The U.S. dollar sharply strengthened on Tuesday after inflation data in the United States were published: the Consumer Price Index (CPI) and Core CPI both rose in January by +0.3% and +0.4%, respectively, exceeding the forecasts of +0.2% and +0.3%.

Although the annual Consumer Price Index declined in January to +3.1% from +3.4% in December, it exceeded the market's expectations of +2.9%. The annual Core CPI increased by +3.9%, surpassing the preliminary estimate of +3.7%.

Following the better-than-expected CPIs, economists adjusted their expectations regarding the Federal Reserve's move towards a more lenient policy. According to the Chicago Mercantile Exchange's (CME) FedWatch Tool, the probability of maintaining the interest rate in March is 91.0%, and the likelihood of a 25-basis-point interest rate cut in May is less than 50%.

Against this background, the dollar index (DXY) rose to 104.85 yesterday and remains near that level as of writing. Additionally, the dollar receives additional support from the rising yields of U.S. government bonds: 10-year bonds are trading at 4.288%, 0.111% higher than last week's closing rate of 4.177%.

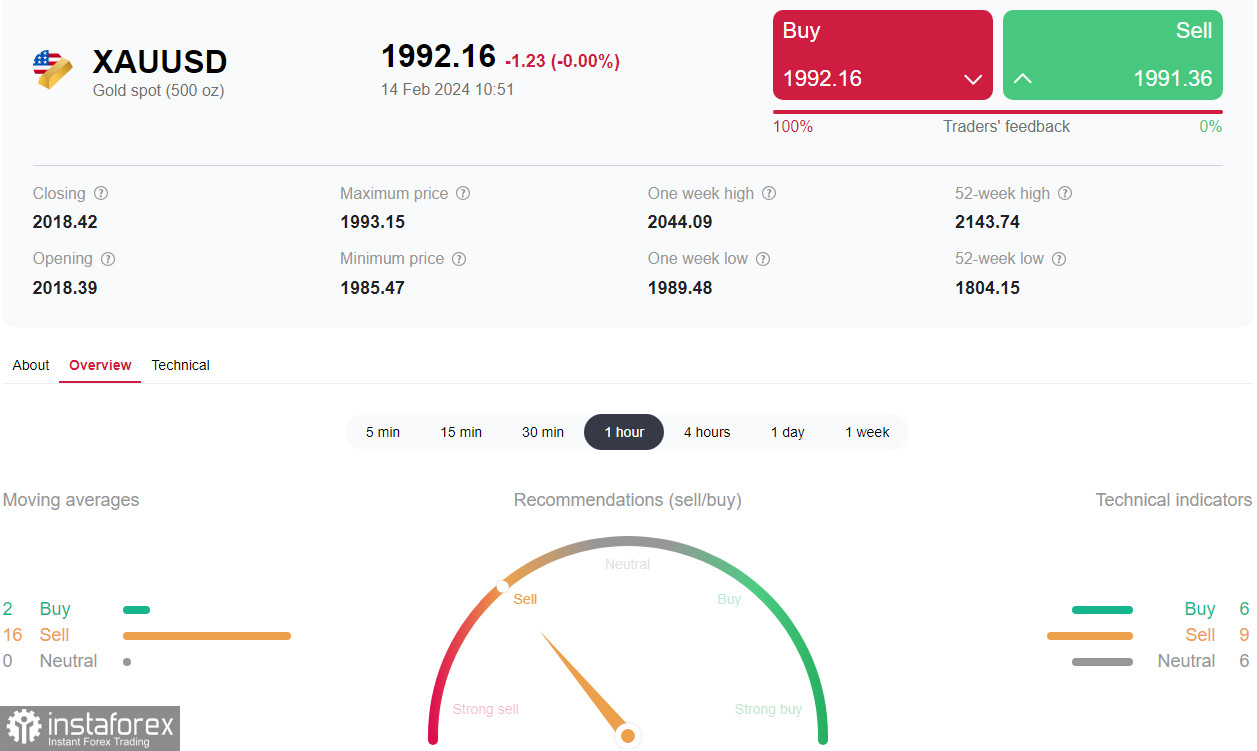

The strengthening of the dollar and the rise in yields of U.S. government bonds exerted pressure on gold prices. They sharply declined on Tuesday, and the XAU/USD pair continued to decrease during Wednesday's Asian trading session, reaching 1986.00 early in the European session—the lowest since December 14 and an important medium-term support level (144-period moving average on the daily chart).

Gold prices are known to be highly sensitive to changes in the credit and monetary policies of major central banks, especially the Federal Reserve. The reduced likelihood of easing the monetary policy of the U.S. central bank after Tuesday's publication of CPI indices puts pressure on the quotes of this precious metal.

Among the positive factors for gold are the persisting high geopolitical uncertainty and potential issues in economic growth, which are also associated with high inflation.

Now, market participants will await new evidence for either an increase or a slowdown in inflation in the United States: on Friday (at 13:30 GMT), data on producer inflation will be published. A similar picture to the dynamics of the CPI indices is expected here: an acceleration of PPI indices in January with a slowdown in annual figures.

As growing production costs increase wholesale prices, this ultimately raises consumer inflation. An increase in inflation (under normal economic conditions) usually puts upward pressure on the quotes of the national currency, as it implies a tighter monetary policy by the central bank, which, in turn, puts pressure on gold prices and the XAU/USD pair.

From a technical standpoint, despite Tuesday's sharp decline, XAU/USD continues to trade in the zone of medium-term and long-term bullish markets, and it would be logical to enter new long positions upon the appearance of signals. The first such signals could be the breakthroughs of local resistance levels at 1996.00 and 2000.00.

Regarding other events on the economic calendar, the dollar quotes, and consequently the XAU/USD pair, will rise again on Thursday with the publication (at 13:30 GMT) of retail sales and initial jobless claims data.