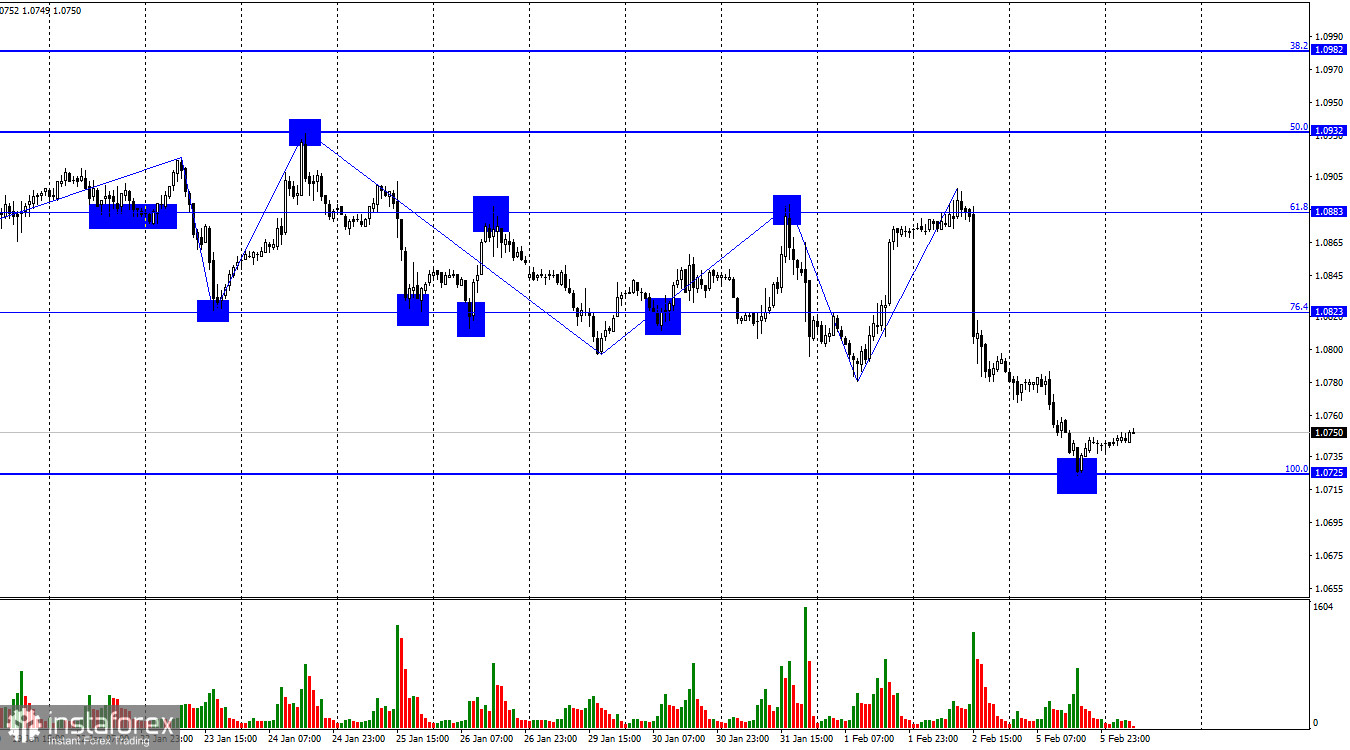

On Monday, the EUR/USD pair continued the process of falling towards the corrective level of 100.0% (1.0725). The rebound of the pair's exchange rate from this level allows us to count on a reversal in favor of the European currency and some growth in the direction of the Fibo level of 76.4%–1.0823. The consolidation of quotes below the level of 1.0725 will increase the likelihood of a further fall toward the next level of 1.0644.

