Recently, the market has been focused on one topic – central bank interest rates. However, in my opinion, a lot of people are already tired of this topic, as we have not received any new and, more importantly, specific information for a very long time. Many politicians and officials continue to talk about how "interest rates will be lowered this year," but no one can say when the Federal Reserve will start the process. Therefore, I suggest temporarily moving away from the topic of monetary policy.

Earlier, I mentioned that, in my opinion, the U.S. economy is strong enough for the Fed to maintain rates at the current level for almost any period. Both of these factors are enough to increase demand for the dollar. If we look at the EUR/USD instrument, it is indeed growing, but we are interested in the further prospects. If we look at the wave analysis, the prospects are excellent, as wave 3 or C is far from over. However, it recently became known that many American consumers are dissatisfied with President Joe Biden's policies and may cast their votes for Donald Trump in the upcoming elections.

The grievances of Americans are mainly related to high inflation. Practically all other macroeconomic indicators under Joe Biden show firm growth. The economy is steadily growing at more than 3% per year, and the labor market is at its most stable state in the last 60 years. The unemployment rate is low, close to a record low, and inflation has been reduced without a recession. At first glance, it is entirely unclear what Americans could be dissatisfied with. However, it is the same as in the currency market – facts can indicate one thing, while market participants' opinions may be entirely different.

The approval rating of the incumbent president is only 39%, which is one of the lowest values throughout his term in office. According to a survey, 58% of respondents do not support Biden, despite economic growth and other positive changes. Nevertheless, many Americans believe that Biden is too old to run for a second term. What is interesting is that they hold the same opinion about Donald Trump, who will turn 78 this summer. However, four years ago, Americans chose the lesser of two evils. Back then, the American population was tired of scandals associated with the president and voted for Biden with the principle of "anyone but Trump." This year, the situation may be directly opposite.

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. The failed attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci, suggests that the market is prepared to sell a month ago. I am currently considering short positions with targets around the level of 1.0462, which corresponds to 127.2% according to Fibonacci.

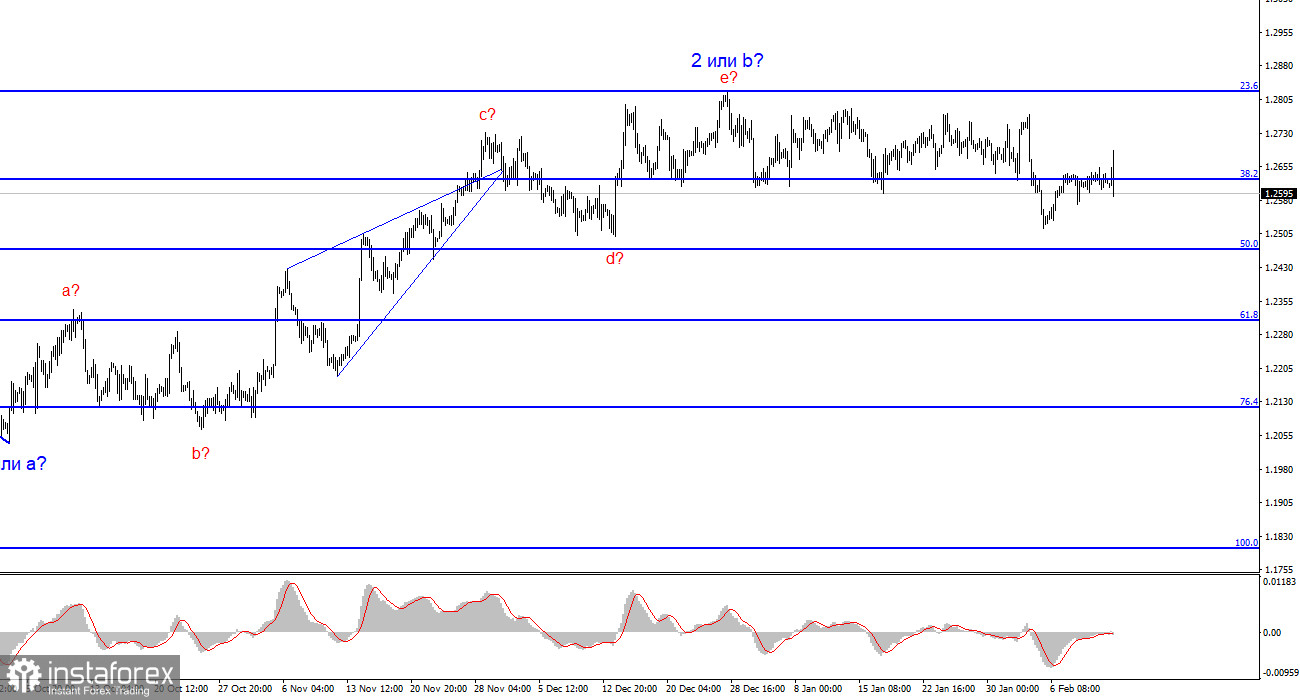

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, just like the sideways trend. I would wait for a successful attempt to break through the 1.2627 level as this will serve as a sell signal. In the near future, there could be another signal in the form of an unsuccessful attempt to break this level. If it appears, the pair could firmly fall at least to the level of 1.2468, which would already be a significant achievement for the dollar, as the demand for it remains very low.