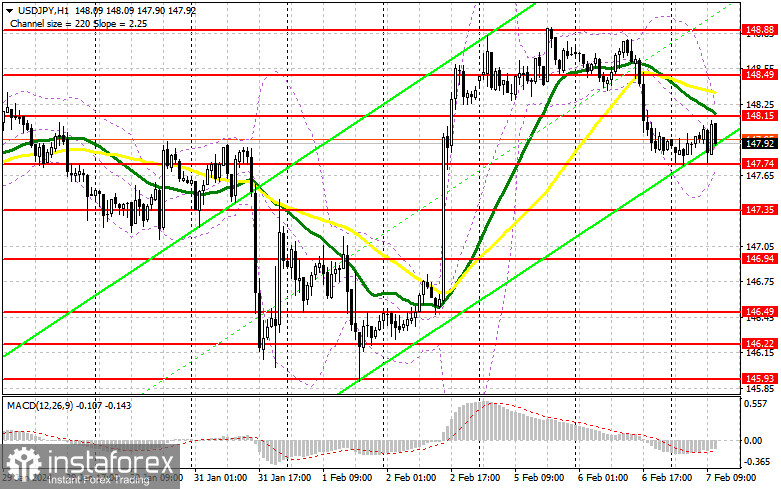

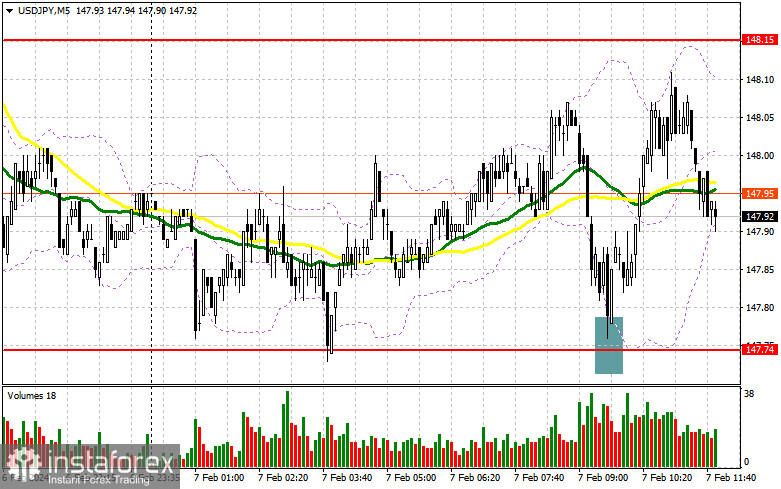

In my morning forecast, I drew attention to the level of 147.74 and planned to make decisions on market entry based on it. Let's take a look at the 5-minute chart and analyze what happened. The decline and the formation of a false breakout around 147.74 allowed entering the market in long positions, resulting in the pair's rise by more than 30 points. However, trading remained within a sideways channel, prompting me to leave the technical picture unchanged for the second half of the day.

To open long positions on USD/JPY, the following is required:

Further demand for the dollar will depend on the external trade balance data and consumer credit volume. Good statistics will allow the continuation of growth, and attempts to resume which were observed in the first half of the day. However, I recommend focusing on the speeches and interviews of Federal Reserve representatives. Statements from FOMC members Susan M. Collins, Thomas Barkin, and Michelle Bowman are expected. A tendency towards a more dovish policy will harm the dollar, leading to a new sell-off of USD/JPY, which I plan to take advantage of.

I plan to act on the decline after a false breakout in the support area of 147.74, similar to what I discussed earlier. This will offer an additional buying opportunity, anticipating a stronger upward surge towards 148.15, where the moving averages slightly favor the sellers. Breaking and retesting this range from top to bottom will lead to another good option for increasing long positions, capable of pushing USD/JPY up to around 148.49. The ultimate target will be the area of 148.88, where I plan to make a profit. In the scenario of the pair's decline and the absence of activity at 147.74 from buyers in the second half of the day, as this level has already worked once today, pressure on the dollar will return. In this case, I will try to enter the market around 147.35. But only a false breakout there will signal the opening of long positions. I plan to buy USD/JPY immediately on the rebound only from the minimum around 146.94, targeting a 30-35 point correction within the day.

