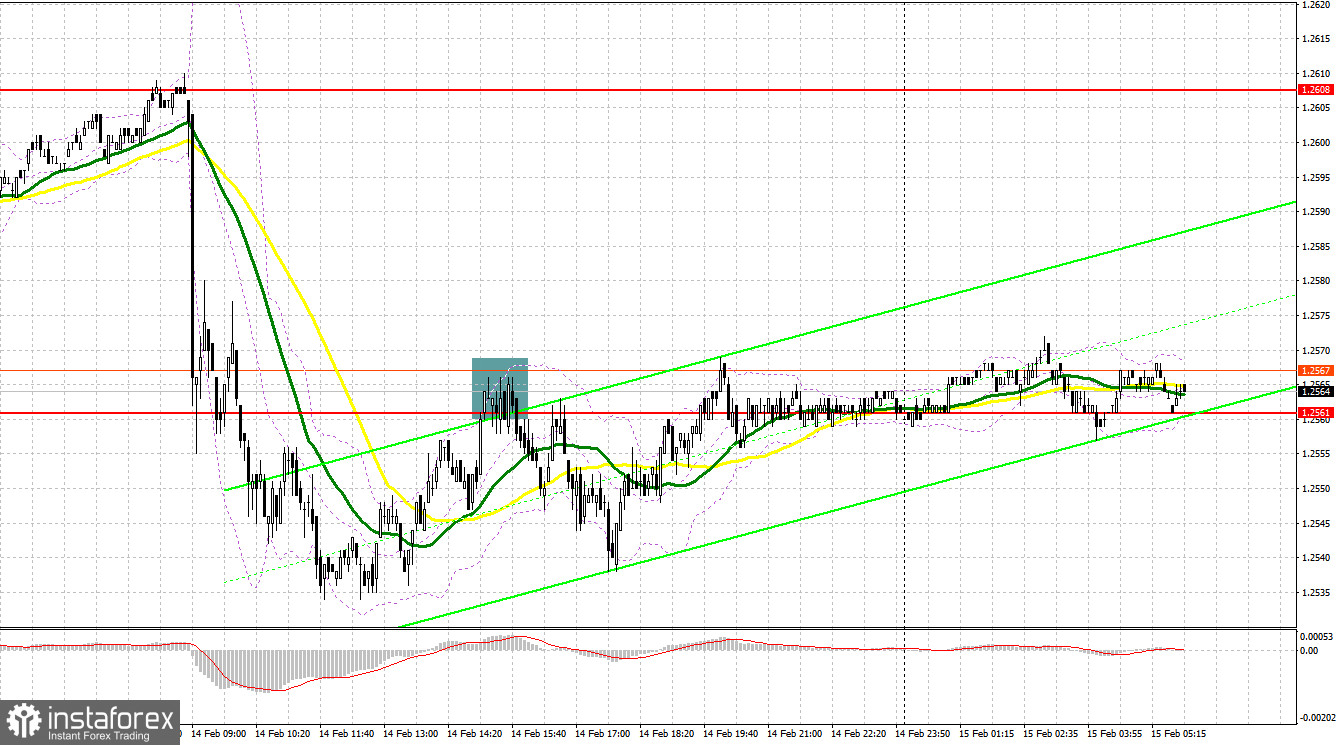

Yesterday, GBP/USD generated several signals to enter the market. Now let's look at the 5-minute chart and try to figure out what actually happened. In my morning forecast, I indicated the level of 1.2573 and planned to make decisions on entering the market from there. A breakout and upward retest of 1.2573 generated a sell signal, which sent the pair down by more than 30 pips. In the afternoon, failed consolidation above 1.2561 produced another sell signal. As a result, the pair fell by more than 20 pips.

For long positions on GBP/USD:

Yesterday, the pound slipped sharply on the news that UK inflation slowed more than expected. Today, pound buyers will have to closely monitor the UK GDP growth numbers for the fourth quarter. If it turns out to be a disappointing report, it will likely push the Bank of England towards an earlier interest rate cut, which is bad for the pound. If the data turns out to be better than economists' forecasts, then traders should also look at reports on industrial production, the goods trade balance, and changes in investment volume in the UK. These reports could also support the pound.

