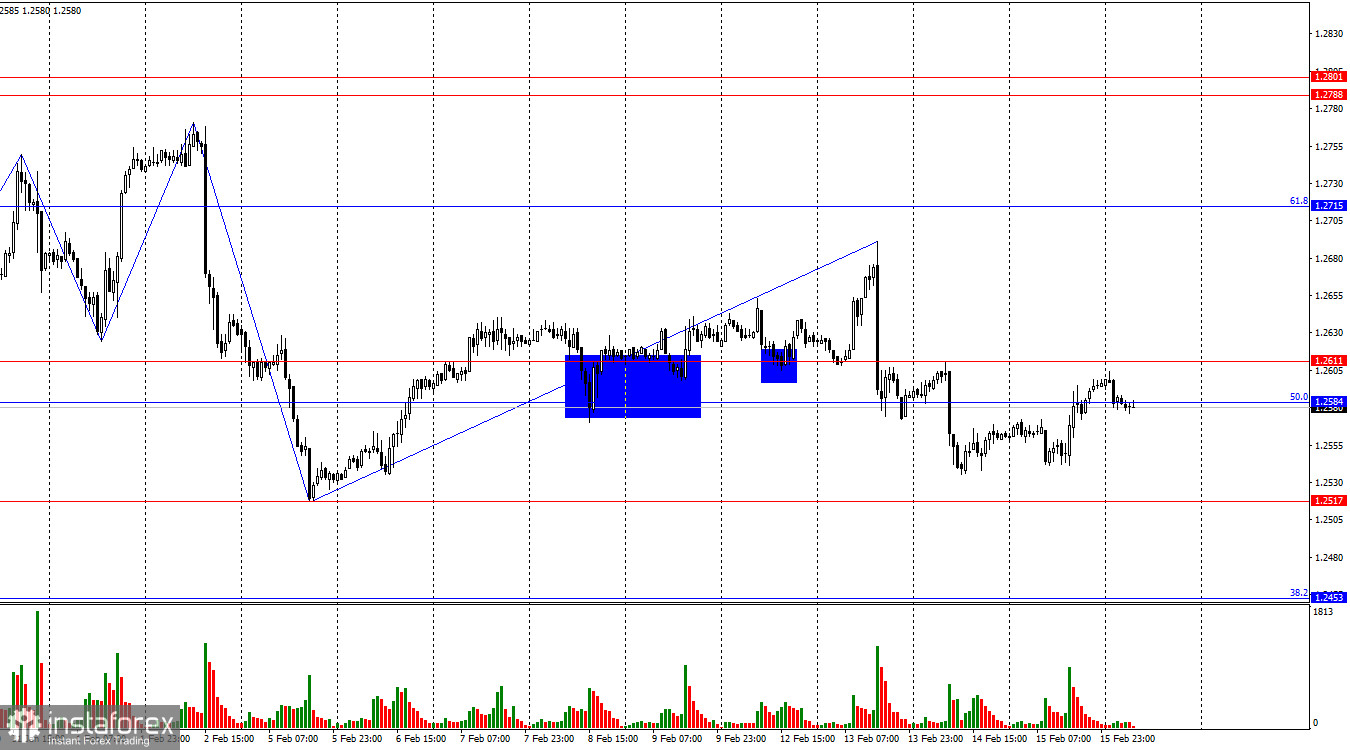

On the hourly chart, the GBP/USD pair returned to the resistance zone of 1.2584–1.2611 on Thursday. A rebound from this zone will again work in favor of the US dollar and lead to a drop towards 1.2517. However, I want to emphasize once again that bears are still very weak at the moment. Consolidating the pair's rate above the zone of 1.2584–1.2611 will increase the probability of further pound growth towards the corrective level of 61.8%–1.2715.

The wave situation remains very ambiguous. For a long time, we observed horizontal movement, within which single waves or triples were almost constantly forming, alternating, and having approximately the same size. It has been too short since the end of the sideways movement to conclude. Traders' sentiment has changed to "bearish," allowing for a prolonged decline in the pound, but bears are showing their weakness again. There are no signs of the end of the new "bearish" trend, and I expect a decline in the British currency. The last upward wave failed to surpass the previous peak, but the last downward wave also could not push the pair down to 1.2517. There are more questions now than answers.

Yesterday, the preliminary estimate of the GDP volume for the fourth quarter became known in the UK. The British economy contracted for the first time in a long time, immediately by 0.3% q/q. However, the industrial production report somewhat softened the negative effect of the economic downturn, and the reports from the US gave even more strength to the bull traders. Thus, instead of logically continuing the pound's decline, we once again saw its growth. The growth could be stronger and more significant. The resistance zone of 1.2584–1.2611 may force the bulls to retreat today. However, with the support of the information background, bull traders could continue their attacks on Friday.

