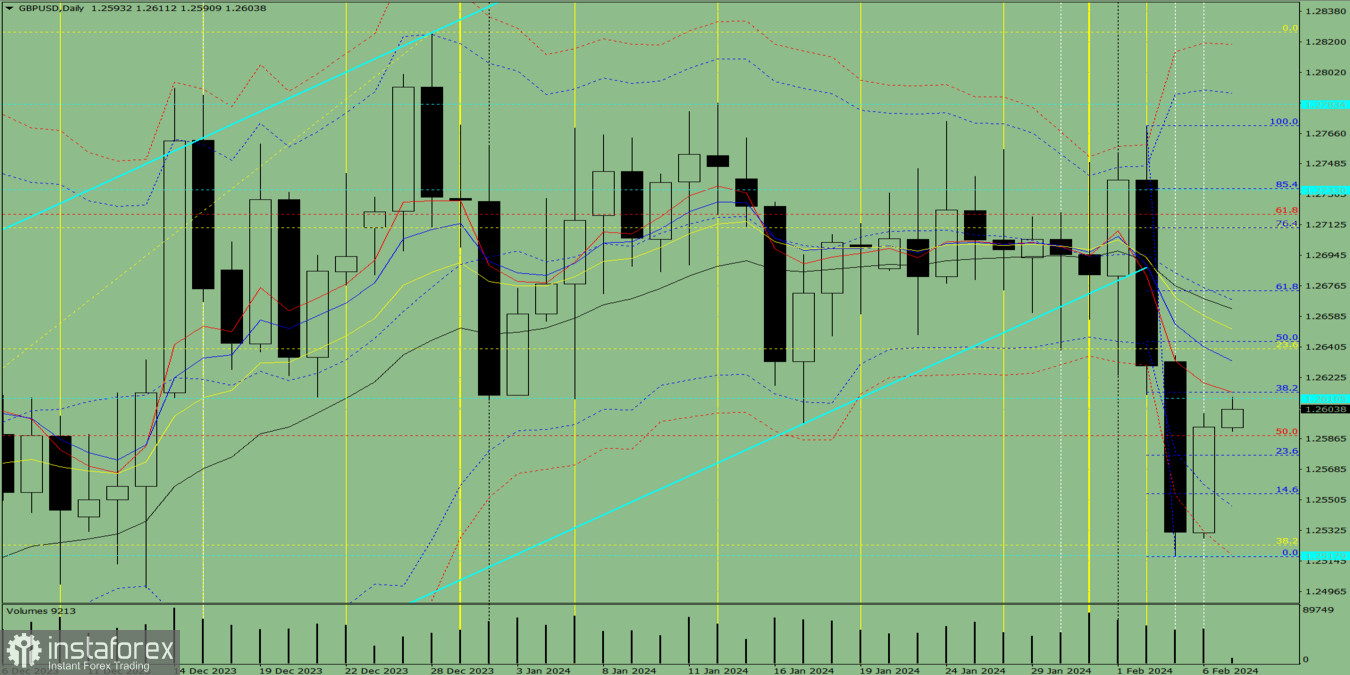

The GBP/USD currency pair traded upward on Tuesday, almost testing the historical resistance level of 1.2611 (blue dotted line), and then the price went down a little, closing the daily candle at 1.2594. Today, the market may move up. Economic calendar news is expected at 15:30 UTC (dollar).

Trend analysis (Fig. 1).

The market may move upward from the level of 1.2594 (closing of yesterday's daily candle) to 1.2611, the historical resistance level (blue dotted line). In the case of testing this level, a continued upward movement is possible with a target of 1.2644, the 50% pullback level (blue dotted line).

Fig. 1 (daily chart).

Comprehensive analysis:

- Indicator analysis – up;

- Fibonacci levels – up;

- Volumes – up;

- Candlestick analysis – up;

- Trend analysis – up;

- Weekly chart – up;

- Bollinger bands – down.

General conclusion: Today, the price may move upward from the level of 1.2594 (closing of yesterday's daily candle) to 1.2611, the historical resistance level (blue dotted line). In the case of testing this level, a continued upward movement is possible with a target of 1.2644, the 50% pullback level (blue dotted line).

Alternatively, the price may move upward from the level of 1.2594 (closing of yesterday's daily candle) to 1.2611, the historical resistance level (blue dotted line). In the case of testing this level, a downward movement is possible with a target of 1.2588, the 50% pullback level (red dotted line).