EUR/USD

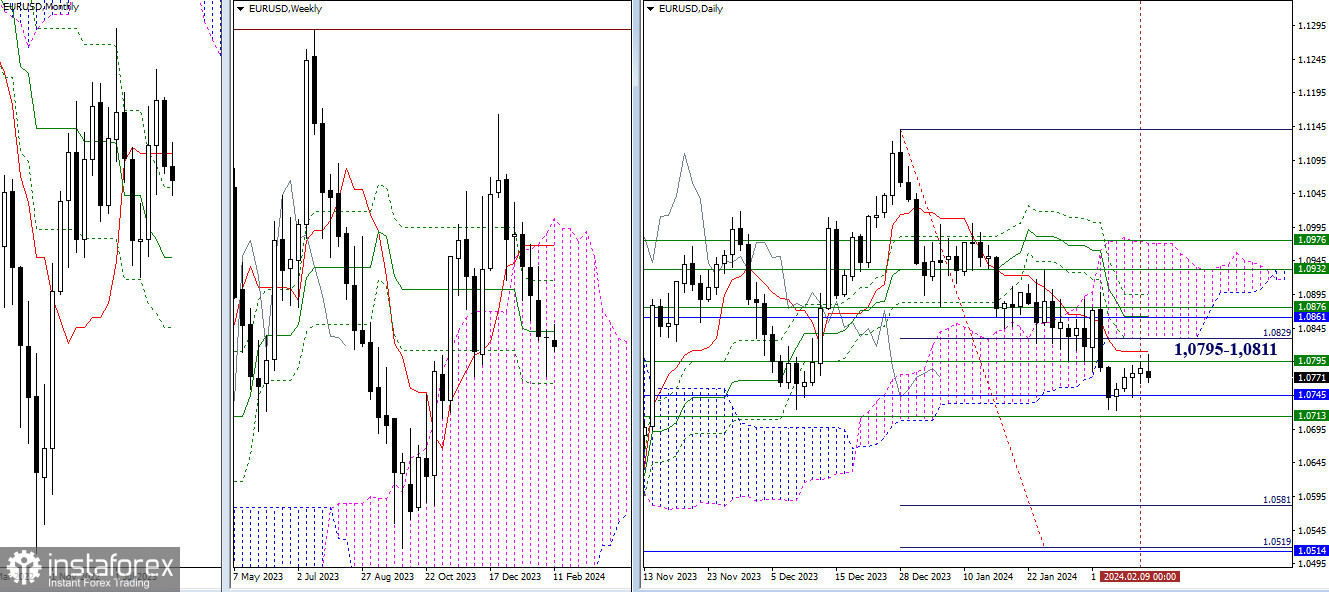

Higher Timeframes

The market reached last week's high today, but further activity is not yet observed. Resistance in the range of 1.0795 (weekly medium-term trend) to 1.0811 (daily short-term trend) remains a barrier for upward movement. The inability to develop the ascent may lead to bearish players, regaining strength during the pause, vigorously storming the support levels of the monthly (1.0745) and weekly (1.0713) timeframes. All other conclusions and expectations voiced earlier remain relevant today.

