The British pound continues to lose ground after the UK inflation rate remained unchanged. The market was expecting the pace of consumer price growth to accelerate from 4.0% to 4.1%. However, during the US trading session, the pound stopped falling and we witnessed some semblance of a rebound, an attempt to correct the current imbalances. The pound's oversold condition is apparent. The market will try to grab any excuse to rectify the situation. However, today's UK industrial production data does not inspire optimism, as the pace of decline is expected to accelerate from -0.1% to -0.2%. In theory, the pound should fall further. However, its oversold condition severely limits the downward movement. It is quite possible that the combination of these factors will lead to a temporary standstill for the pound.

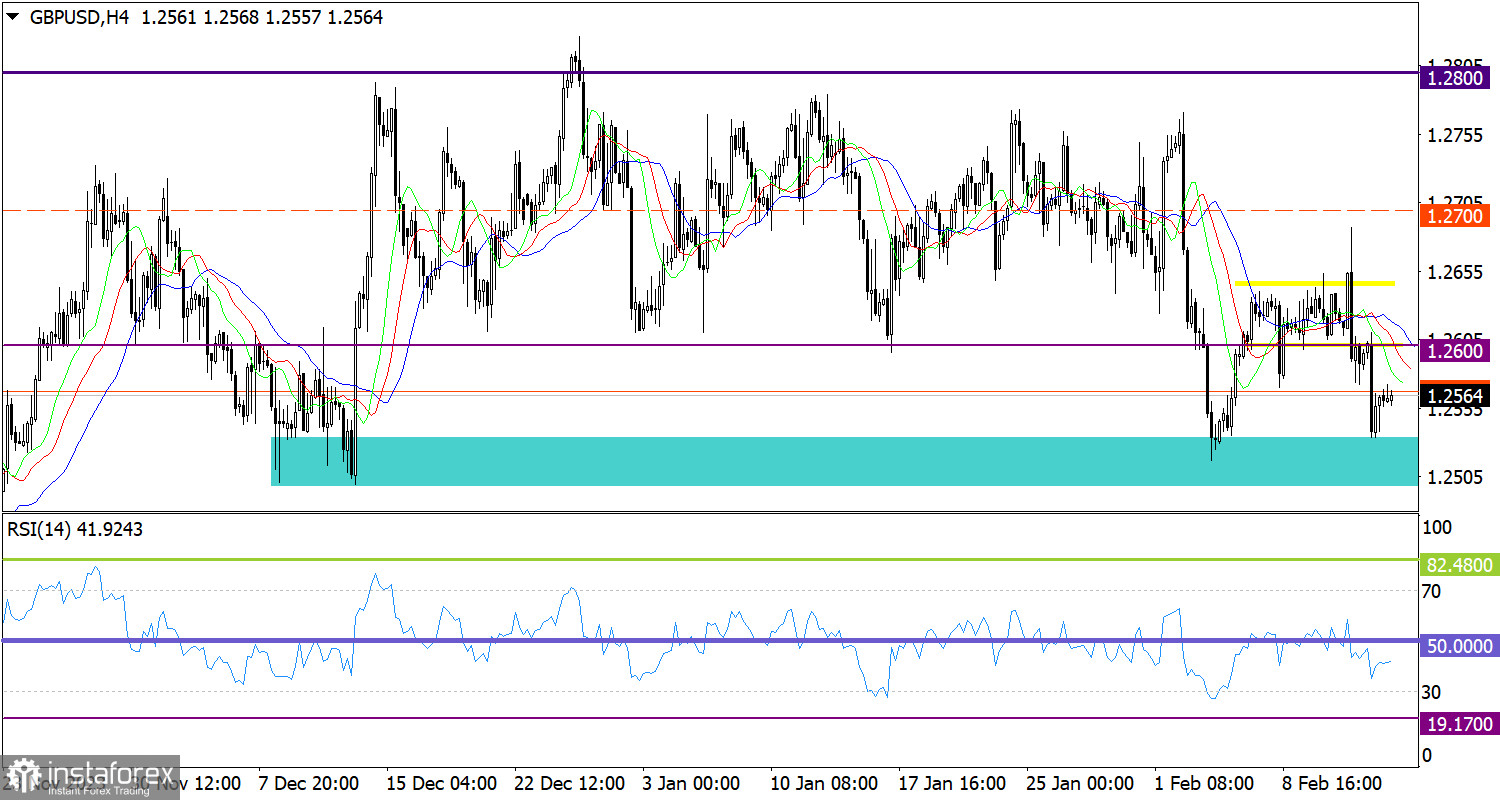

During a speculative surge in short positions on the British pound, the exchange rate headed towards the local low set in December 2023. However, market participants failed to overcome it, resulting in a partial decrease in short positions, which led to a rebound.

On the four-hour chart, the RSI technical indicator is hovering in the lower area of 30/50, indicating the prevailing bearish sentiment.

On the same chart, the Alligator's MAs are headed downwards, which corresponds to the current cycle.

Outlook

The 1.2500/1.2530 range serves as a support for sellers, complicating the process of building a subsequent downward cycle. If the price fails to stay below this range in the daily chart, the pound may recover towards 1.2600.

The complex indicator analysis unveiled that indicators are suggesting a pullback in the short-term period, while indicators in the intraday period point to a downward cycle.