The GBP/USD currency pair ended near the moving average line the past week. Recall that two Fridays ago and last Monday, the price sharply plummeted (not without reason), and after being in a range for about a month and a half, it finally left the sideways channel. However, at the moment, traders have practically failed to derive any practical benefit from leaving the range. The price exited the sideways channel, and everyone immediately started counting on a new downtrend, but instead, the pair corrected upward for four days with minimal volatility.

Certainly, it did not consolidate above the moving average, and the exit from the range occurred through the lower boundary. In the 24-hour timeframe, the Fibonacci level of 61.8% (1.2763) was not overcome; presumably, a new long-term downtrend began last summer. Thus, the technical picture fully supports the decline of the British currency. However, it can be noted that the market is quick to sell the pair even after leaving the sideways channel.

We assume the market refrains from selling the pound due to the Bank of England's position. Although its rhetoric was softened at the last meeting, the market still did not see any hints of an imminent shift to monetary policy easing. Or consider these hints insignificant. The Bank of England will start cutting rates later than the Fed, and this factor prevents the pound from falling. Although, from our point of view, this is unfair.

This week in the United States, the Consumer Price Index for January will be published, which is the week's key event. Inflation in the US may slow down to 3% y/y. Such a slowdown is unlikely to be a reason for Jerome Powell and his colleagues to soften their monetary rhetoric. However, 3% is already close to 2.5%, so the Fed will be forced to lower the key rate. If inflation falls below 3%, it will be a serious reason for the market to sell the US dollar.

In addition to inflation in the US, there will be a few interesting events. As usual, several representatives of the Fed will speak during the week, and some routine reports will be released, capable of causing market reactions within a day. Still, this reaction is unlikely to affect the technical picture, and the reports are unlikely to affect the overall market sentiment.

In the UK, the background will also be interesting. Firstly, on Monday, the Governor of the Bank of England, Andrew Bailey, will speak. Of course, Mr. Bailey only sometimes says important things, but due to the rarity of his speeches, the likelihood of significant statements increases. We recommend not ignoring this event or, at least, being prepared for it.

Second, a mass of macroeconomic reports will be published in the UK. This is the unemployment rate, jobless claims, and average earnings on Tuesday. Recall that even the wage indicator is important now, directly affecting inflation. There will be an inflation report on Wednesday and, on Thursday, the first estimate of GDP for the fourth quarter. Inflation may rise to 4.2%, and GDP may decline by another 0.1%. However, inflation is more important. Together with the US Consumer Price Index report, we risk assuming the pair's growth this week is even more likely.

