The British pound continues to fare much better than the British economy. Recall that the UK economy started facing problems in 2016 when a majority of citizens voted for Brexit in the referendum. Since then, the UK (which remains one of the strongest in the world) has been experiencing economic turbulence. In the last one and a half years, the Bank of England has been forced to raise interest rates, further cooling economic growth. The fact that the UK economy has not yet slipped into recession is both surprising and pleasing.

Bank of England Governor Andrew Bailey has repeatedly said that they will manage to avoid a recession, and the economy shows higher resilience against the backdrop of the central bank's tough policy. However, even if the economy manages to avoid a recession, it does not mean that it will quickly recover after the BoE starts reducing rates. It may take years to revive economic growth.

The International Monetary Fund also believes that the UK economy will continue to face problems in 2024. The IMF forecasts UK GDP to grow by 0.6% in 2024, which is lower than the previous forecast of 1%. That's less economic growth than that of Germany or France. The IMF believes that the UK will face weak economic growth due to a more extended period during which the BoE will be forced to keep rates at peak levels because inflation is still showing high rates.

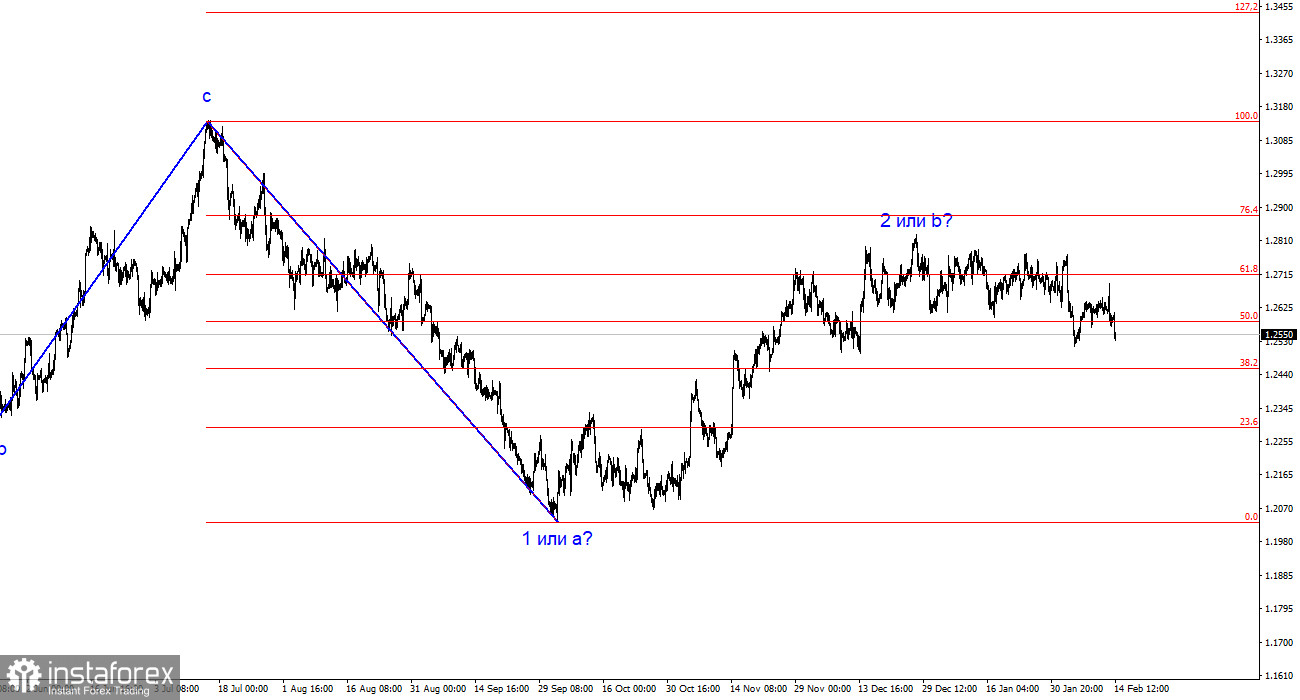

In my opinion, the dismal state of the British economy should exert pressure on the British pound. To "seal" the downtrend, the pound should fall to the 1.20 level. After that, at any moment, the downtrend can be recognized as complete (it will turn out to be a three-wave trend), and after that, the market can start working on a more attractive uptrend. Therefore, I don't need the pound to fall constantly or, for instance, throughout the year. However, without falling to the 1.20 level or below, there's a chance that the wave analysis may appear hopelessly confusing. I would like to remind you that we are interested in wave structures that are simple and understandable, ones that we can work on, not structures created on charts for the sake of appearance or to demonstrate the depth of knowledge in wave analysis.