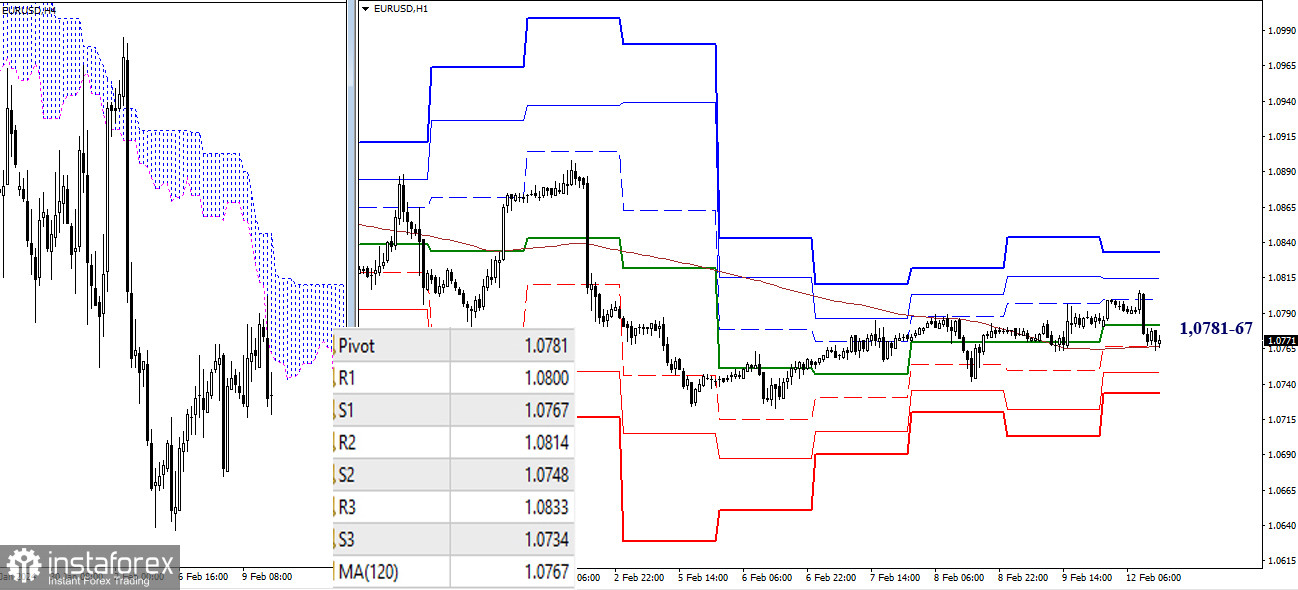

H4 - H1

On the lower timeframes, the ascent is currently paused, and the pair has descended to the key supports, which are currently converging in the range of 1.0781-67 (central pivot point of the day + weekly long-term trend). Possession of these levels indicates an advantage. Classic pivot points serve as targets for the development of directional movement within the day. Today's classic pivot points, which may still come in handy in case of activity, are noted at 1.0748 - 1.0734 (supports) and 1.0814 - 1.0833 (resistances).

