The market needs time to cool down. The initial reaction can be very turbulent, but gradually, emotions give way to reason. The stability of underlying inflation in the U.S. at 3.9% YoY and the rapid growth of service inflation by 0.7% MoM inspired the bears on EUR/USD to attack. However, a decline in retail sales by 0.8% MoM allowed the main currency pair to lick its wounds. In the end, it became clear that neither report was good enough nor bad enough.

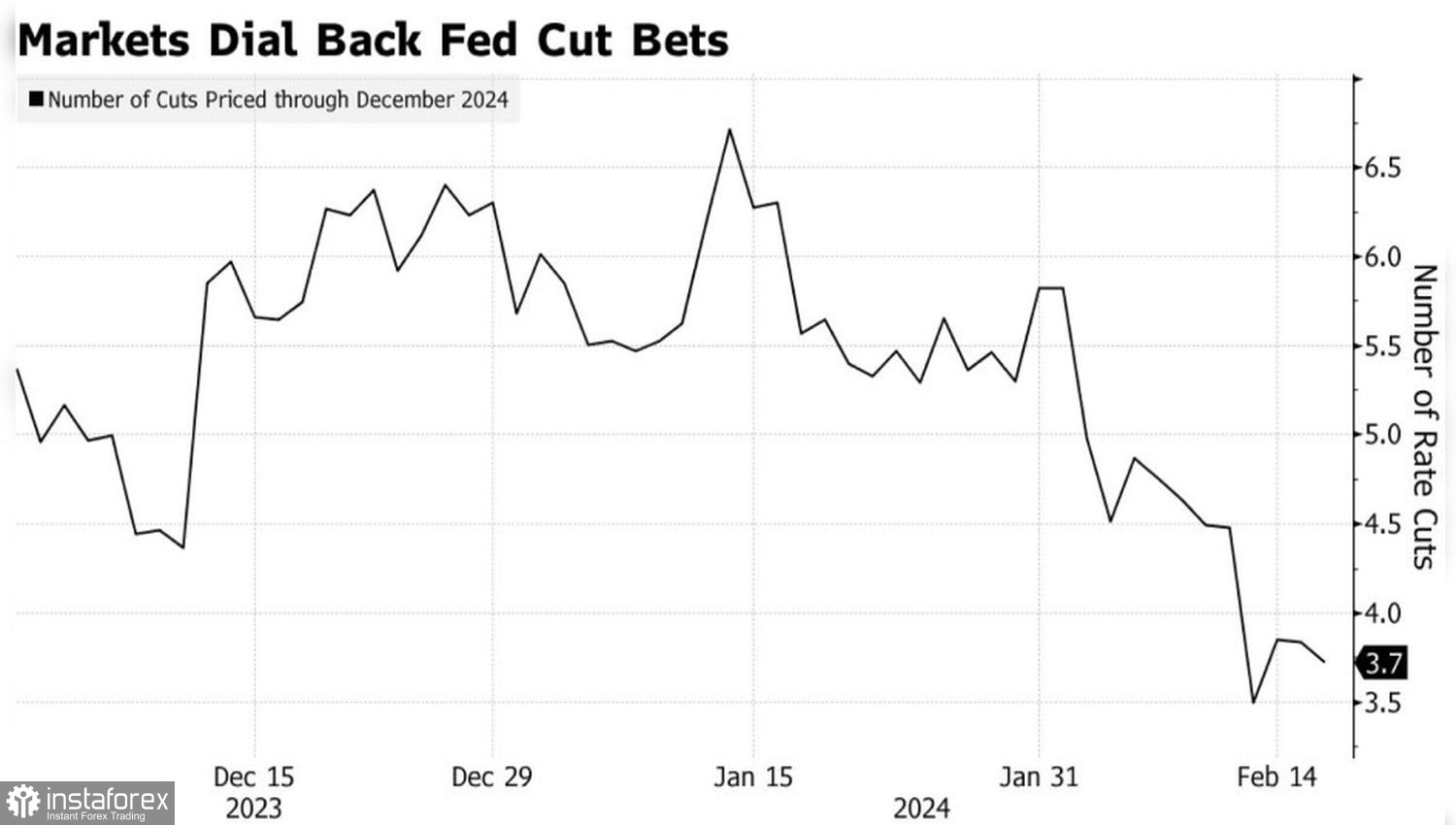

Indeed, the weakness in January retail sales may be attributed to strong Christmas purchases that set a high base. In any trend, pullbacks always occur. And the downward trend in CPI is no exception. The market began to expect slightly less than four acts of monetary expansion by the Federal Reserve in 2024 instead of the 6.5 in mid-January, which pushed EUR/USD quotes to a three-month low. However, signs of a slowdown in the U.S. economy helped the bulls raise their heads.

Dynamics of expected acts of monetary expansion by the Federal Reserve

Currently, there are two main opinions in the market. The first assumes that the strength of the U.S. labor market and the economy, as a whole, will lead to an acceleration of consumer prices. This will prompt the Federal Reserve to abandon the idea of lowering the federal funds rate in June and its forecast of three acts of monetary expansion in 2024. Thus, Nordea notes that the current dynamics of the U.S. GDP is far from the Fed's forecast of +1.4% for this year. As a result, the company has changed its views: it expects two interest rate cuts of 25 bps each – in September and December. If this happens, EUR/USD will continue to fall.

