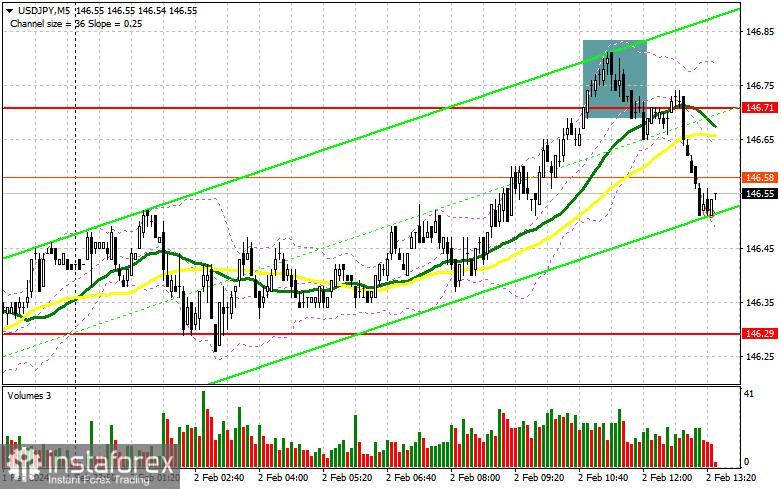

In my morning forecast, I drew attention to the level of 146.71 and planned to decide on market entry based on it. Let's look at the 5-minute chart and analyze what happened there. The rise and the formation of a false breakout around 146.71 led to an excellent entry point for selling the dollar, resulting in a drop of more than 20 points. The technical picture was slightly reassessed for the second half of the day.

To open long positions on USD/JPY, the following is required:

No one is in a hurry to buy the US dollar, especially in anticipation of important US labor market statistics, which could disappoint significantly, pushing the Federal Reserve to more active actions to lower interest rates. This, of course, is bad for the US dollar and its strength. The unemployment rate and changes in the number of employed in the non-agricultural sector will be decisive for the pair's direction. Weak reports with an increase in unemployment and a sharp reduction in the number of employed will lead to a new decline in USD/JPY, which I plan to take advantage of.

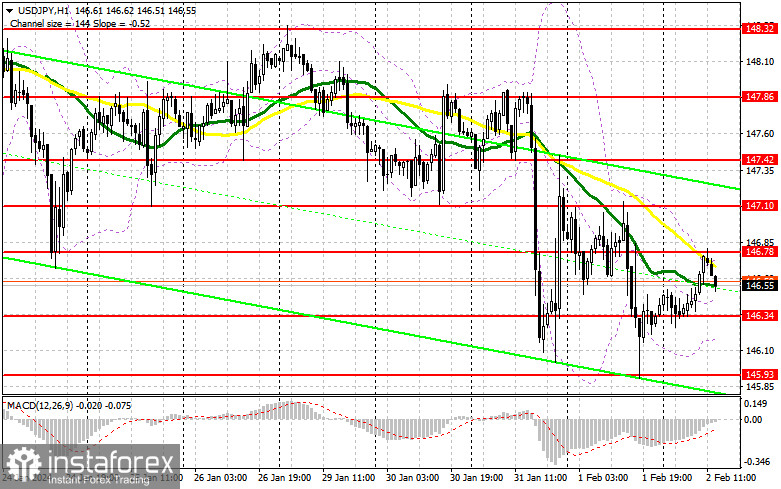

I plan to act on buying in the second half of the day according to the morning plan as low as possible and after forming a false breakout around 146.34. Good data on the US labor market will be the key to the success of the upward trend in the dollar with the target of another update to the level of 146.78, which we failed to break above in the first half of the day. A breakthrough and a reverse test from top to bottom of this range will lead to another scenario of increasing long positions, capable of pushing USD/JPY up to around 147.10. The ultimate target will be the area of 147.42, where I plan to make a profit. In the scenario of a pair's decline and the absence of activity from buyers at 146.34 in the second half of the day, pressure on the dollar will intensify, leading to another major sell-off in continuation of the new trend. In this case, I will try to enter the market around 145.93 – the last hope for buyers. Only a false breakout will there be a good condition for opening long positions. I plan to buy USD/JPY immediately on the rebound, only from the minimum, around 145.61, with the target of a correction of 30-35 points within the day.

