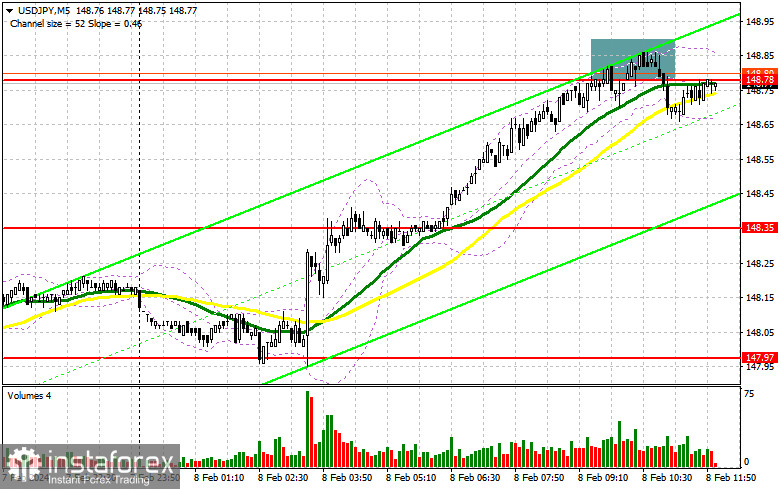

In my morning forecast, I paid attention to the level of 148.78 and planned to make decisions on entering the market from it. Let's look at the 5-minute chart and figure out what happened there. The growth and formation of a false breakout in the area of 148.78 allowed entering the market in short positions against the bullish trend, but it never reached a major sell-off. As a result, I decided to exit the market and revised the technical picture for the afternoon.

To open long positions on USD/JPY, it is required:

The speech of an important official of the Central Bank of Japan put pressure on the yen in the morning. Although it was said that the policy would sooner or later be normalized, the representative of the regulator warned that further rate increases would occur solely as a reaction to economic changes, which weakened the yen's position, as traders expected a more aggressive approach. In the afternoon, much will depend on the US data: the number of initial applications for unemployment benefits and a serious discrepancy with forecasts will lead to a market surge. If the pair falls, large buyers will take advantage of this, so I advise you to pay attention to this point. The speech of FOMC member Thomas Barkin should be on the side of dollar buyers, which will lead to the resumption of the bull market.

I will act on the decline only after a false breakout in the area of the nearest support at 148.57. This will provide another entry point for buying, counting on a more powerful upward surge to the annual maximum of 148.90. Only a breakout and a reverse test from top to bottom of this range against the backdrop of strong US statistics will lead to another good option for increasing long positions, capable of pushing USD/JPY up to around 149.23. The ultimate target will be the area of 149.62, where I plan to make a profit. In the scenario of the pair's decline and the lack of activity at 148.57 from buyers in the second half of the day, nothing detrimental to the bullish market will happen. In this case, I will try to enter purchases around 148.29, where the moving averages are located. Only a false breakout there will signal the opening of long positions. I plan to buy USD/JPY immediately on the rebound from the minimum of around 147.97 with the target of a correction of 30-35 points within the day.

To open short positions on USD/JPY, it is required:

Sellers did everything to stop the bullish market around the annual maximum, but it is still too early to open short positions on the dollar. Now, without a proper test and defense of 148.90, it will be premature to talk about a return of pressure on the pair in the second half of the day. For this reason, I recommend focusing specifically on this level, where the formation of a false breakout after the soft position of the Fed representatives and weak labor market data will be a suitable condition for opening short positions with the aim of a decline to the area of 148.57 – intermediate support. A breakthrough and a reverse test from the bottom to the top of this range will deal a more serious blow to bullish positions, leading to stop-loss triggering and opening the path to 148.29. The ultimate target will be the area of 147.97, where profits will be taken. In the scenario of USD/JPY growth and the absence of activity at 148.90 in the second half of the day, buyers will regain the initiative, continuing the upward trend. In this case, it is best to postpone sales until testing the next resistance at 149.23. If there is no downward movement there, I will sell USD/JPY immediately on the rebound from 149.62, but only counting on a pair correction down by 30-35 points within the day.

Indicator signals:

Moving averages

Trading is conducted above the 30 and 50-day moving averages, indicating further pair growth.

Note. The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline, the lower boundary of the indicator at 147.70 will act as support.

Description of indicators:

• Moving average (MA) is used to determine the current trend by smoothing volatility and noise. Period - 50. Marked on the chart in yellow;

• Moving average (MA) is used to determine the current trend by smoothing volatility and noise. Period - 30. Marked on the chart in green;

• MACD indicator (Moving Average Convergence/Divergence) Fast EMA - period 12. Slow EMA - period 26. SMA - period 9;

• Bollinger Bands (Bollinger Bands). Period - 20;

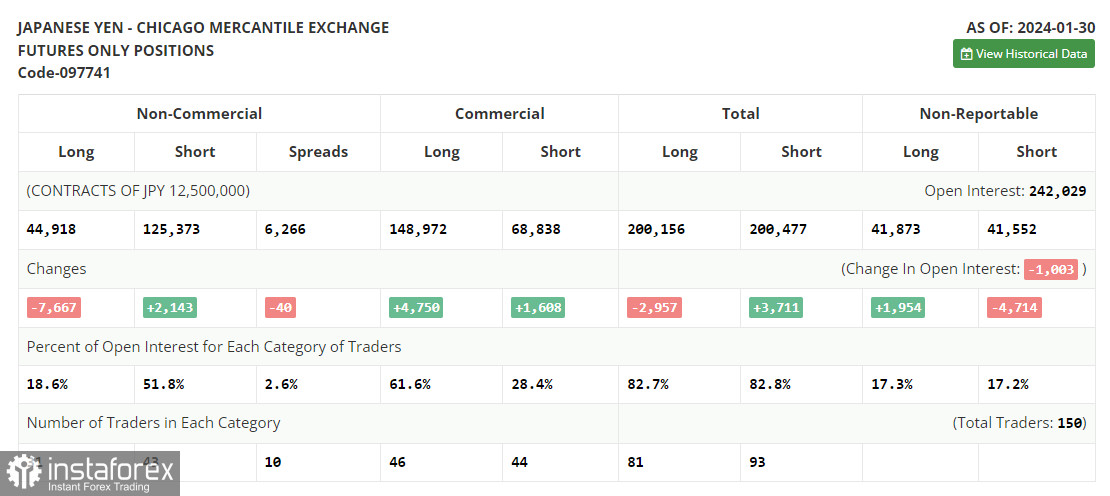

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific requirements;

• Long non-commercial positions represent the total long open position of non-commercial traders;

• Short non-commercial positions represent the total short open position of non-commercial traders;

• The total non-commercial net position is the difference between short and long positions of non-commercial traders.