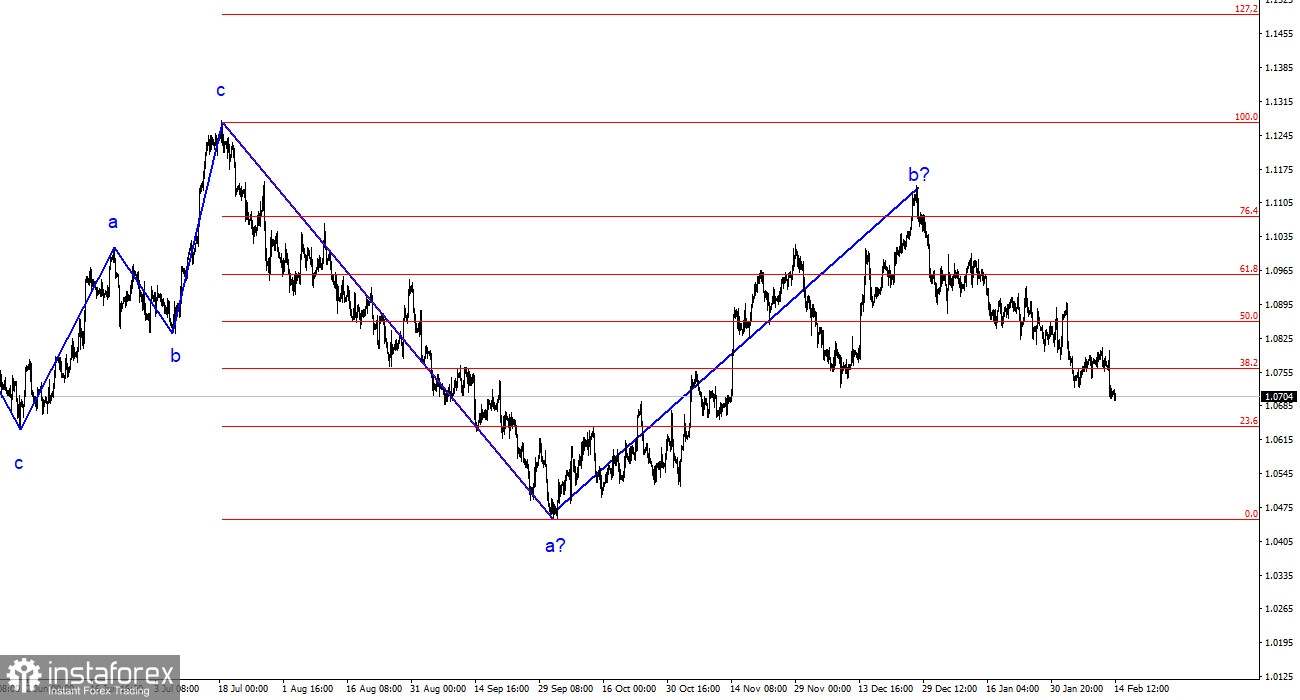

The wave analysis of the 4-hour chart for the euro/dollar pair remains unchanged. In the past year, we have seen only three wave structures that constantly alternate with each other. At the moment, the construction of another three–wave downward trend is continuing. The expected wave 1 is completed, wave 2 or b has become more complicated three or four times, but at this time it can still be considered conditionally completed, since the decline of the instrument has been going on for more than a month.

The upward section of the trend can still be resumed, but its internal structure will be completely unreadable in this case. Let me remind you that I try to identify clear and unambiguous wave structures that do not tolerate ambivalent interpretation. If the current wave marking is correct, then the market has moved to the formation of wave 3 or C. A successful attempt to break through the 1.0788 mark, which corresponds to 76.4% Fibonacci, once again confirmed the market's readiness to sell. Now the nearest target is 1.0637, which equates to 100.0% Fibonacci. But even with this, I do not expect the end of the fall of the euro currency. Wave 3 or c should be much more extended both in time and in terms of goals.

Demand for the euro currency continues to decline under the pressure of statistics.

The euro/dollar pair rate remained unchanged throughout Wednesday. Yesterday, the European currency fell by 60 basis points under the pressure of the report on American inflation. Today's reports on GDP and industrial production in the European Union added fuel to the fire. I remind you that it is currently very difficult to expect high values from the European economy. Stagnation has been going on for more than a year, and it is not yet clear what (other than the ECB's rate cut) can make it start growing again. The second estimate of GDP for the fourth quarter confirmed the value of the first estimate, which was 0%. Industrial production unexpectedly grew by 2.6% in December, with expectations of -0.2%, but this is more of an isolated case than the overall dynamic of the indicator. Looking at the chart of the last 12 months, half of them ended with a decline.

Based on all of the above, I believe that the European currency does not have any special chances for growth today. For the market, the more important factors are the ECB and Fed rates, and there are no changes in this regard. There are also no changes in the wave pattern, which still implies the construction of a downtrend wave 3 or c with minimal targets around the 1.05 figure. So, regardless of the news background, I still expect only a decline in the EUR/USD pair. I also want to note that the decline is relatively slow, and such a type of movement usually has a protracted nature. In my opinion, most factors indicate a continuation of the pair's decline.

General conclusions.

Based on the analysis, I conclude that the construction of a downward set of waves continues. Wave 2 or b has taken on a completed form, so in the near future I expect the continuation of the construction of an impulsive downward wave 3 or c with a significant decrease in the instrument. An unsuccessful attempt to break through the 1.1125 mark, which corresponds to 23.6% Fibonacci, indicated that the market was ready to sell a month ago. I am currently considering only sales with targets near the estimated 1.0462 mark, which corresponds to 127.2% Fibonacci.

On the higher wave scale, it can be seen that the proposed wave 2 or b, which is already more than 61.8% Fibonacci in length from the first wave, can be completed. If this is indeed the case, then the scenario with the construction of wave 3 or c and the decline of the instrument below the 4th figure has begun to be realized.