, but Jerome Powell cast doubt on the rate cut in March. He openly stated that inflation this year would decrease more slowly than in the past, and at certain times, upward risks may work against the Fed's goals. Based on this, there is no time to discuss a rate cut. Moreover, the Fed is ready to keep rates longer if the situation requires it. At the same time, the labor market is crucial for the US economy and its growth, so the FOMC will closely monitor any changes in it and react to them. Tomorrow, we will bring the latest Nonfarm Payrolls and unemployment reports.

As for inflation in the European Union, it decreased in January to 2.8% annually, coinciding with market expectations. Core inflation slowed to 3.3%, also in line with analysts' forecasts.

General Conclusions:

Based on the conducted analysis, I conclude that the construction of a bearish wave set continues. Wave 2 or b has taken a completed form, so in the near future, I expect the continuation of the construction of a downward impulse wave 3 or c with a significant decrease in the pair. The unsuccessful attempt to break through the 1.1125 mark, corresponding to 23.6% Fibonacci, indicated the market's readiness for sales a month ago. I am only considering sales with targets around the calculated mark of 1.0462, corresponding to 127.2% Fibonacci.

On the higher wave scale, the presumed wave 2 or b, which in length is already more than 61.8% Fibonacci from the first wave, may be completed. If this is indeed the case, then the scenario with the construction of wave 3 or c and a decrease in the pair below the 1.04 figure has begun to unfold.