***

GBP/USD

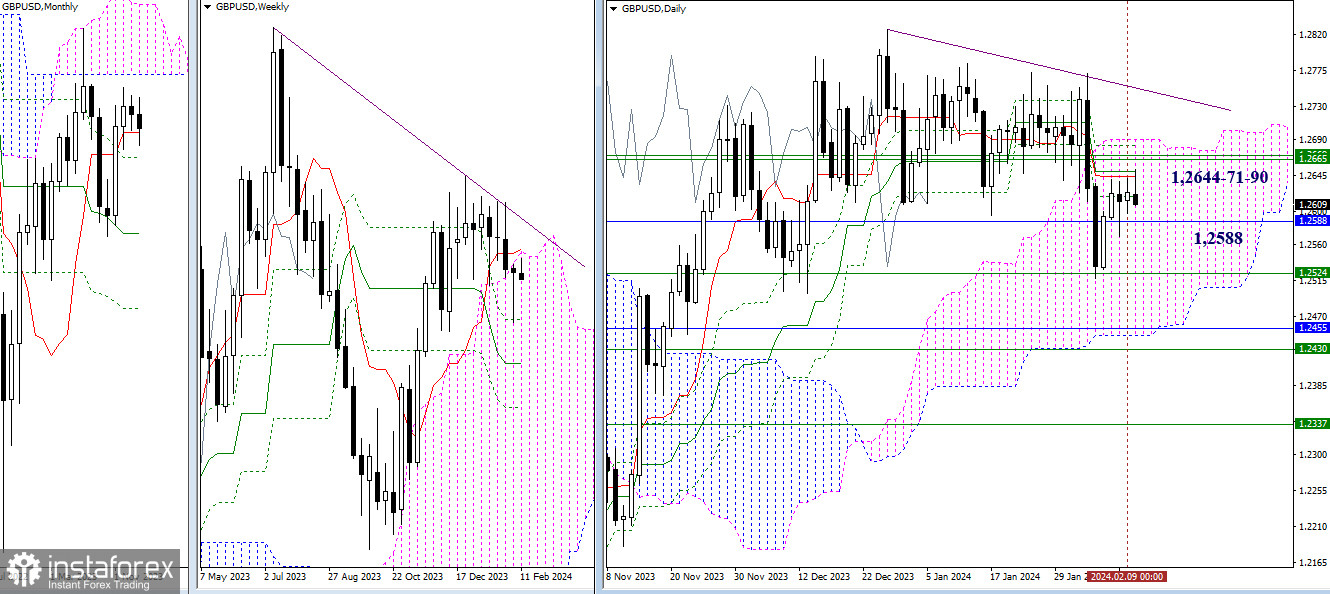

Higher Timeframes

Bullish players have encountered resistance and are currently unable to overcome it. The resistance zone at this chart segment has combined several strong and significant levels from different timeframes (1.2644-51 – 1.2669-71 – 1.2682-90). A breakout and a reliable consolidation above it could significantly change the balance of power, making breaking beyond the high (1.2826) and restoring the upward weekly and monthly trend the main target. In turn, to bring bearish advantages and sentiments back to the market, the pound must firmly settle below the nearest supports (1.2588 – 1.2524).

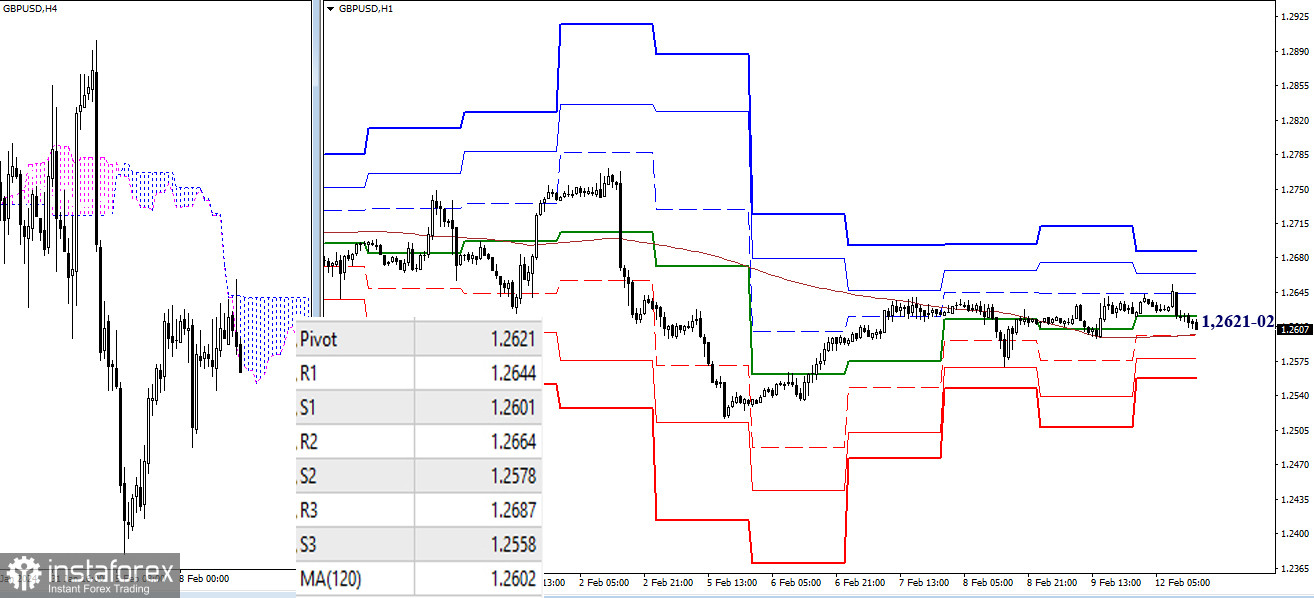

H4 - H1

On the lower timeframes, the pair is testing key levels, which currently act as supports, located in the range of 1.2621-02 (weekly long-term trend + central pivot point of the day). Trading above these levels maintains an advantage for bullish players, with the resistance levels of classic pivot points (1.2644 – 1.2664 – 1.2687) serving as targets in this case. A consolidation below key levels will favor bearish players, and the development of bearish sentiments is possible by passing below the supports of classic pivot points (1.2578 – 1.2558).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)