Analysis of GBP/USD 5M

GBP/USD traded with clear positivity on Wednesday. If the euro gradually moved upwards, the British pound rose significantly, already recovering about 50% of its losses from the slump at the end of last week and the beginning of this week. Currently, the price has approached the Kijun-sen line on the 4-hour chart, and take note that this line is quite strong. The flat phase has ended, so we can reasonably expect a rebound from the critical line and maybe a continuation of the downward trend.

We have been saying that the British pound remains overbought and should fall. However, the market is still not in a rush to sell and doesn't seem to show much favor to the US dollar. The recent US economic reports on GDP, labor market, unemployment, and ISM indices have been very strong. Meanwhile, we rarely receive positive news from the UK. Nevertheless, the British pound is not far from its five-month highs.

The GBP/USD pair recently left the sideways channel but managed to consolidate above the 1.2605-1.2620 area. We hope that this does not bring back the flat phase. For now, we will rely on the Kijun-sen line, expecting a rebound from it. However, we should remember that the bulls are once again applying pressure and the pair has the potential to rise to the level of 1.2786, which would be absolutely illogical from a macroeconomic and fundamental perspective.

COT report:

COT reports on the British pound show that the sentiment of commercial traders has been changing quite frequently in recent months. The red and green lines, representing the net positions of commercial and non-commercial traders, often intersect and, in most cases, are close to the zero mark. According to the latest report on the British pound, the non-commercial group opened 6,300 buy contracts and 5,800 short ones. As a result, the net position of non-commercial traders increased by 500 contracts in a week. The fundamental backdrop still does not provide a basis for long-term purchases on the pound.

The non-commercial group currently has a total of 72,600 buy contracts and 41,100 sell contracts. Since the COT reports do not provide an accurate forecast of the market's behavior at the moment, we need to pay close attention to the technical picture and economic reports. However, even these types of analysis are currently secondary because, despite everything, the market still maintains a bullish bias towards the pound, and the price has been in a flat range for the second month. The technical analysis suggests that there's a possibility that the pound could show a pronounced downward movement (but there are no clear sell signals yet), and for a long time now, the economic reports have also been significantly stronger in the United States than in the United Kingdom, but this has not benefited the dollar.

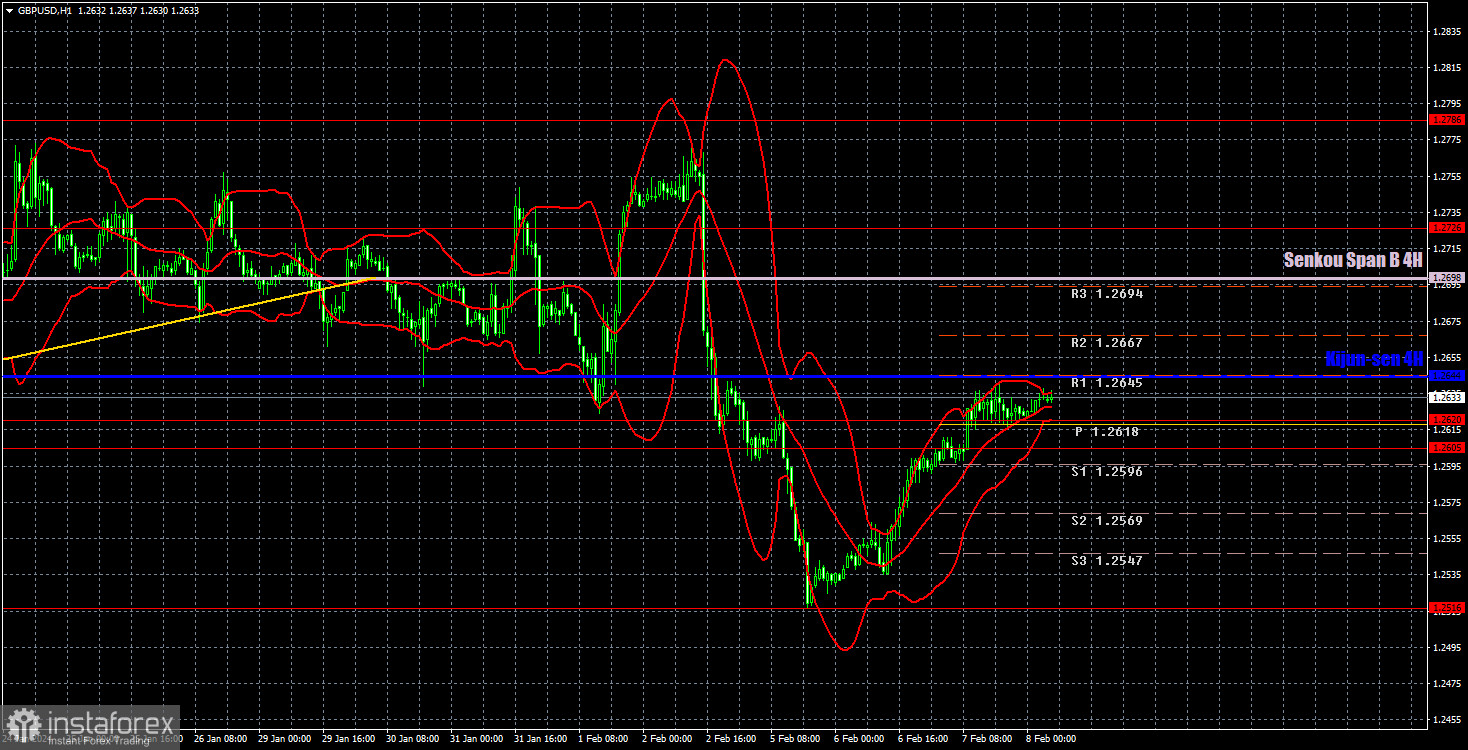

Analysis of GBP/USD 1H

On the 1H chart, GBP/USD is no longer trading in the sideways channel and it may be on track to form a downtrend. However, recently, we've seen that the market is not in a rush to sell the pound. Let's hope that this is a fluke.

Since the last phase of growth (on the 24-hour timeframe) took several months, there is a possibility that the pound may continue to fall for several months. The targets of $1.18-$1.20 seem realistic since the pound currently lacks fundamental and macroeconomic support. There is a risk of reviving the flat phase, or maybe the pound could rise, but there is nothing we can do about it. If the pair's movements do not correspond to news, reports, and events, then you should trade based on technical analysis. If the pair overcomes the Kijun-sen line, then the pound can continue to rise with targets at the Senkou Span B line and the level of 1.2726.

As of February 8, we highlight the following important levels: 1.2215, 1.2269, 1.2349, 1.2429-1.2445, 1.2513, 1.2605-1.2620, 1.2726, 1.2786, 1.2863, 1.2981-1.2987. The Senkou Span B (1.2698) and Kijun-sen (1.2644) lines can also serve as sources of signals. Don't forget to set a breakeven Stop Loss to breakeven if the price has moved in the intended direction by 20 pips. The Ichimoku indicator lines may move during the day, so this should be taken into account when determining trading signals.

Today, there are no significant events lined up in both the UK and the US. We can only highlight the US report on unemployment claims, which objectively has little impact on the market sentiment. Representatives of the Bank of England and the Federal Reserve will also speak, but their speeches can only shape the overall background for the pound and the dollar. They do not influence the pair's intraday movements.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.