The first week of February turned out to be very dull. Both instruments previously plunged due to the Bank of England and the Federal Reserve meetings, Fed Chair Jerome Powell's speeches, and strong US ISM data. But after that we did not see any important events or news so the movements became very weak. Therefore, I believe that we should try to understand what we can expect from the upcoming week.

In the European Union, there will be many speeches and few reports in the next five trading days. The upcoming reports can be interesting, but not more. In the current circumstances, I don't think the GDP and industrial production reports are capable of pushing the market to become more active. For instance, this will be the second estimate of the Q4 GDP report and the European economy is expected to show no growth. In my opinion, such a value will not evoke any emotions from the market.

It is enough to recall the last four quarters and their values: -0.1%, +0.1%, +0.1%, -0.1%. And now it could be 0%. What changes should the market react to? The same applies to industrial production. This report itself is not important, but a sharp rise or a sharp fall may affect movement. But what can we expect from the EU production figure? The last time we saw growth was in August 2023. Back then the indicator added 0.4%. Of the last 12 months, seven closed with a negative result. There is a good chance that the new report will also show a decline, but certainly not a significant increase.

All other events of the week include speeches by members of the European Central Bank Governing Council. Philip Lane, Pablo Hernandez de Cos, Claudia Buch, Anneli Tuominen, Luis de Guindos, Isabel Schnabel, Christine Lagarde and Philip Lane. As we can see, there will be a lot of speeches, but how many of them can provide the market with new and important information just two weeks after the ECB meeting? Will most of them share any specific details regarding interest rates if all the previous speeches only talked about one thing: the ECB is not in a rush, policymakers are afraid to make a mistake, everything will depend on inflation and economic indicators?