Societe Generale even believes that further acceleration of U.S. GDP will fuel inflation. The Fed will be forced to return to tightening monetary policy. Currently, the central bank has no reason to hurry, as the 525 bps increase in the federal funds rate since the beginning of the cycle has not cooled the economy at all. Jupiter Asset Management assigns a 20% probability that the Fed will resume monetary restriction. This is fraught with further strengthening of the U.S. dollar.

According to Deutsche Bank, if the Fed does not lower rates in May, EUR/USD will fall to 1.05. JP Morgan believes that if the economic downturn in the eurozone deepens, the euro will return to parity with the U.S. dollar.

On the other side of the barricades are supporters of the recovery of the main currency pair. Credit Agricole notes that the main trump cards of the bears have been played out. The market has come to a consensus with the Fed on the quantity and scale of monetary expansion. The economy is slowing down, and the divergence in economic growth between the U.S. and the eurozone is narrowing. Isn't that a reason to buy the euro?

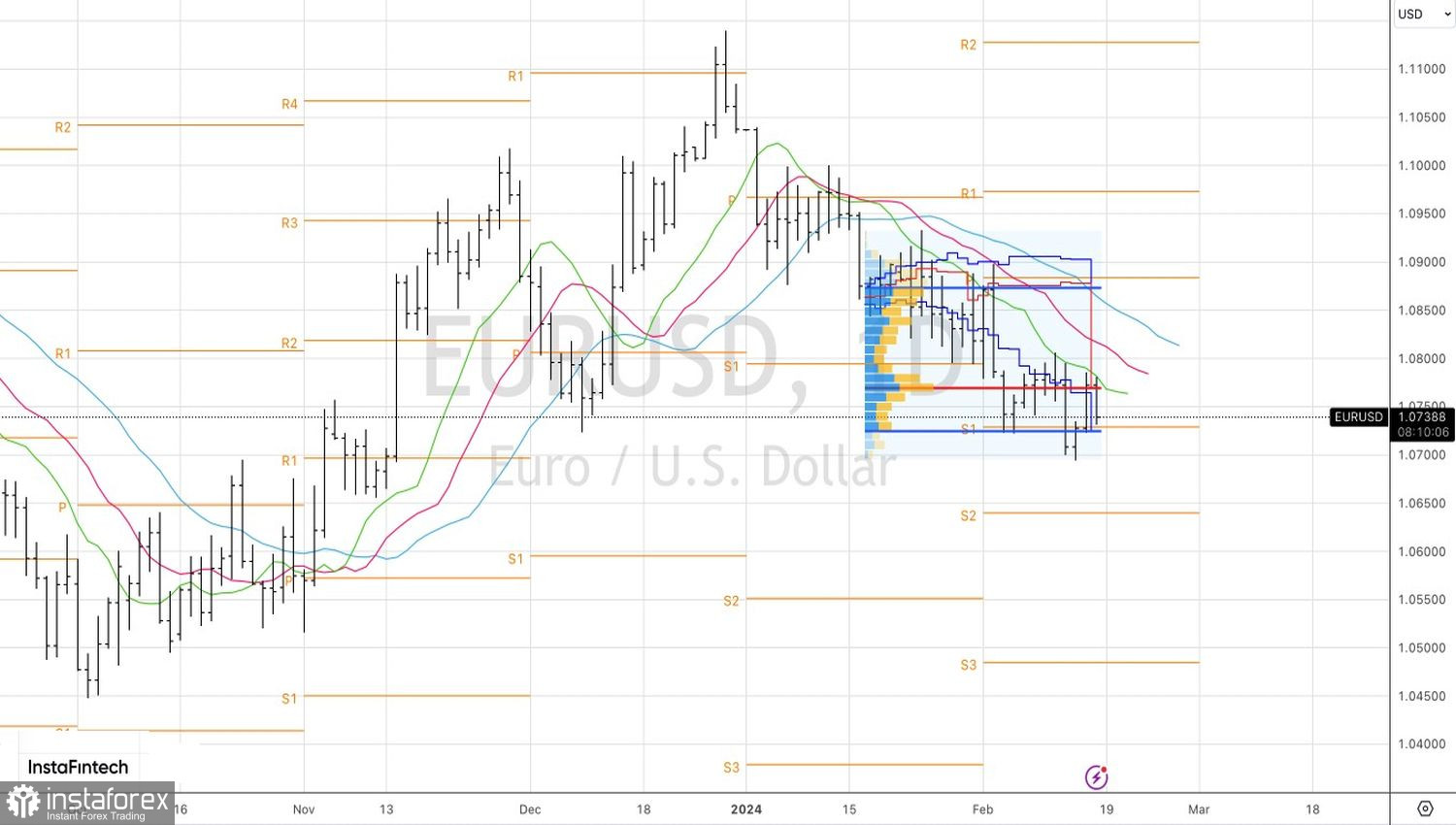

Technically, on the daily chart, the inability of the bulls to grasp fair value is a sign of their weakness. After an unsuccessful attempt to play the Anti-Turtles pattern, the initiative returned to the bears. A successful assault on support at 1.073 is a reason to increase previously formed shorts.