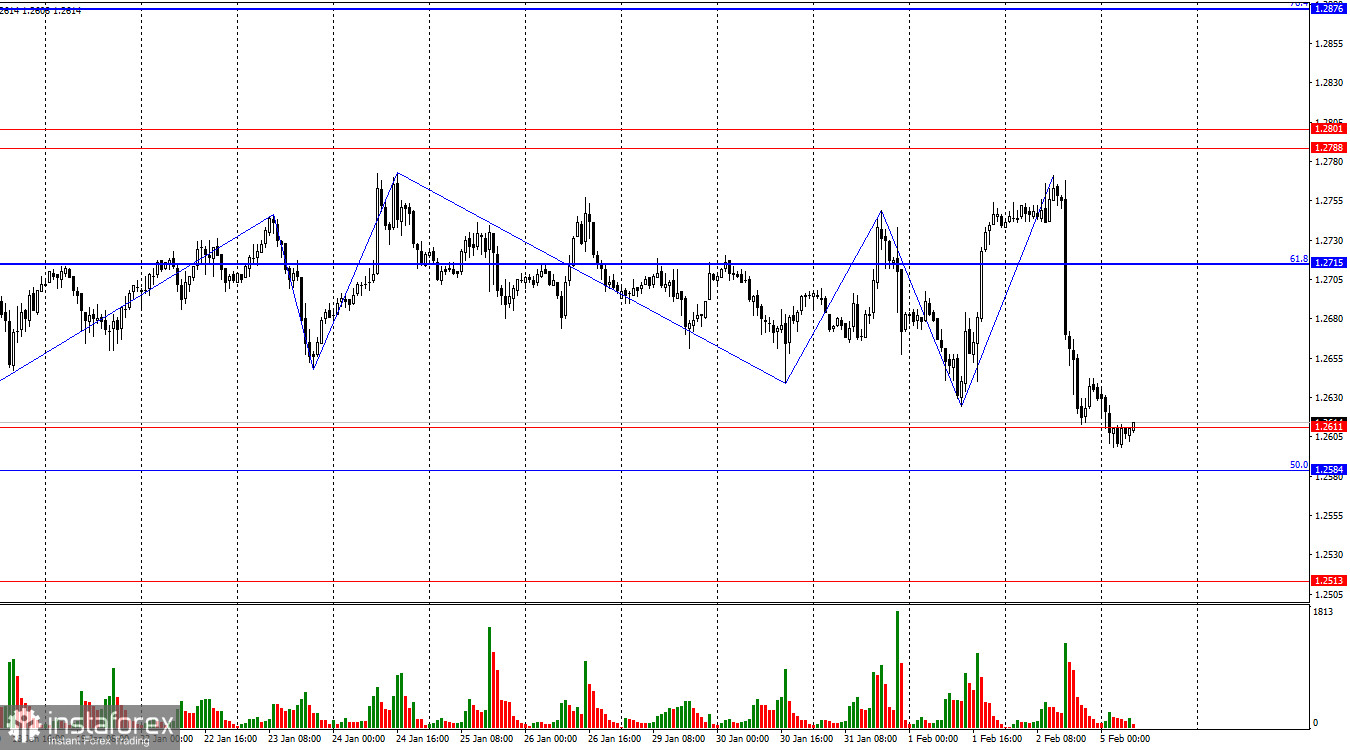

On the hourly chart, the GBP/USD pair reversed in favor of the American currency last Friday, leading to a decline toward the support zone of 1.2584–1.2611. A rebound of quotes from this zone will favor the British pound, initiating new growth towards the corrective level of 61.8% (1.2715). The consolidation of the pair's rate below the zone of 1.2584–1.2611 will allow traders to expect a continuation of the decline towards the level of 1.2513.

The wave situation remains highly ambiguous. The trends are currently quite short-term; almost always, we see single waves or triplets that alternate with each other and are approximately the same size. The "bullish" sentiment among traders persists only because of the bears' inability to close below the level of 1.2584. Thus, the sideways movement will continue until the pair exits the zone of 1.2584–1.2801. The last two "triplets" look almost mirror-like. The last upward wave broke the previous peak, and the last downward wave broke the previous low.

The information background on Friday was very strong. Nonfarm Payrolls and unemployment turned out better than traders' expectations, but in addition to them, the consumer sentiment report from the University of Michigan also exceeded forecasts. Thus, if bulls were counting on support from secondary indicators on Friday, they were mistaken. Unfortunately, even such a strong set of statistics was not enough for bears to overcome the magical zone of 1.2584–1.2611. A rebound from it may occur today, leaving the British pound within the horizontal channel. We will witness single waves and triplets within the horizontal corridor for another couple of weeks, which is extremely difficult to use in trading.

