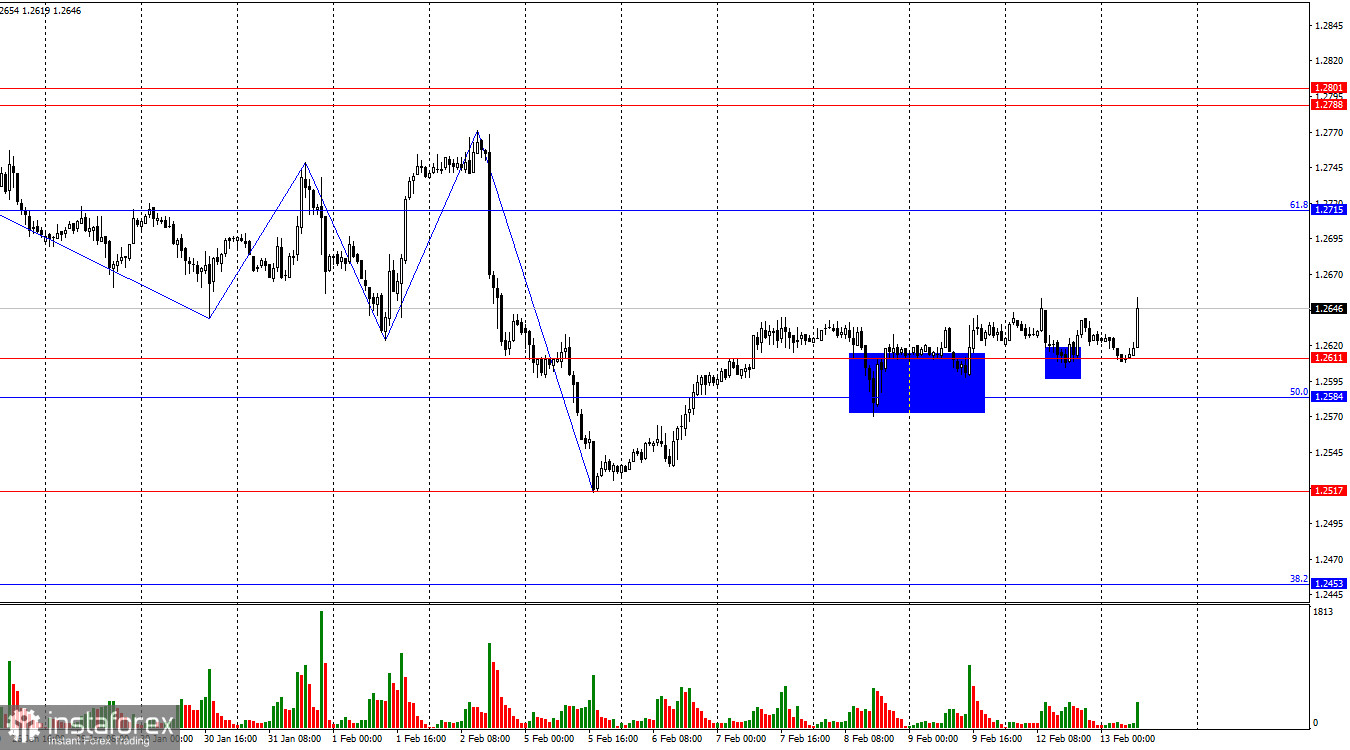

On the hourly chart, the GBP/USD pair rebounded from the level of 1.2611 on Monday, and this morning - another rebound. Thus, the growth process can be continued towards the corrective level of 61.8% (1.2715). Despite the low trader activity, the pound's rise may continue, as three attempts to consolidate below the support zone of 1.2584–1.2611 have ended in failure. Bulls are regaining dominance in the market.

The wave situation remains very ambiguous. For a long time, we observed horizontal movement, within which almost all the time single waves or triplets were formed, alternating with each other and having approximately the same size. It has been too little time since the beginning of the new downtrend to draw any conclusions. Trader sentiment has changed to "bearish," allowing for a prolonged fall in the pound, but bears are showing their weakness again. I expect the completion of the corrective upward wave, after which I will wait for a new decline in the pound. There are no signs of the end of the new "bearish" trend yet.

There was no news background on Monday. In the evening, Andrew Bailey spoke, but the Governor of the Bank of England talked about the banking system and banking reserves, not the CPI. Thus, traders found nothing interesting in his speech. This morning in the UK, the unemployment report was released, which unexpectedly showed a decrease in December, not an increase as traders expected. The wage level fell from 6.7% to 5.8% y/y, which is rather bad for the pound, as inflation may continue to slow down. The market reacted with pound purchases after this data, but I believe that the rise will be restrained. The US inflation report in the second half of the day may strengthen it or even end it.