To open short positions on USD/JPY, the following is required:

Sellers have made themselves known, but a major dollar sale has yet to be achieved. Many are now counting on US data and a weak labor market. Bears must defend the resistance at 146.78 in case of another bearish move, slightly below the moving average intersection. A false breakout there, similar to what I analyzed, will be a suitable scenario for selling, with the target of a decrease to around 146.34. After the data, a breakthrough and a reverse test from the bottom to the top of this range will deal a more serious blow to buyer positions, leading to the removal of stop orders and opening the way to 145.93. The ultimate goal will be the area of 145.61, where I plan to make a profit. In the scenario of USD/JPY growth and the absence of activity at 146.78 in the second half of the day, as well as strong data on the number of employed in the non-agricultural sector in the US, buyers will regain the advantage. In this case, postponing sales until testing the next resistance at 147.10 is best. If there is no downward movement, I will sell USD/JPY immediately on the rebound from 147.42, but only counting on a pair correction down by 30-35 points within the day.

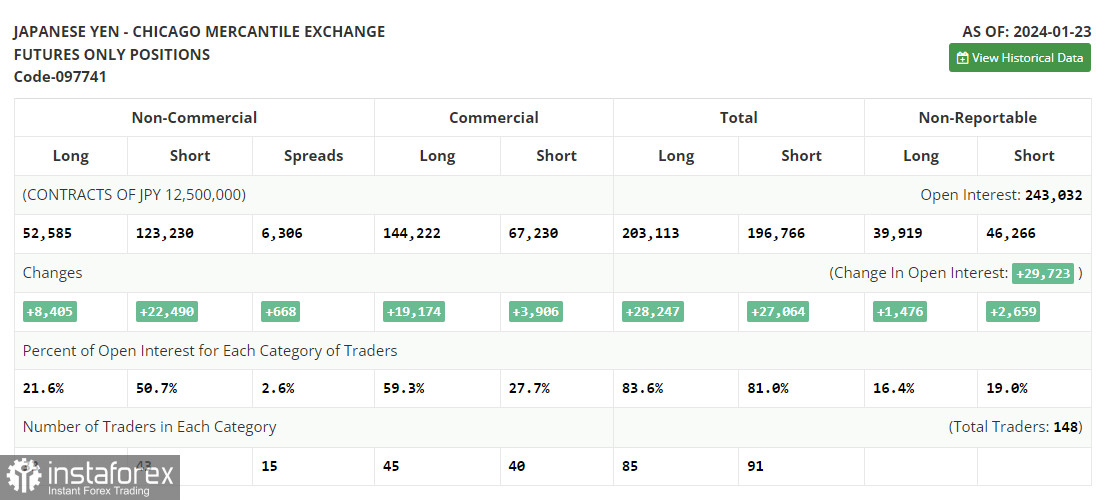

In the COT report (Commitment of Traders) for January 23rd, there was an increase in both long and short positions. The results of the Bank of Japan meeting indicated that no one intends to deviate from their position on normalizing monetary policy despite the slowdown in inflationary pressure, which aligns with the regulator's expectations. Against this background, demand for the yen returned, but so far, it has only limited the development of the bullish market observed in the pair since the beginning of the year. Everything will be decided at the next meeting of the Federal Reserve, the tough position of which may lead to a resumption of the bullish market and the renewal of annual highs. The latest COT report states that long non-commercial positions increased by 8,405 to 52,585, while short non-commercial positions jumped by 22,490 to 123,230. As a result, the spread between long and short positions increased by 668.

Indicator Signals:

Moving Averages

Trading is conducted around the 30 and 50-day moving averages, indicating market uncertainty.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differs from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline, the lower boundary of the indicator, around 146.30, will act as support.

Indicator Descriptions:

- Moving Average (determines the current trend by smoothing volatility and noise). Period – 50. Marked on the chart in yellow.

- Moving Average (determines the current trend by smoothing volatility and noise). Period – 30. Marked on the chart in green.

- MACD Indicator (Moving Average Convergence/Divergence – Convergence/Divergence of Moving Averages) Fast EMA – period 12. Slow EMA – period 26. SMA – period 9.

- Bollinger Bands. Period – 20.

- Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between non-commercial traders' short and long positions.