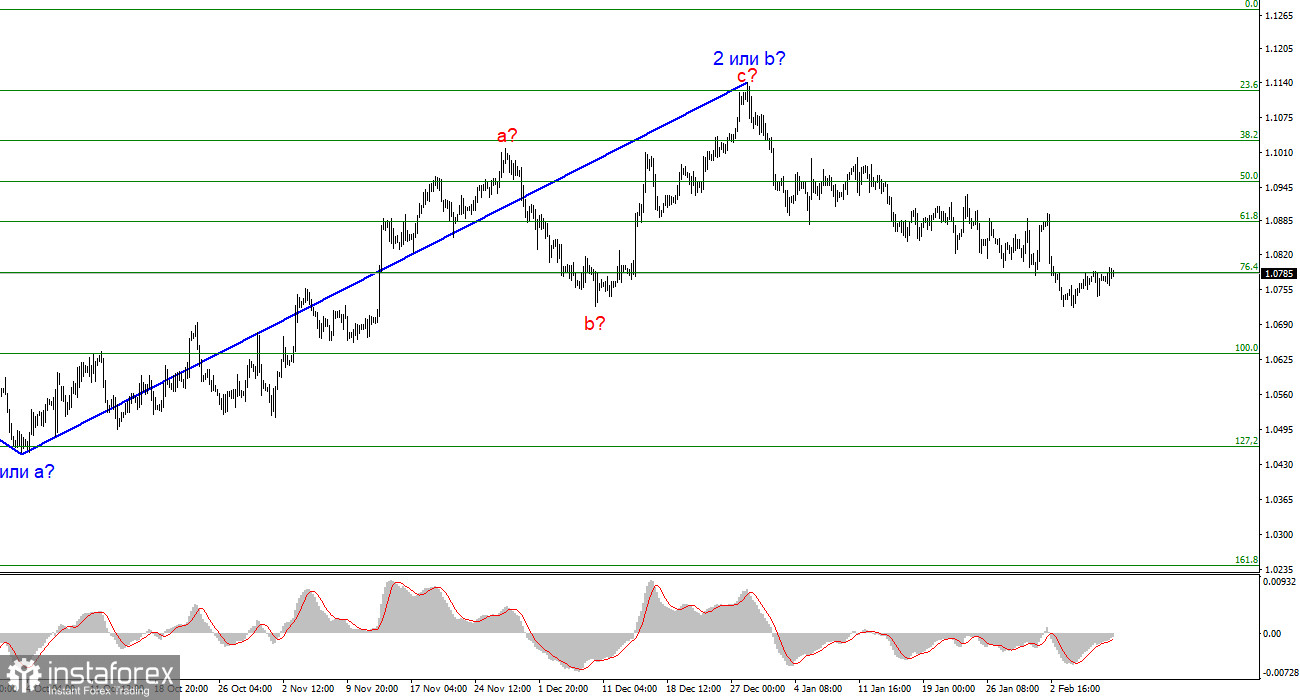

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. The failed attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci, suggests that the market is prepared to sell a month ago. I will only consider short positions with targets around the level of 1.0462, which corresponds to 127.2% Fibonacci.

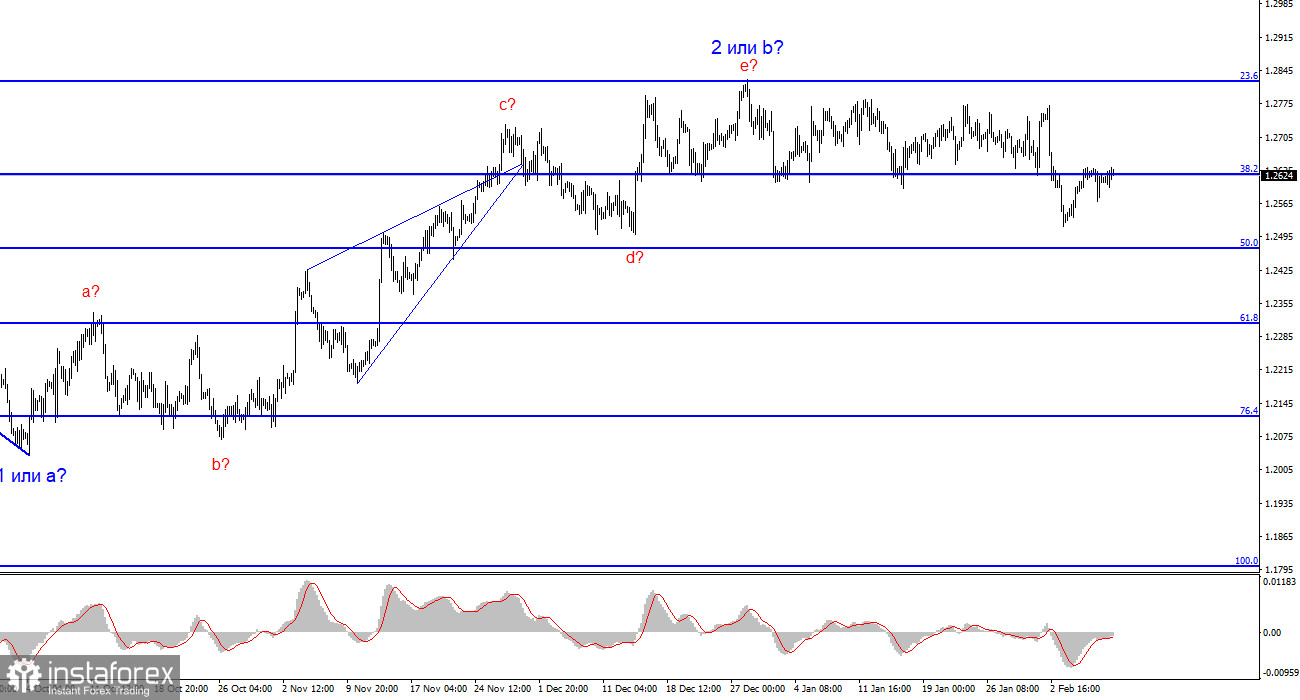

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, just like the sideways trend. I would wait for a successful attempt to break through the 1.2627 level, as this will serve as a sell signal. In the near future, there could be another signal in the form of an unsuccessful attempt to break this level. If it appears, the pair could firmly fall at least to the level of 1.2468, which would already be a significant achievement for the dollar, as the demand for it remains very low.