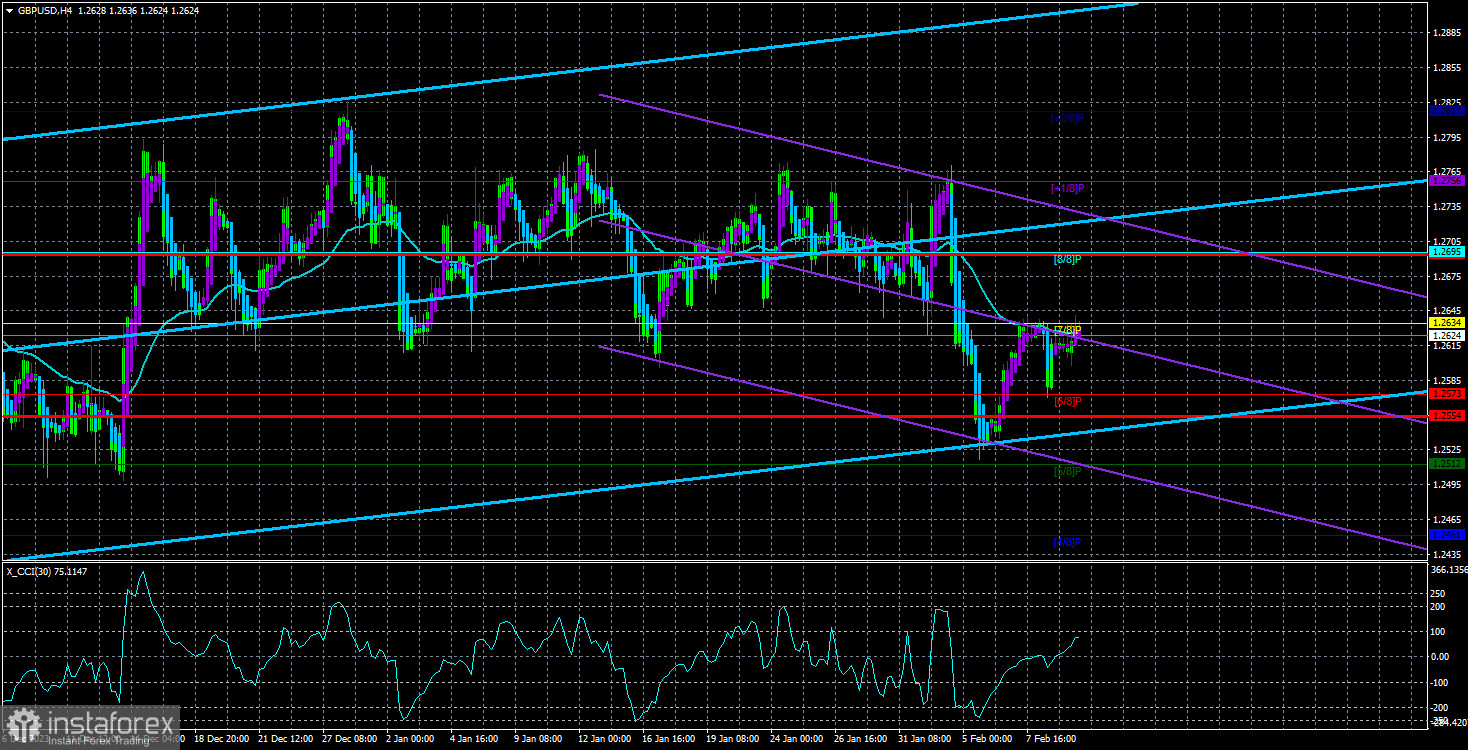

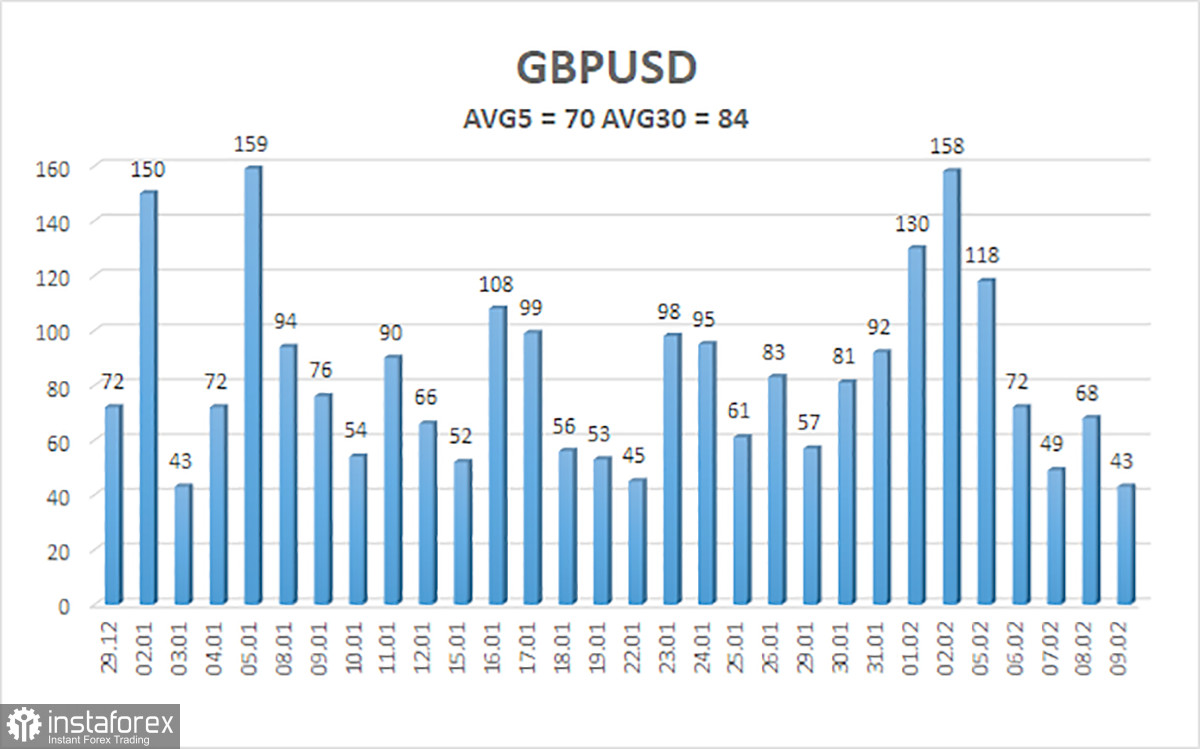

The average GBP/USD pair volatility for the last five trading days is 70 points. For the pound/dollar pair, this value is considered "average." Therefore, on Monday, February 12, we expect movements within the range limited by the levels of 1.2554 and 1.2694. A downward reversal of the Heiken Ashi indicator will indicate a possible resumption of the downward movement.

Next support levels:

S1 – 1.2573

S2 – 1.2512

S3 – 1.2451

Next resistance levels:

R1 – 1.2634

R2 – 1.2695

R3 – 1.2756

Trading recommendations:

The GBP/USD pair has left the sideways channel and may begin to form a downtrend, about which we have been talking for a long time. However, for some reason, this moment is dragging on. The pair has already moved down more than 200 points but corrected towards the moving average. After completing the current correction, we expect a resumption of the decline with targets at 1.2512 and 1.2451. Long positions can be considered after the price consolidates above the moving average with targets at 1.2695 and 1.2707 and in the presence of a favorable macroeconomic background. However, if a downtrend has begun, it is evident that purchases cannot be a priority.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. The trend is currently strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal towards the opposite side is approaching.