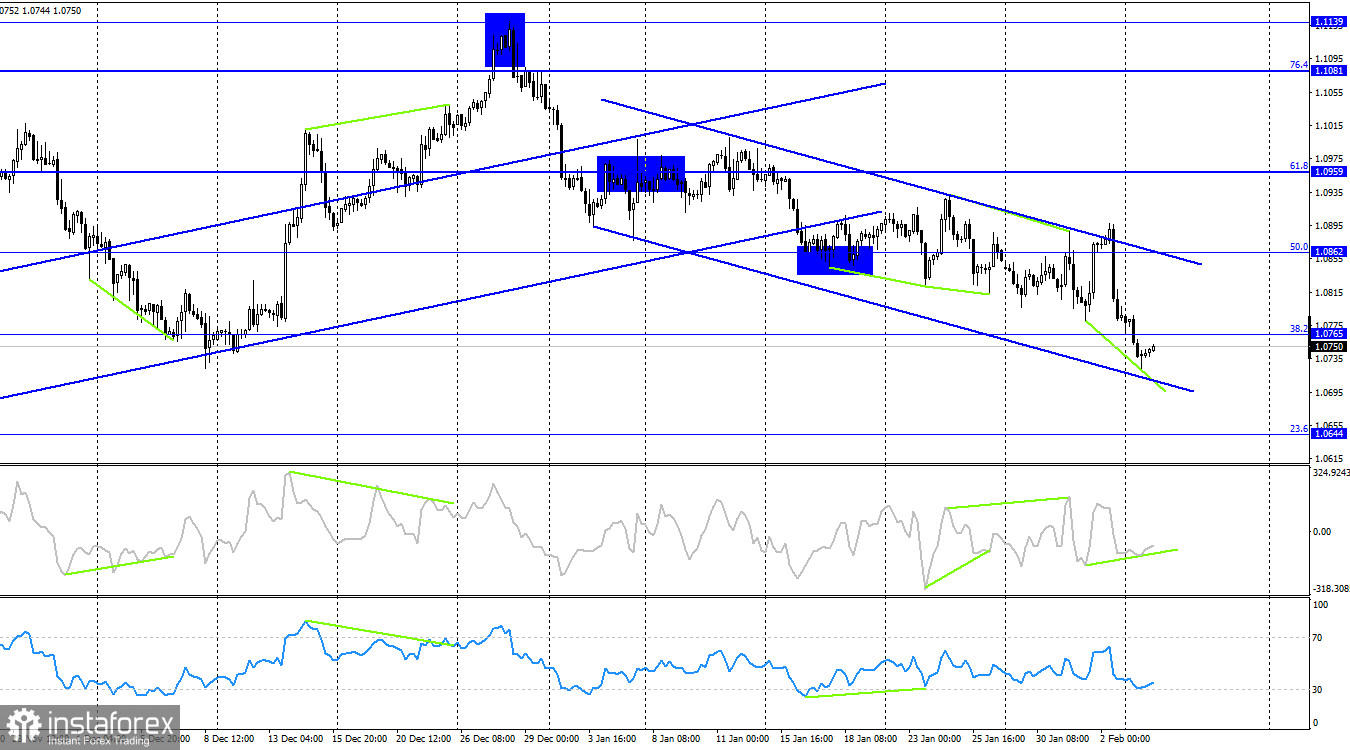

The situation with the waves remains ambiguous and is only getting more confusing every day. The bearish trend is undeniable, but the waves are very strange. The last wave broke the peak of the previous wave, but only by a few points. A new downward wave also broke through the lows of the previous wave. Everything suggests that the "bearish" trend persists, but the waves are currently about the same size. We do not see clearly defined impulse and corrective waves, but at the same time, we can count on the continuation of the fall of the European currency. However, the current picture shows that the bears have a rather weak advantage and a strong fall in the euro currency should not be expected.

The background information on Monday was interesting. The calendar of economic events contained only a few reports, but the day began with the news that Jerome Powell gave an interview on television and reported once again about the low probability of easing the PEPP at the March meeting. Let me remind you that last week, Powell also made it clear to the market that the first interest rate cut should be expected no earlier than May. And even in this case, everything will depend on the dynamics of inflation and other economic indicators. Dollar bulls cheered up after this information and have been terrorizing the euro for two days now. In the European Union, reports for January on business activity in the services sector were released yesterday, but they had a very weak impact on the mood of traders.

On the 4-hour chart, the pair performed a new reversal in favor of the US currency after rebounding from the upper line of the downward trend channel and falling below the Fibo level of 38.2%–1.0765. This consolidation allows us to count on the continuation of the fall towards the next corrective level of 23.6%–1.0644, but at the moment a "bullish" divergence is brewing in the CCI indicator, which may work in favor of the euro currency and growth towards the upper line of the downward trend corridor.