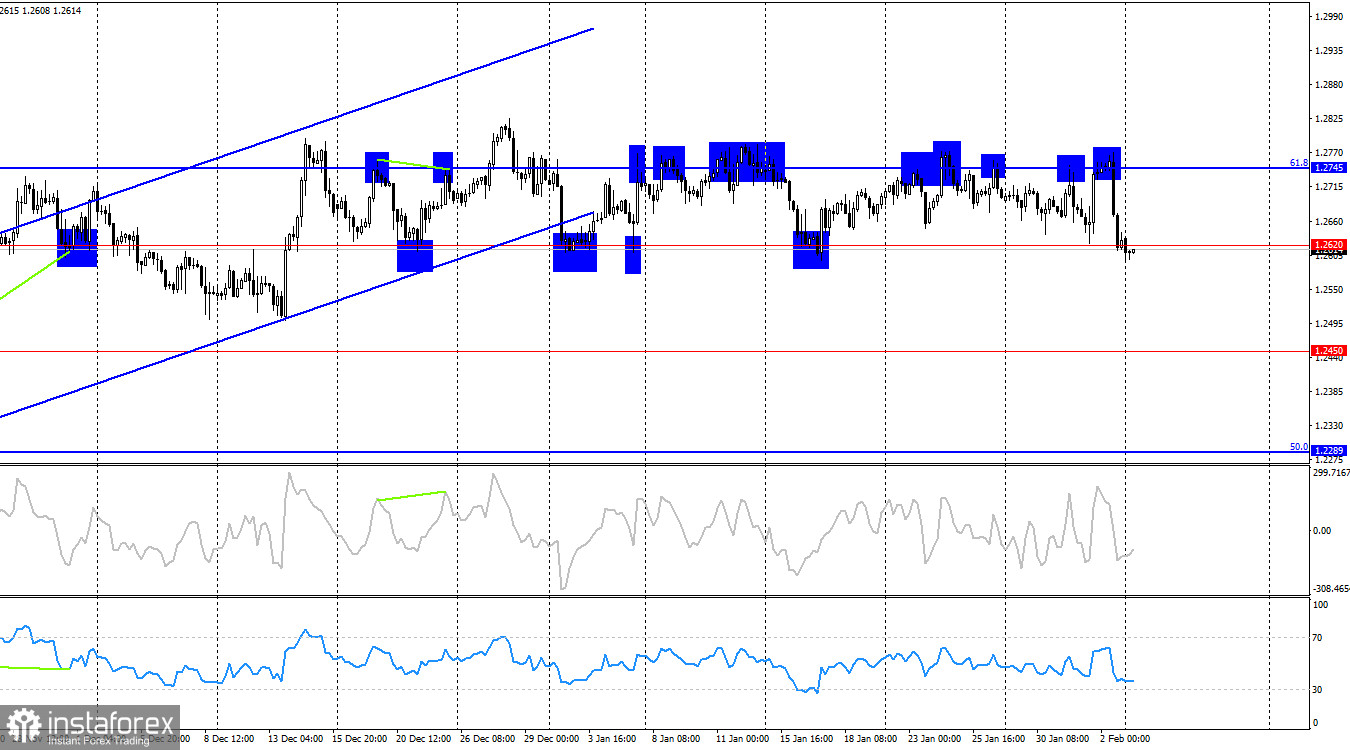

On the 4-hour chart, the pair made another rebound from the level of 1.2745 and fell to 1.2620. A new rebound from this level will again work in favor of the British pound, leading to new growth towards the level of 1.2745. There are no impending divergences today in any indicator, and the quotes abandoned the ascending trend corridor a month ago. The trend may continue to shift to "bearish," but it will take time and require significant efforts from the bears, especially closing below the level of 1.2620. The sideways movement for the British pound persists and is visible to the naked eye.

