Two members of the Monetary Policy Committee voted in favor of a rate hike, and this made a lasting impression on market participants. There were active discussions about the Bank of England being the last of the major central banks to start easing its monetary policy. This became the main driving force that pushed the pound higher. It is quite noteworthy that such speculations, and even statements, started to spread as soon as the US trading session opened, which is when the main movement towards the British currency's growth took place. However, there is a sense that one extremely noteworthy fact is deliberately being ignored. Namely, that one voted for a quarter-point cut. No one voted for this before. In other words, there is no consensus within the BoE on monetary policy, indicating that the British central bank may find it challenging to understand what to do in the current realities. This is quite dangerous, as it may lead to rash or delayed actions, which, in turn, could have an extremely negative impact on the economy as a whole. Therefore, the pound's current growth should be viewed as speculative, especially considering the media's disregard for the actual distribution of votes on monetary policy.

Nevertheless, this won't immediately affect the British currency. The momentum is quite strong. Moreover, forecasts for today's report from the United States Department of Labor are negative. There are concerns that the unemployment rate may increase from 3.7% to 3.8%. Even if the unemployment rate remains unchanged, the number of new non-farm jobs will play a role. According to the most optimistic forecasts, there should be around 180,000 new jobs. Given the population size and its growth rate, the United States needs to create approximately 250,000 new jobs each month to maintain labor market stability. So, unless the data significantly exceeds expectations, the dollar may weaken further.

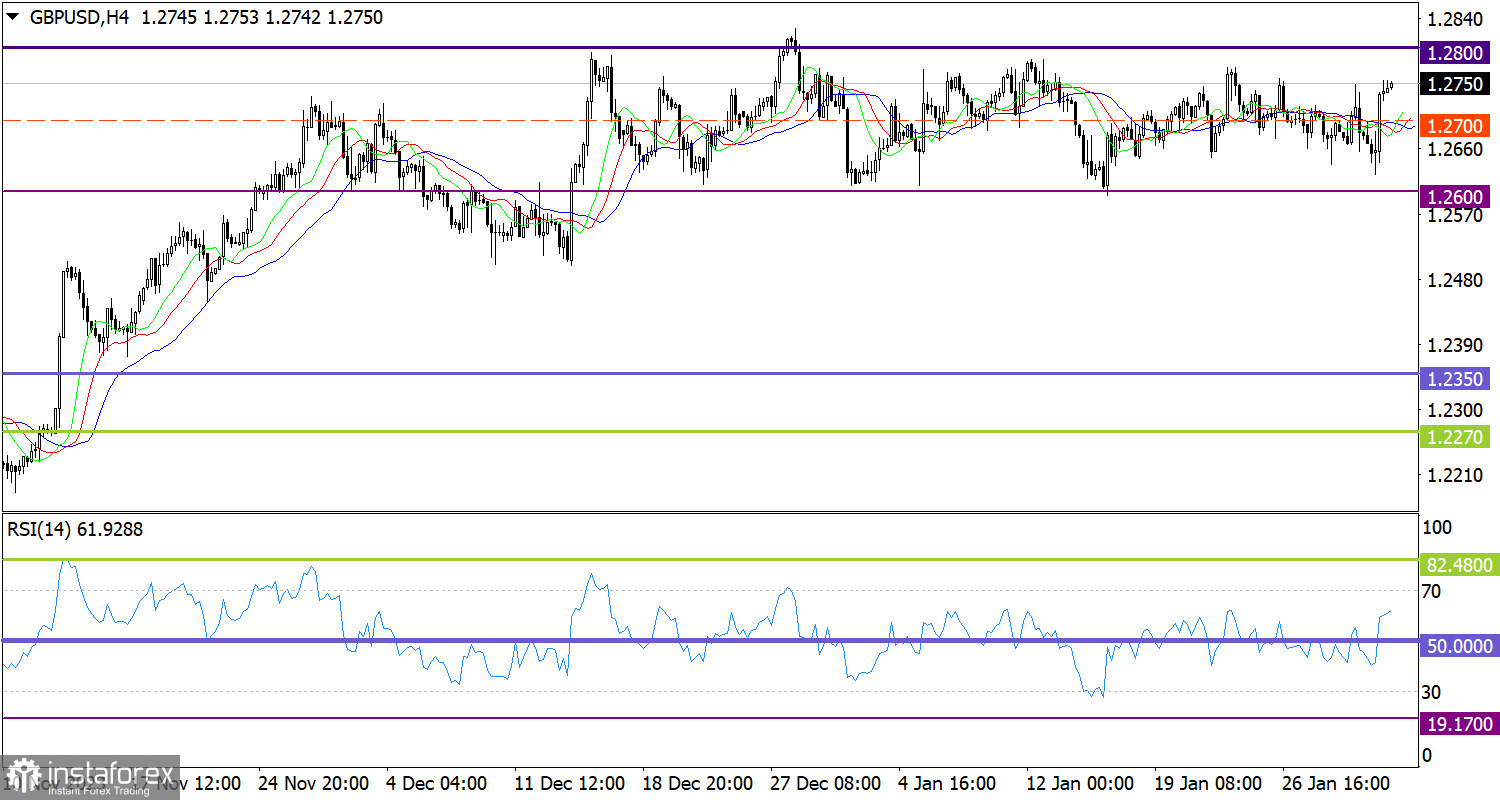

Although the GBP/USD pair experienced unusually high volatility on Thursday, the quote continues to stay within the range of the sideways channel of 1.2600/1.2800. Based on price fluctuations, the price bounced from the lower boundary of the channel, and returned to its upper range of 1.2700/1.2800.

On the four-hour chart, the RSI technical indicator is hovering in the upper area of 50/70, which points to the growth in the volume of long positions within the channel.

On the same time frame, the Alligator's MAs are intersecting each other, confirming the current flat market.

Outlook

If we follow the theory of working within the channel, the convergence between the price and the upper boundary of the area will lead to a decrease in buying volumes. In this case, the most effective tactic would be trading on the rebound. However, the scale of the channel indicates how unstable it is. Therefore, a breakout can take place at any moment, triggering a new round of speculation. However, we don't know when this moment will come. For this reason, traders always anticipate a possible breakout of one or the other boundary of the established flat.

The complex indicator analysis suggests a bullish sentiment within the structure of the sideways channel in the short-term and intraday periods.