GBP/USD

Yesterday, UK reports on GDP, industrial production, and trade balance data turned out to be mixed, and the US data also showed mixed results. However, since the dollar index fell by 0.41% on Thursday, amid a slight increase in risk appetite in the broader markets, the pound rose by 0.27%.

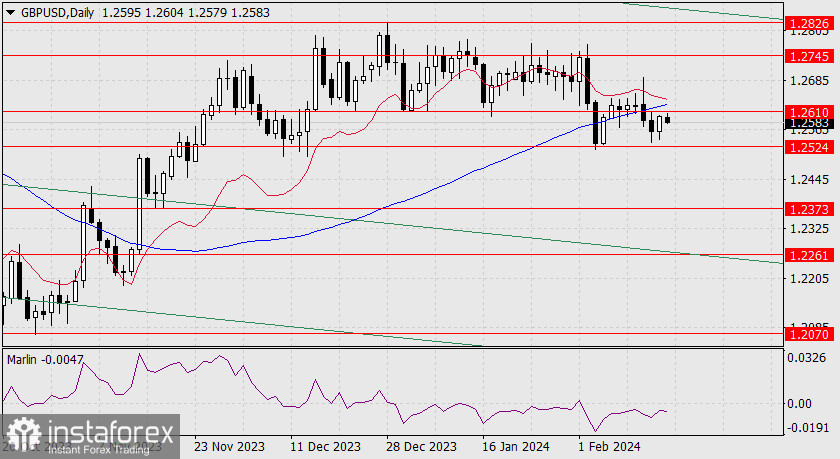

This morning, the price retreated from the target level of 1.2610 so it failed to reach this mark. Today, the price could have the opportunity to reach this target, but since the MACD line on the daily chart is just above this level, and the Marlin oscillator is in negative territory, it doesn't seem as important to reach the 1.2610 level. Unless the market plans to see a stronger rise, at least to the peak of February 13 at the 1.2691 level. If the bearish sentiment turns out to be stronger and the price breaks below the support at 1.2524, investors will be enthusiastic about reaching 1.2373.

On the 4-hour chart, the price turned down from the balance and MACD resistance lines, which explains why the pound is reluctant to expand its growth. The signal line of the Marlin oscillator is turning down from the zero line. We are waiting for progress, hoping that the pair falls further.