To open short positions on USD/JPY, the following is required:

Sellers had a chance, but they did not take advantage of it. Without a proper test and defense of 148.15 in the second half of the day, it will be difficult to talk about a return of pressure on the pair. For this reason, I suggest focusing precisely on this level, where the formation of a false breakout after the soft position of Fed representatives will be a suitable condition for opening short positions with the aim of another decline to around 147.74. Breaking and bottom-up retesting of this range will deal a more serious blow to bullish positions, leading to the triggering of stop orders and opening the way to 147.35. The ultimate target will be the area of 146.94, where I plan to make a profit. In the scenario of USD/JPY growth and the absence of activity at 148.15 in the second half of the day, buyers will regain full initiative, continuing the upward trend. In this case, it is best to postpone selling until testing the next resistance at 148.49. If there is no downward movement there, I will sell USD/JPY immediately on the rebound from 148.88, but only counting on a pair correction down by 30-35 points within the day.

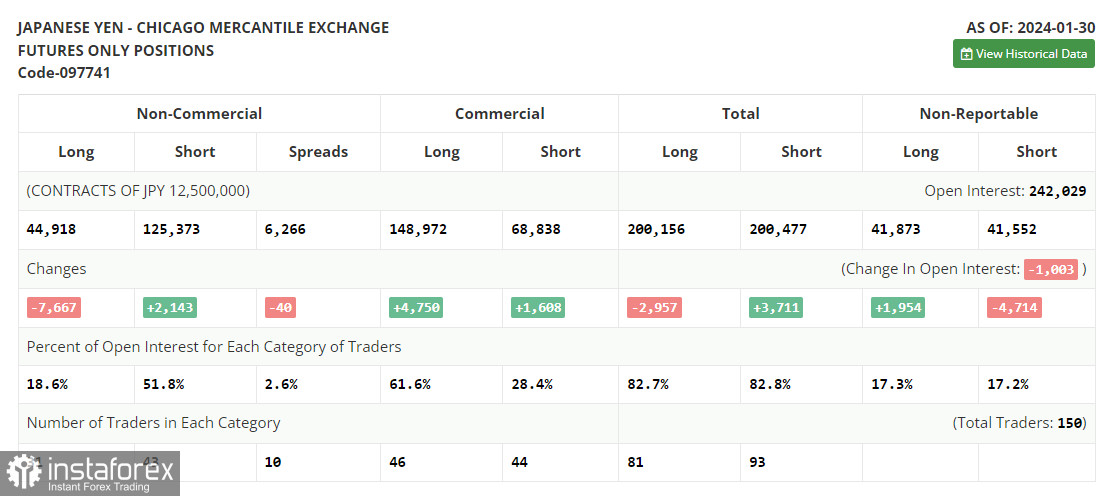

In the Commitment of Traders (COT) report as of January 30, there was an increase in short positions and a reduction in long positions. The results of the meeting of the Bank of Japan have long been forgotten by everyone, but a certain emphasis and the wait-and-see position of the Federal Reserve, even without clear indications of the possibility of raising interest rates – all this maintains pressure on the yen and demand for the dollar. Most likely, buyers will continue active attempts to break through the annual maximum, which may result in a new medium-term upward trend. In the latest COT report, it is stated that non-commercial long positions decreased by 7,667 to the level of 44,918, while non-commercial short positions jumped by 2,143 to the level of 125,373. As a result, the spread between long and short positions decreased by 40.

Indicator signals:

Moving averages

Trading is conducted below the 30 and 50-day moving averages, indicating further pair decline.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of decline, the lower boundary of the indicator around 147.74 will act as support.

Indicator Descriptions:

- Moving Average (MA, determines the current trend by smoothing volatility and noise). Period 50. Marked on the chart in yellow.

- Moving Average (MA, determines the current trend by smoothing volatility and noise). Period 30. Marked on the chart in green.

- Moving Average Convergence/Divergence (MACD) indicator. Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands. Period 20.

- Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between the short and long positions of non-commercial traders.