The situation with the USD/JPY pair can be characterized by the enigmatic quote from Confucius: "Everything has beauty, but not everyone sees it."

Despite the disappointing GDP report, the USD/JPY pair is acting as if nothing happened. Moreover, the bears even organized a downward pullback, taking advantage of the US dollar's broad weakness. On Thursday, the dollar was clearly not in good shape and was seen falling across the market. The main reasons are a correction and weak retail sales data (which we will discuss below). However, the downward dynamics are not only due to the US dollar index's decline but also to another, more significant factor. The fact is that after the recent surge, the pair is trading in the "risk zone." In turn, Japanese authorities have already voiced transparent hints, the essence of which boils down to the readiness to carry out a currency intervention if the yen continues to depreciate. Therefore, traders are not in a hurry to test the patience of the Japanese authorities. After testing the 150th figure, many buyers of USD/JPY took profit, thereby triggering a bearish rollback.

Can we talk about a trend reversal in such conditions? In my opinion, no. Verbal interventions "work," but they have a short-term impact on the market. As soon as the dollar recovers (for instance, if the chances of a rate hike in May finally increase), USD/JPY buyers will take the initiative again. The "instinct for self-preservation" will be suppressed by another dollar rally.

Sooner or later, this story will end with a predictable ending: Japanese authorities will conduct a currency intervention. However, this does not mean that the pair, fearing such a scenario, will collapse by several hundred points in the near future. Such a development is unlikely unless Japanese authorities actually intervene. However, it is unlikely for the pair to storm the 151st figure without a strong impetus (in favor of the greenback). Therefore, the third scenario, which is currently being implemented, is possible.

The current price is 200 points away from the conditional "red line". The pair has already approached the resistance level of 151.00, but the bullish momentum would fade away every time it gets close. A similar situation occurred last year, although at that time the price ceiling was at the level of 150.00. All other fundamental circumstances were quite similar: the yen's weakness against the backdrop of the Bank of Japan's dovish position + the dollar's strength amid hawkish signals from the Federal Reserve. These circumstances pushed the pair upward. Meanwhile, trouble comes in the form of a possible reaction from the Japanese Ministry of Finance preventing traders from entering above 150.00. Buyers took profit and entered into sales, taking advantage of how predictable the situation is. In turn, representatives of the Japanese government intensified verbal interventions as soon as the yen approached "unacceptable" levels. Market participants understood the hint: for several weeks, the scheme worked like clockwork. The pair approached the borders of the 150th figure, then bounced off and declined to the base of the 149th figure.

A similar situation is developing at the moment, but this year the upper limit of the range is the 151st figure.

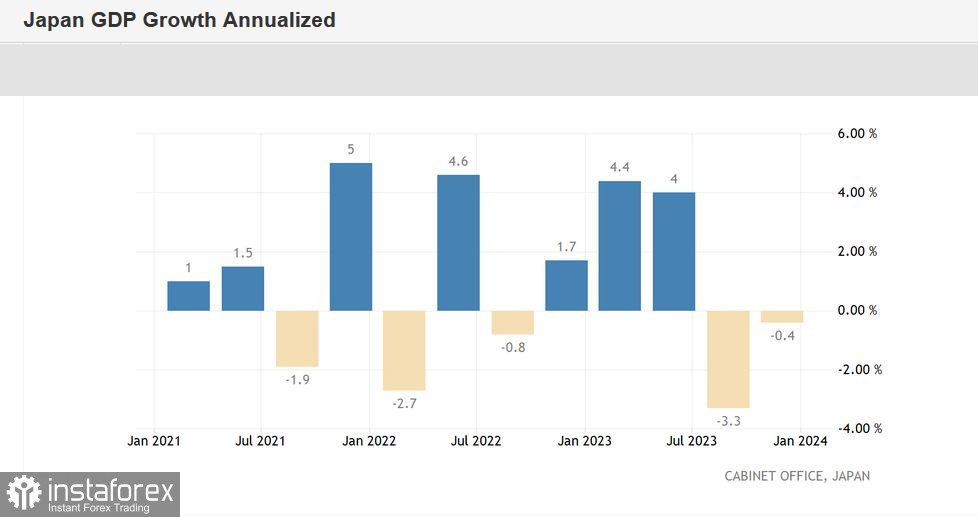

It is important to emphasize that there are no prerequisites for the yen's growth. Japan's latest GDP report aggravated the situation and put pressure on the Japanese currency. Instead of the predicted growth (albeit small), Japan's economy contracted again. Japan's GDP fell an annualised 0.4% in the October-December period after a 3.3% slump in the previous quarter (the third-quarter figure was revised downward).

This suggests that Japan slipped into a technical recession in the second half of 2023. And according to a number of experts, the current quarter will not please investors either, primarily due to the sluggish level of consumption and capital spending.

Thus, the current fundamental background does not provide support for the yen. The US economy continues to grow, while the Japanese economy has entered a recession. The BOJ continues to implement accommodative policies (weak domestic demand will continue to hinder the central bank from tightening monetary policy), while the Fed keeps pushing back the date of the first round of interest rate cuts. All these factors play in favor of USD/JPY buyers.

Thursday's price pullback occurred for two reasons. Firstly, the US retail sales data disappointed. Retail sales fell 0.8% in January (against a forecasted decline of 0.2%), excluding the auto sector, it fell 0.6% (against a forecast of a rise by 0.3%). Secondly, the market reacted to the words of Japan's top currency diplomat. Vice finance minister for international affairs Masato Kanda told reporters that the recent movements in the currency market were "too swift." In this context, he warned that authorities are ready to "take appropriate steps in the market if necessary."

All these factors exerted slight pressure on the pair. But buyers are still in control of the situation. Note that despite the pullback, USD/JPY is unable to settle within the 149.00 range. This indicates that the bullish bias remains intact. Therefore, from the current positions, it would be reasonable to consider longs with the main target at 150.90 (the upper line of the Bollinger Bands indicator on the D1 timeframe).