On the 4-hour chart, the pair has consolidated below the level of 1.2620, which signals the end of the sideways movement and allows counting on a drop toward the level of 1.2450. As mentioned, traders' sentiment changed to "bearish" after consolidating below the ascending trend corridor. However, it took a month and a half for the bears to at least go on the offensive. The "bullish" divergence on the CCI indicator suggests some growth, while the descending trend line indicates a "bearish" priority. The situation could be clearer.

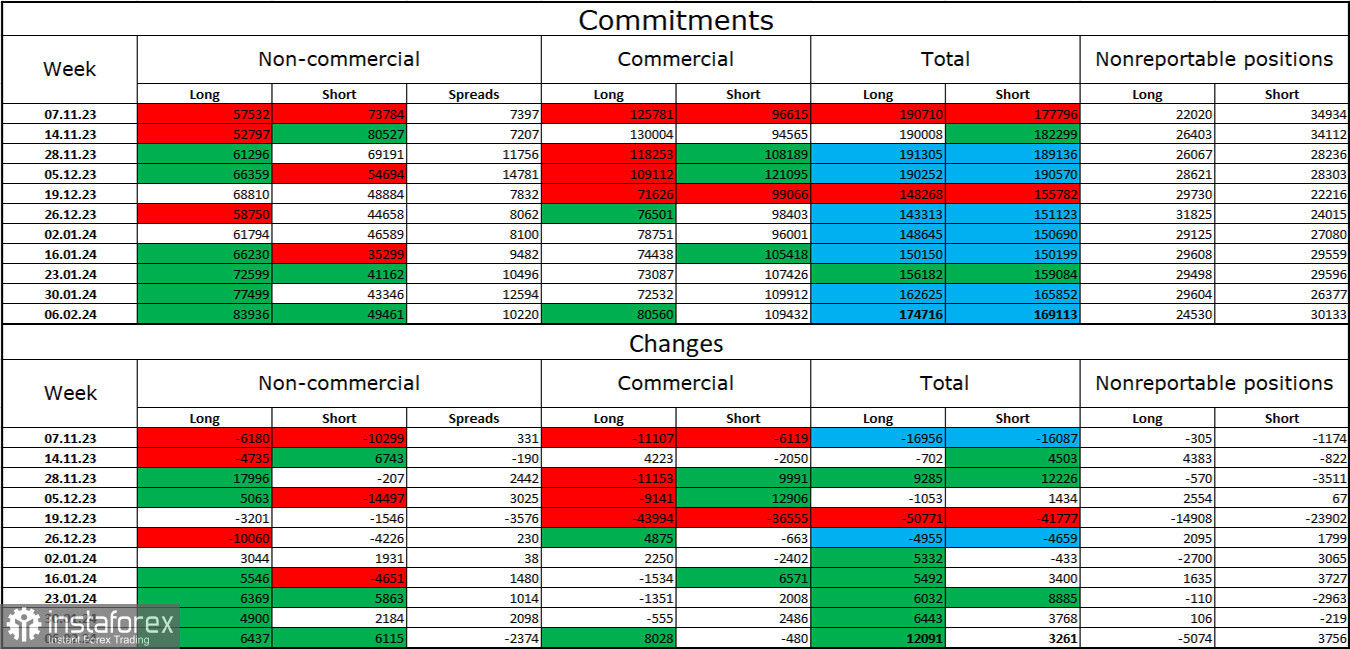

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category has not changed much over the past reporting week. The number of long contracts in the hands of speculators increased by 6437 units, and the number of short contracts increased by 6115 units. The overall sentiment of large players changed to "bearish" several months ago, but now, bulls still have a significant advantage. There is an almost twofold gap between the number of long and short contracts: 84 thousand versus 49 thousand.

The prospects for the pound's decline remain excellent. Overs will start getting rid of buy positions over time, as all possible factors for buying the British pound have already been worked out. The growth we have seen in the last three to four months is corrective. Bulls have not been able to push the level of 1.2745 for almost two months. However, the bears are also in no hurry to go on the offensive and cannot fully cope with the zone of 1.2584–1.2611.

News Calendar for the US and the UK:

UK – Retail Sales Volume Change (07:00 UTC).

US – Building Permits (13:30 UTC).

US – Producer Price Index (PPI) (13:30 UTC).

US – University of Michigan Consumer Sentiment Index (14:00 UTC).

On Friday, the economic events calendar contains several entries that can affect the course of the pound and the dollar. The impact of the information background on the market sentiment for the rest of the day may be of moderate strength.

Forecast for GBP/USD and Trader Recommendations:

Sales of the pair could be considered on consolidation below the support zone of 1.2584–1.2611 with targets at 1.2517 and 1.2453. The targets have not been reached. Today, sales can be considered again on a rebound from the zone of 1.2584–1.2611 with the same targets. Purchases will be possible after closing above 1.2584–1.2611 on the hourly chart with a target of 1.2715. Or in case of a rebound from the level of 1.2517.