The most preferable scenario for me in the current situation would be to buy during a decline near 1.2547. A false breakout of this level, similar to what I discussed above, would serve as a buy signal, aiming for a recovery towards 1.2678, where the moving averages are currently aligned in favor of sellers. A breakout and consolidation above this range will strengthen the demand for the pound and open the way to 1.2608, which would be a strong correction for the pair. The ultimate target will be the 1.2652 high where I intend to take profit. In a scenario where GBP/USD falls and there are no buyers at 1.2547, we might see another pound sell-off, which will revive the bear market. In such a scenario, only a false breakout near the next support at 1.2519 would provide an entry signal. I would immediately go long on a bounce from the 1.2486 low, bearing in mind an intraday correction of 30-35 pips.

For short positions on GBP/USD:

Sellers are in control of the market and their goal is to go beyond the annual low. In case GBP/USD attempts to recover in the first half of the day, I plan to sell only after forming a false breakout near the new resistance at 1.2578, as this would confirm the presence of big players in the market, creating a sell signal that will give bears a chance to move the price down to 1.2547 - an intermediate support. A breakout and a retest from below will deal a more serious blow to the buyers' positions, leading to the removal of stop orders and open the way to 1.2519, where I anticipate big buyers to show up. The next target will be 1.2486, where I plan to take profits. If GBP/USD grows and there are no bears at 1.2578, and if we receive strong UK GDP data, the bulls will try to regain the market's favor in hopes of a correction. In such a case, I will postpone sales until the price performs a false breakout at 1.2608. If there is no downward movement there, I will sell GBP/USD on a bounce right from 1.2652, considering a downward correction of 30-35 pips within the day.

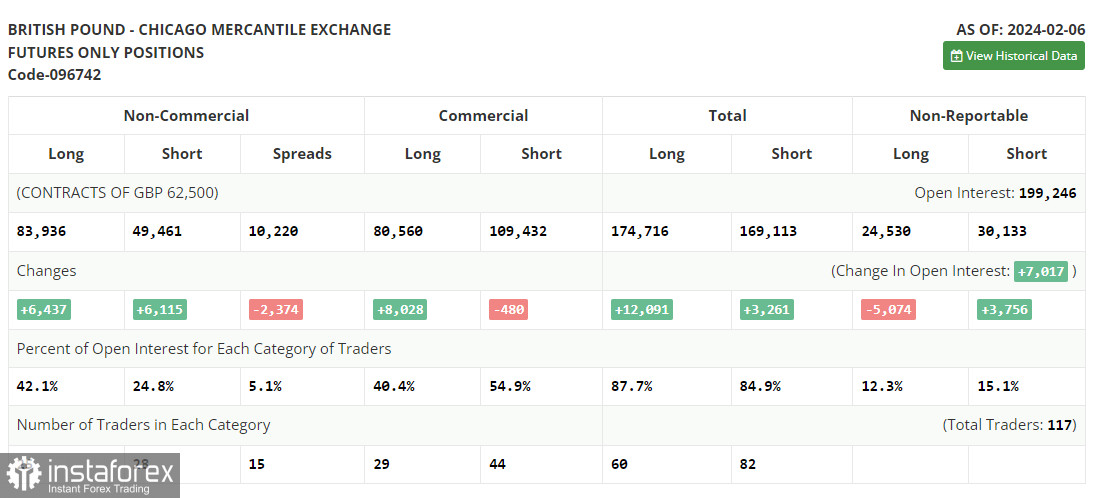

COT report:

In the COT report (Commitment of Traders) for February 6, we find an increase in both long and short positions. Although traders already have a clear view of the Bank of England's future policy, which intends to actively control inflation, the pound is not in a rush to show growth. Recent statements by BoE officials indicate a soft wait-and-see stance that can change at any moment – if, of course, the data allows. In the near future, we can look forward to UK reports on the labor market, wage growth, and inflation, which can significantly change the balance of power in the market. But don't forget to consider the Federal Reserve's wait-and-see position, so uncertainties are much greater now than before. The latest COT report said that long non-commercial positions rose by 6,437 to 83,936, while short non-commercial positions increased by 6,115 to 49,461. As a result, the spread between long and short positions decreased by 2,374.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates a possible decline in the pair.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If GBP/USD falls, the indicator's lower boundary near 1.2545 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.