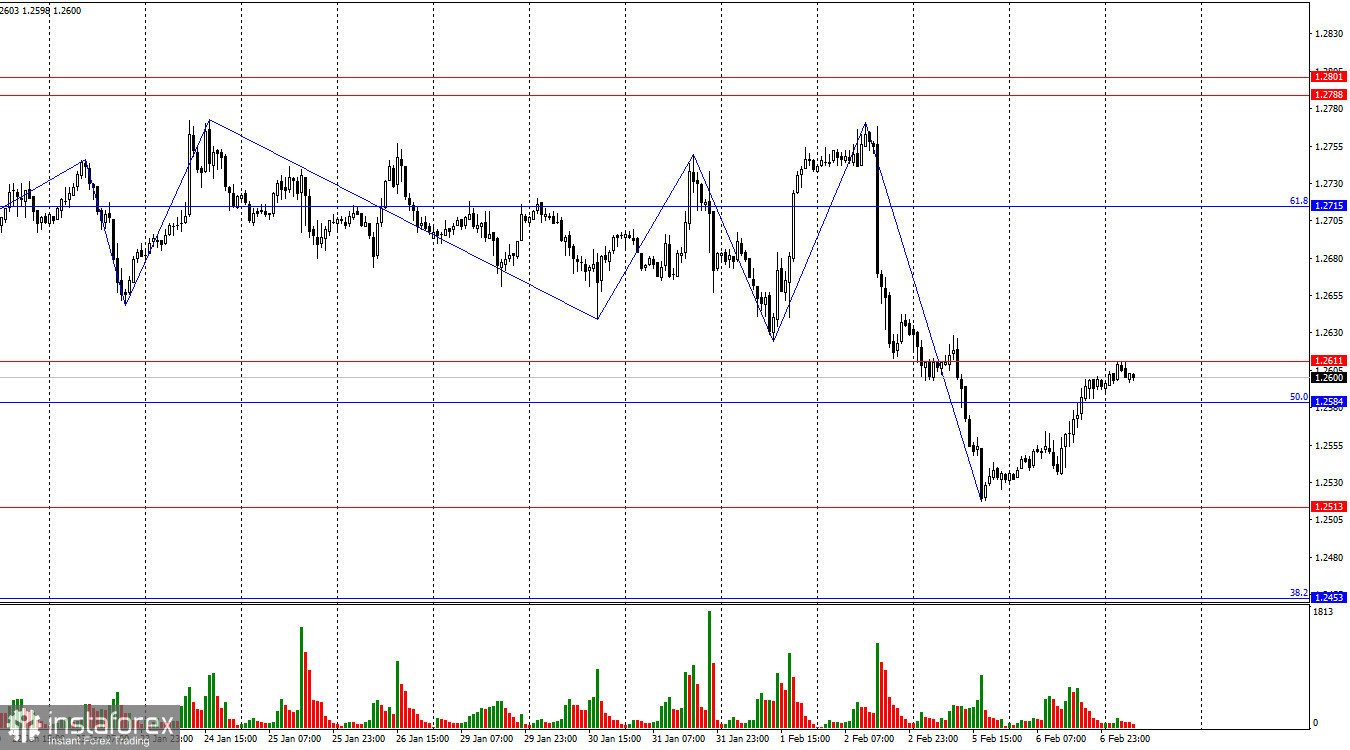

On the hourly chart, the GBP/USD pair executed a reversal in favor of the British pound on Tuesday, returning to the zone of 1.2584–1.2611. A rebound of quotes from this zone will work in favor of the American currency and the resumption of the decline toward the levels of 1.2513 and 1.2453, which, in my opinion, would be the most logical scenario. However, consolidation above the zone of 1.2584–1.2611 will increase the likelihood of the British pound continuing to rise towards the corrective level of 61.8% (1.2715), and the sideways movement may resume in this case.

The situation with the waves remains very ambiguous. The trends are quite short-term; almost all the time, we see single waves or triplets alternating with each other and having approximately the same size. Trader sentiment has shifted to "bearish," allowing for an extended decline of the British pound. The last downward wave confidently and deeply broke the low of the previous wave, but the key is the exit from the sideways movement, indicating the transition to the "bearish" trend stage. Now, I expect the completion of the corrective upward wave, after which a new decline of the pound may occur.

The information background on Tuesday was weak. In the UK, the index of business activity in the construction sector was released, which turned out to be better than traders' expectations. However, I do not think that one secondary index supported the British by 75 points. I think it's all about the corrective wave, which may end today. On Wednesday, there is no information background, the bears can go on a new offensive, as the reports will not interfere with them. But it is very important that there is no consolidation above the level of 1.2611. In my opinion, the bears retain a good chance of a new fall, and the bulls have no reason to return to the market.

On the 4-hour chart, the pair secured below the level of 1.2620, which became a signal of the end of the sideways movement and allows us to count on a fall in the direction of the level of 1.2450. As I said earlier, the mood of traders began to change to "bearish" after consolidating under the uptrend channel, but it took a whole month and a half for the bears to go on the offensive. And today, a rebound from the 1.2620 level is required for the pair to perform a new reversal in favor of the American. There are no brewing divergences in any indicator.