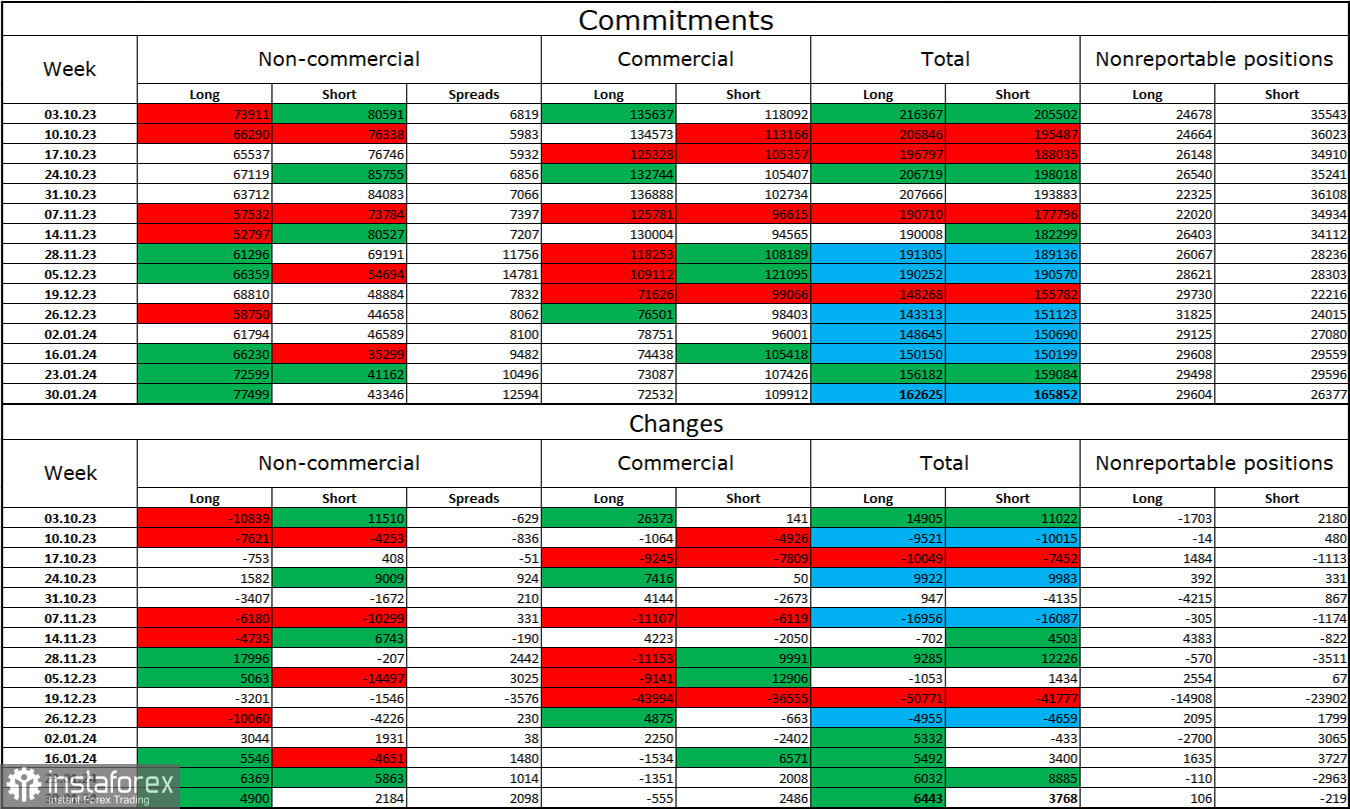

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category has not changed much over the last reporting week. The number of long contracts held by speculators increased by 4900 units, while the number of short contracts increased by 2184. The overall sentiment of major players changed to "bearish" several months ago, but at the moment, bulls still have a significant advantage. There is an almost twofold gap between the number of Long and Short contracts: 77 thousand versus 43 thousand.

The British pound still has excellent prospects for decline. Over time, bulls will start getting rid of buy positions since all possible factors for buying the British pound have already been worked out. The growth we have seen in the last three to four months is corrective. Bulls have been unable to push through the level of 1.2745 for almost two months. However, the bears are not rushing to go on the offensive and cannot cope with the zone of 1.2584–1.2611.

News Calendar for the United States and the United Kingdom:

United Kingdom – Business Activity Index in the Services Sector (09:30 UTC).

United States – Business Activity Index in the Services Sector (14:45 UTC).

United States – ISM Business Activity Index in the Services Sector (15:00 UTC).

On Monday, the economic events calendar contains several entries, the most important being the ISM index in the United States. The impact of the information background on market sentiment today may be of moderate strength.

Forecast for GBP/USD and Trader Recommendations:

Today, selling the pair can be considered if it consolidates below the support zone of 1.2584 – 1.2611 with a target of 1.2513. Purchases will be possible on a rebound from the specified zone on the hourly chart with a target of 1.2715.