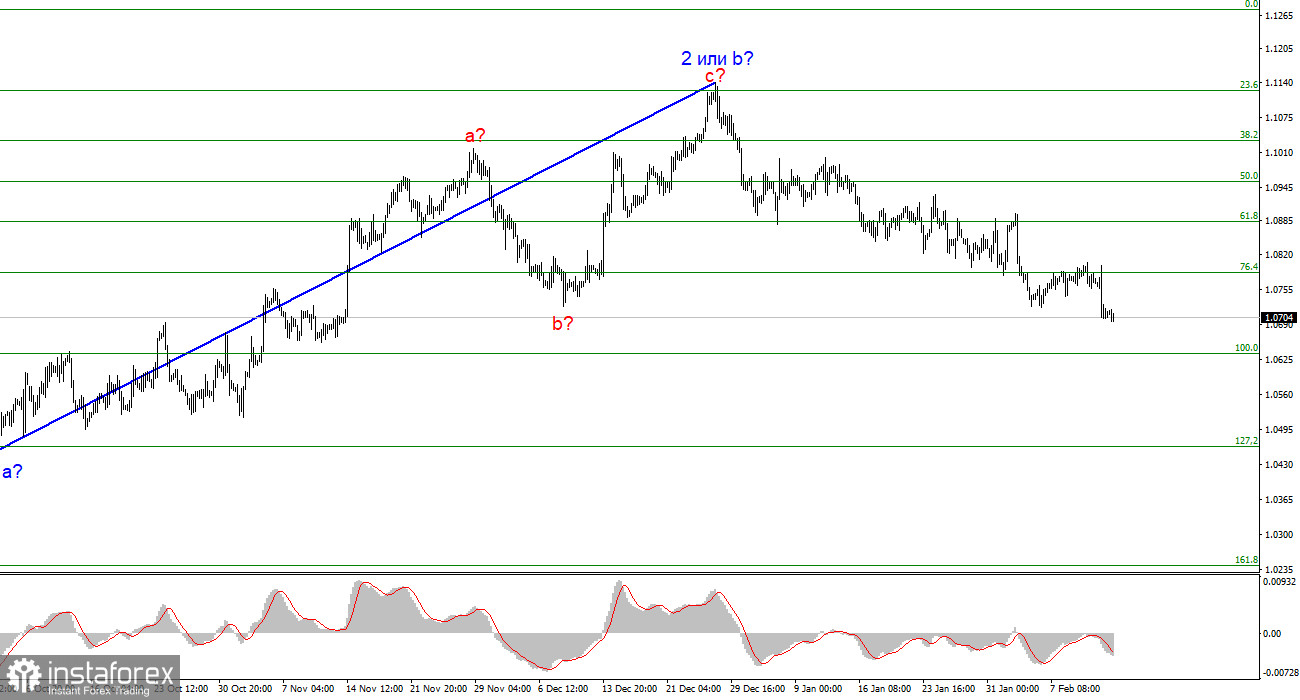

Based on the analysis, I conclude that a bearish wave pattern is being formed. Wave 2 or b appears to be complete, so in the near future, I expect an impulsive descending wave 3 or c to form with a significant decline in the instrument. The failed attempt to break through the 1.1125 level, which corresponds to the 23.6% Fibonacci, suggests that the market is prepared to sell a month ago. I am currently considering short positions with targets around the level of 1.0462, which corresponds to 127.2% according to Fibonacci.

The wave pattern for the GBP/USD pair suggests a decline. At this time, I am considering selling the instrument with targets below the 1.2039 mark because wave 2 or b will eventually end, just like the sideways trend. I would wait for a successful attempt to break through the 1.2627 level as this will serve as a sell signal. Another signal was formed on Tuesday, in the form of an unsuccessful attempt to break this level from below. Now I am quite confident about the instrument's decline, at least to the 1.2468 level, which would already be a significant achievement for the dollar, as the demand for it remains very low.