On the 4-hour chart, the pair consolidated below the level of 1.2620, signaling the end of the sideways movement and allowing for a fall towards the level of 1.2450. As I mentioned earlier, trader sentiment began to change to "bearish" after consolidating below the ascending trend corridor, but it took a month and a half for bears to go on the offensive. And now a rebound from the level of 1.2620 is needed for the pair to make a new reversal in favor of the American and resume falling. At the same time, closing above this level may be executed in the next few hours.

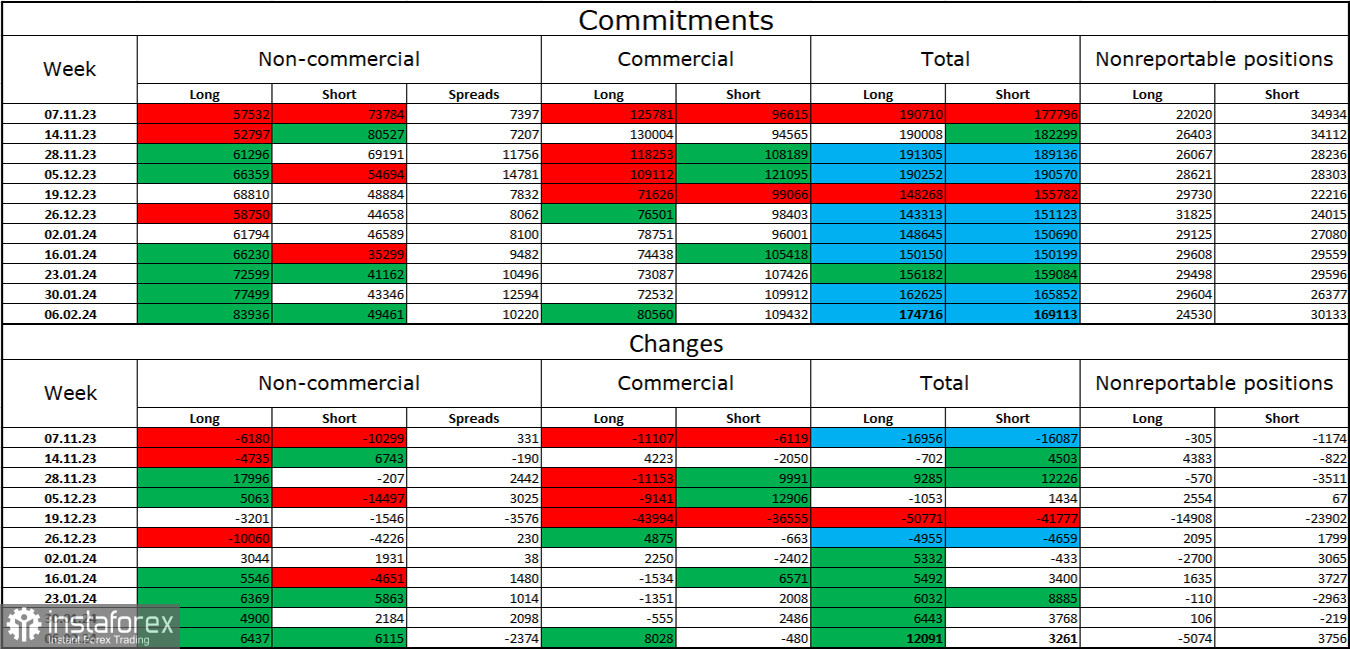

Commitments of Traders (COT) report:

The mood of the "Non-commercial" trader category has not changed much over the past reporting week. The number of long contracts in the hands of speculators increased by 6437 units, and the number of short contracts - by 6115 units. The overall mood of major players changed to "bearish" several months ago, but at the moment, bulls still have a significant advantage. There is an almost twofold gap between the number of long and short contracts: 84 thousand versus 49 thousand.

In my opinion, the pound still has excellent prospects for a fall. I believe that over time, bulls will start getting rid of buy positions since all possible factors for buying the British pound have already been worked out. The growth that we have seen in the last three to four months, in my opinion, is corrective. Bulls have not been able to push the level of 1.2745 for almost two months. However, bears are in no hurry to go on the offensive and cannot cope with the zone of 1.2584–1.2611.

The economic calendar for the US and the UK:

UK - Unemployment rate (07:00 UTC).

UK - Change in the number of unemployment benefit claims (07:00 UTC).

UK - Change in average earnings (07:00 UTC).

US - Consumer Price Index (13:30 UTC).

On Tuesday, the economic events calendar contains several important entries, but only the American inflation remains unpublished. The impact of the news background on the market sentiment today can be significant.

GBP/USD forecast and trader advice:

Selling the pair can be considered today with consolidation below the support zone of 1.2584–1.2611 with targets at 1.2517 and 1.2453. Purchases were possible with a close above 1.2611 on the hourly chart with a target of 1.2715, but bulls can achieve success today only in the case of low inflation in the US.