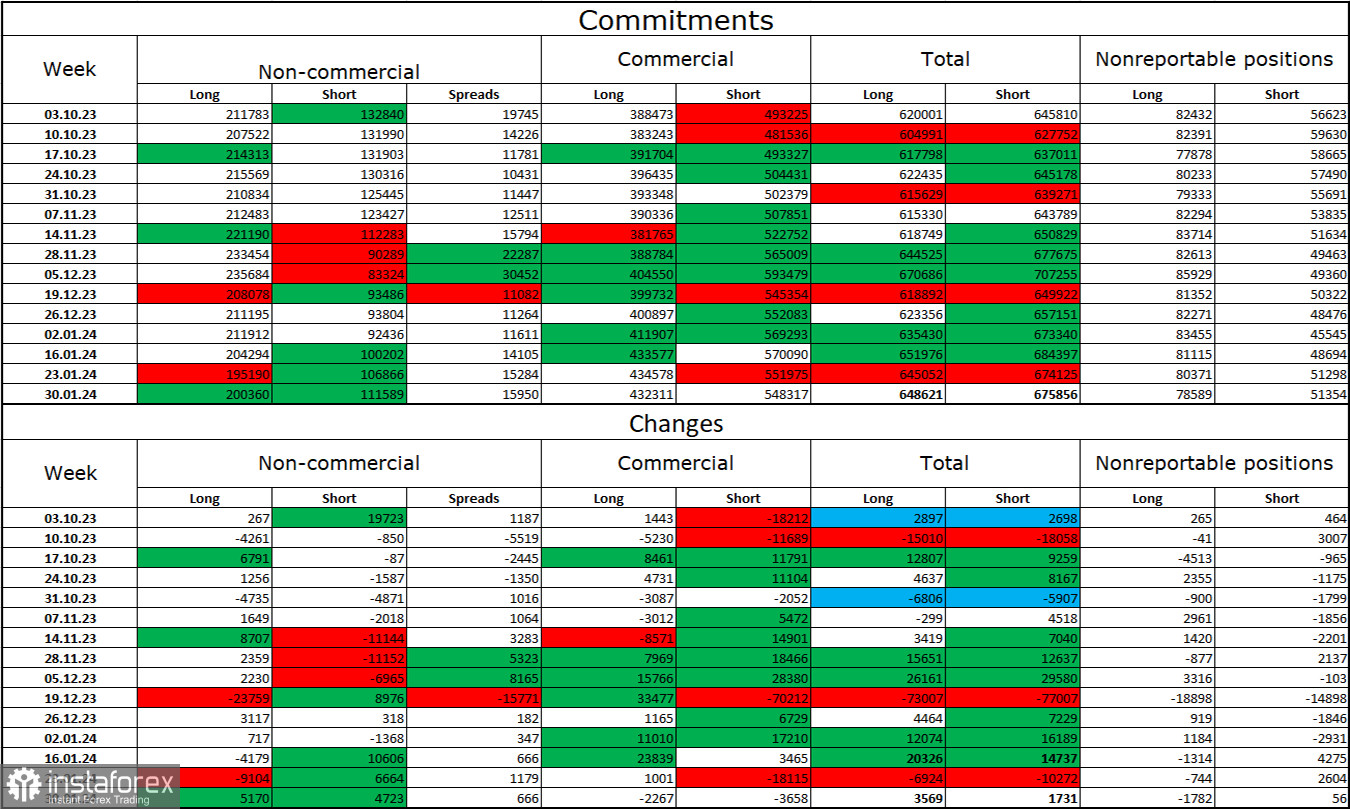

Commitments of Traders (COT) Report:

In the last reporting week, speculators opened 5,170 long and 4,723 short contracts. The mood of large traders remains bullish but continues to weaken. The total number of long contracts concentrated in the hands of speculators now stands at 200 thousand, and short contracts – 111 thousand. Despite the rather large difference, I still believe that the situation will continue to change in favor of the bears. Bulls have dominated the market for too long, and now they need a strong information background to maintain a bullish trend. I don't see such a background right now. Professional traders may continue to close long positions soon. I believe that the current figures allow for the continuation of the fall of the euro currency in the coming months.

News calendar for the USA and the European Union:

EU – Index of business activity in the construction sector (08:30 UTC).

EU – Retail trade (10:00 UTC).

On February 6, the calendar of economic events contains only two not the most important entries. The influence of the information background on the mood of traders today may be very weak.

EUR/USD forecast and tips for traders:

The pair's sales were possible when rebounding from the 1.0883 level on the hourly chart, with targets of 1.0823 and 1.0805. Both targets have been achieved and even the 1.0725 level, which could be considered the third target, has also been worked out. New sales are fixed at 1.0725 with a target of 1.0644. I will consider buying the pair today when the hourly chart rebounds from the 1.0825 level with a target of 1.0823.