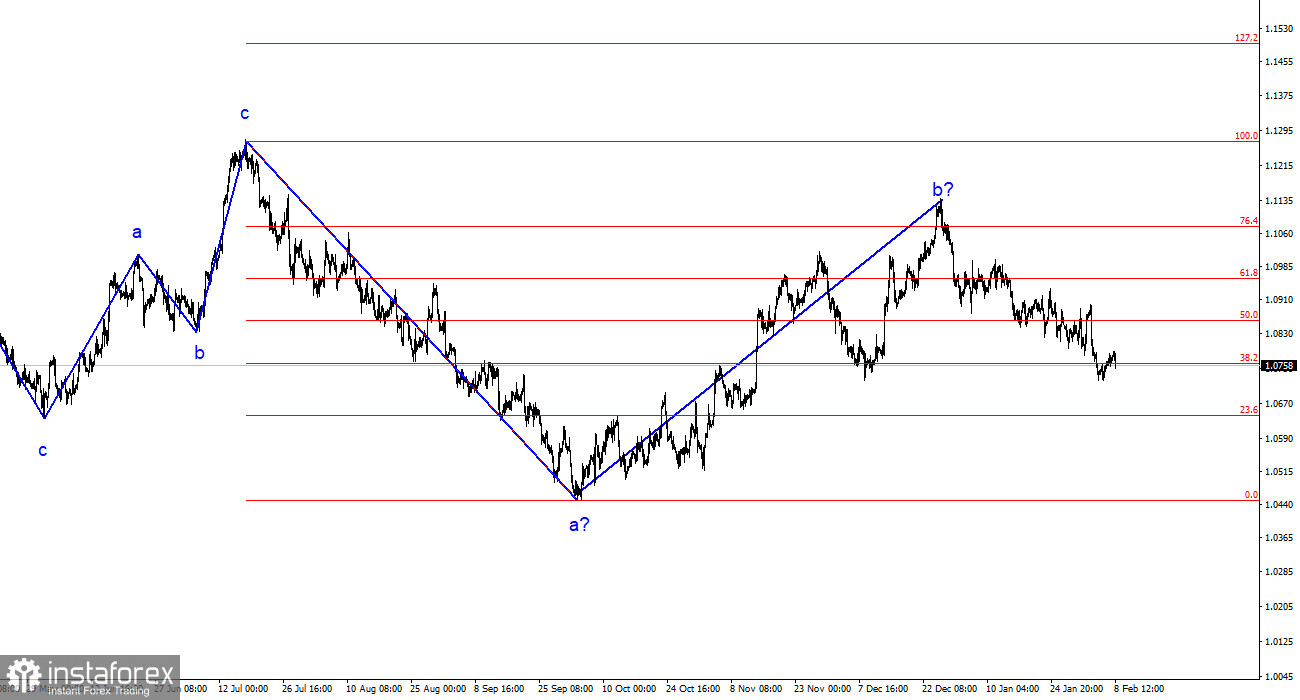

The wave analysis of the 4-hour chart for the euro/dollar pair remains unchanged. Over the past year, we have observed only three-wave structures that constantly alternate with each other. At the moment, the construction of another three-wave structure – a downtrend – continues. The presumed wave 1 is complete, and wave 2 or b has become more complex three or four times. However, at the moment, it can still be considered conditionally complete since the pair has been declining for more than a month.

The rising segment of the trend may still resume, but its internal structure will be unreadable. I would like to remind you that I strive to identify unambiguous wave structures that do not tolerate dual interpretation. If the current wave analysis is correct, the market has moved on to forming wave 3 or c. A successful attempt to break through the level of 1.0788, corresponding to 76.4% Fibonacci, once again confirmed the market's readiness for sales. Now, the nearest target is the level of 1.0637, which is equivalent to 100.0% Fibonacci. However, even at this point, I do not expect the end of the decline of the euro currency. Wave 3 or c should be much more extended both in terms of time and targets.

Demand for the euro currency may start falling again

The euro/dollar pair decreased by 15 basis points on Thursday. The amplitude of movements we have observed in the last three days is very low. The market does not want to switch to more active actions against the backdrop of an empty economic calendar. I would like to remind you that, among the interesting events of this week, only a few reports in the European Union and the United States stood out, which practically did not affect anything. In addition to secondary economic data, the market received quite a bit of interesting information from ECB and FOMC members, but all this information was not significant. In other words, no trend-setting statements were made. The essence of all that was said boiled down to simple phrases that there is no need to rush with lowering the interest rate, it is necessary to make sure of maintaining a downward trajectory in inflation, inflation may present an unpleasant surprise in 2024, and there are increasing risks for accelerating price growth.

Today, there was no news background in the first half of the day, but we still saw a movement that deserves attention. An unsuccessful attempt to break through the level of 1.0788, corresponding to 76.4% Fibonacci, led to the quotes moving away from the reached highs, which simultaneously may indicate that the market has entered a new stage of decreasing demand for the euro currency. I would like to remind you that the wave pattern supports the further decline of the pair within the impulsive wave 3 or c, which is still far from completion. Based on this, even without a news background in support of the dollar, I expect the continuation of the pair's decline.

General conclusions

Based on the analysis conducted, I conclude that the construction of a bearish wave set continues. Wave 2 or b has taken on a completed form, so in the near future, I expect the continuation of the construction of the impulsive downward wave 3 or c with a significant decrease in the pair. An unsuccessful attempt to break through the level of 1.1125, corresponding to 23.6% Fibonacci, indicated the market's readiness for sales a month ago. I am currently considering only sales with targets around the calculated level of 1.0462, which corresponds to 127.2% Fibonacci.

On a larger wave scale, it can be seen that the presumed wave 2 or b, which in length is already more than 61.8% Fibonacci from the first wave, may be completed. If this is indeed the case, then the scenario of constructing wave 3 or c and lowering the pair below the 4-figure mark has begun to unfold.