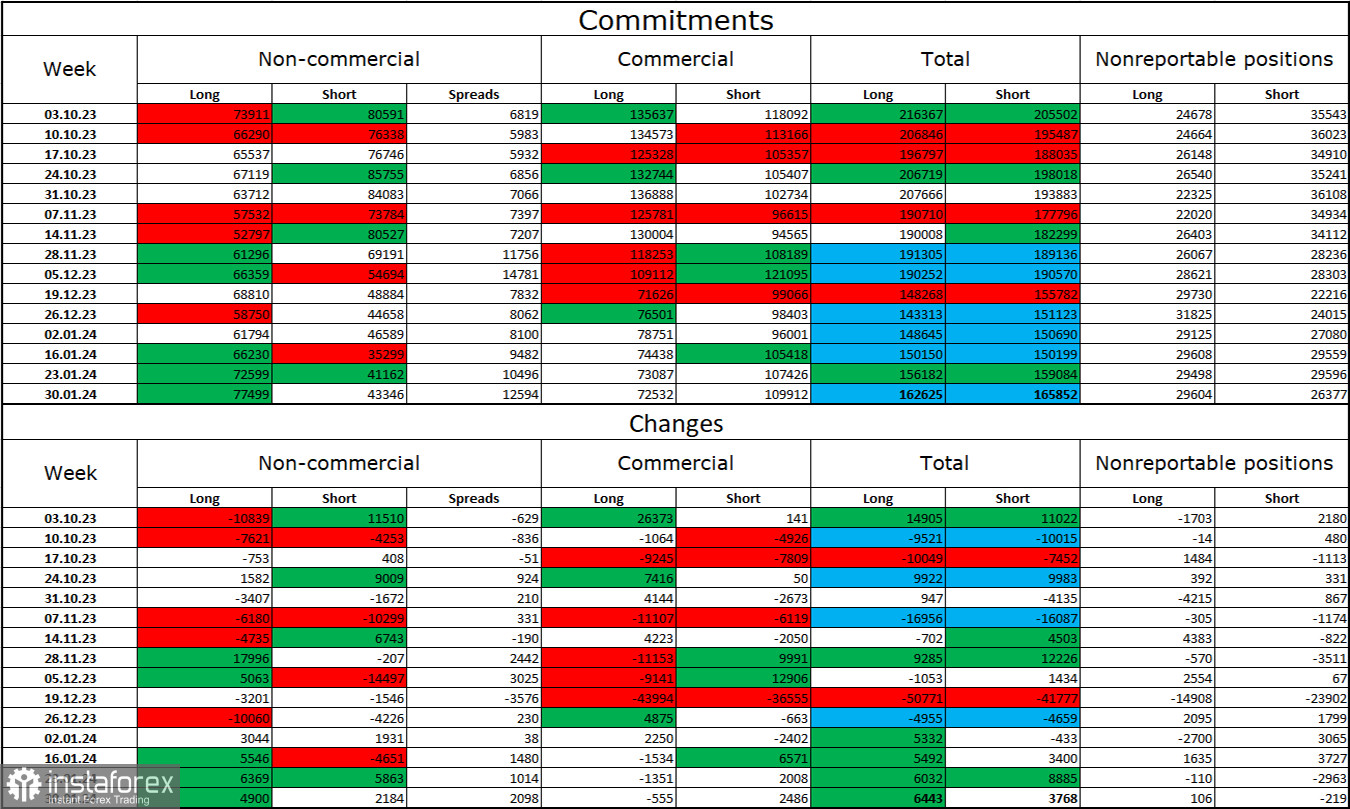

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category changed only slightly over the past reporting week. The number of long contracts held by speculators increased by 4900 units, and the number of short contracts increased by 2184 units. The overall sentiment of major players changed to "bearish" a few months ago, but at present, bulls once again have a significant advantage. There is almost a twofold gap between the number of long and short contracts: 77 thousand versus 43 thousand.

In my view, the British pound has excellent prospects for a decline. I believe that over time, bulls will start to unwind their buy positions, as all possible factors for buying the British pound have already been worked out. The growth we have seen in the last three to four months, in my opinion, is corrective. Bulls have been unable to push the level of 1.2745 for almost two months. However, bears are in no hurry to go on the offensive and cannot cope with the zone of 1.2584–1.2611.

News Calendar for the USA and the United Kingdom:

On Wednesday, the economic events calendar does not contain any interesting entries. The impact of the information background on the market sentiment today will be absent.

GBP/USD Forecast and Trader Tips:

Sales of the pair could be considered on consolidation below the support zone of 1.2584–1.2611 with a target of 1.2513. This target has almost been achieved. Today, selling is possible on a rebound from the zone of 1.2584–1.2611 with the same target. Purchases were possible on a rebound from 1.2513 on the hourly chart with a target of 1.2584. This target has been achieved. New purchases – on closing above 1.2611 with a target of 1.2715.