EUR/USD

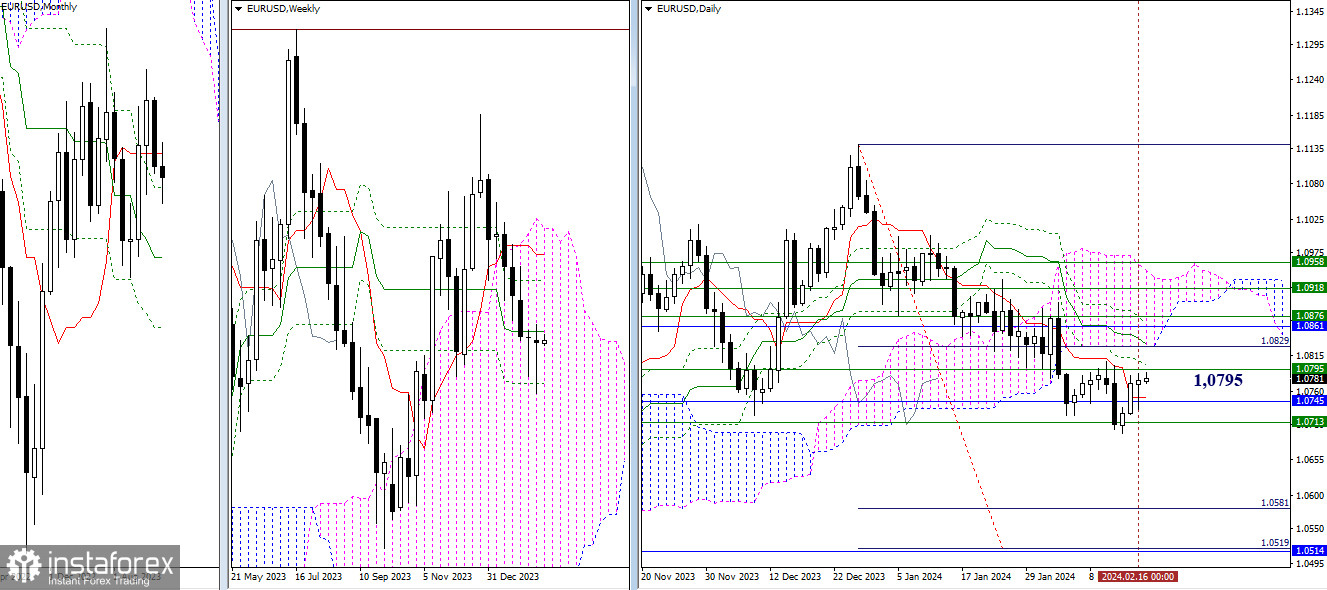

Higher Timeframes

Resistance of the weekly medium-term trend (1.0795) has been holding back developments for two weeks now. Today's opening also occurred under this resistance, and the market currently lacks the ability to move above 1.0795. Perhaps there is the formation of another consolidation. To shift sentiments to the upside, bulls must break through the said level and firmly secure its support.

However, if bears decide to exit the zone of uncertainty first, they need to break through the current supports (1.0745 – 1.0713) and settle below the low (1.0696), restoring the downward trend on the daily chart.

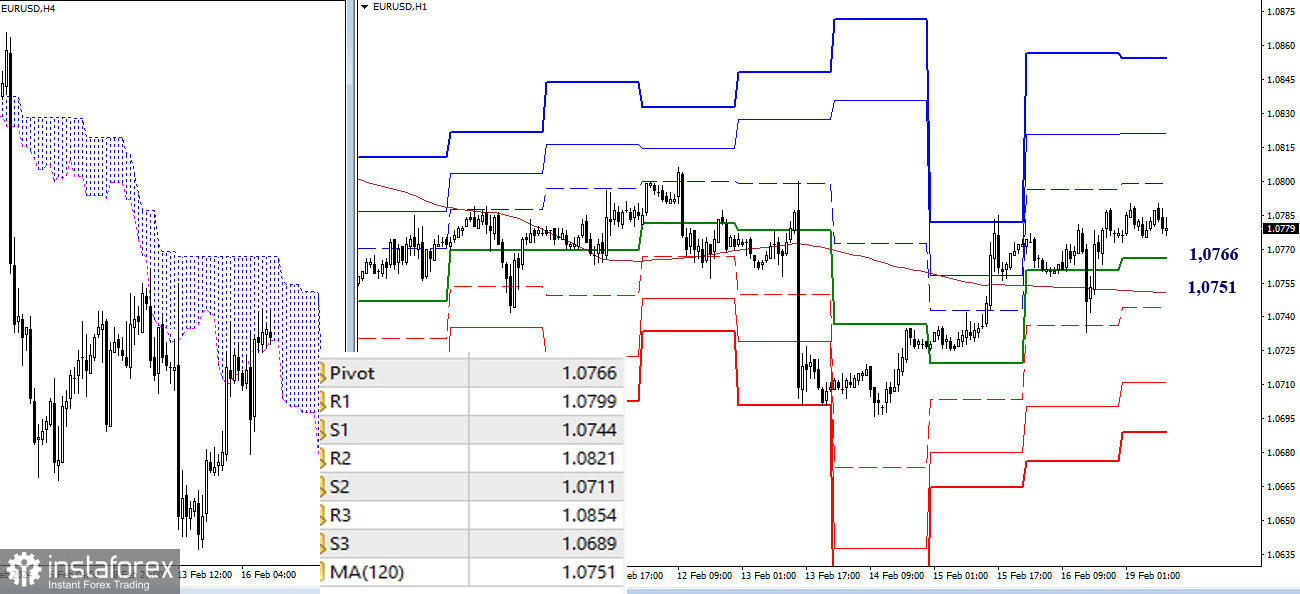

H4 – H1

On the lower timeframes, the advantage currently belongs to the bulls. Upside targets are currently set at 1.0799 – 1.0821 – 1.0854 (classic pivot points of the day). Key levels today form the boundaries of support; in case of a decline, they will encounter the pair at 1.0766 (central pivot point of the day) and 1.0751 (weekly long-term trend). If bears manage to reclaim key levels, attention will be directed to the supports of classic pivot points (1.0744 – 1.0711 – 1.0689).

***

GBP/USD

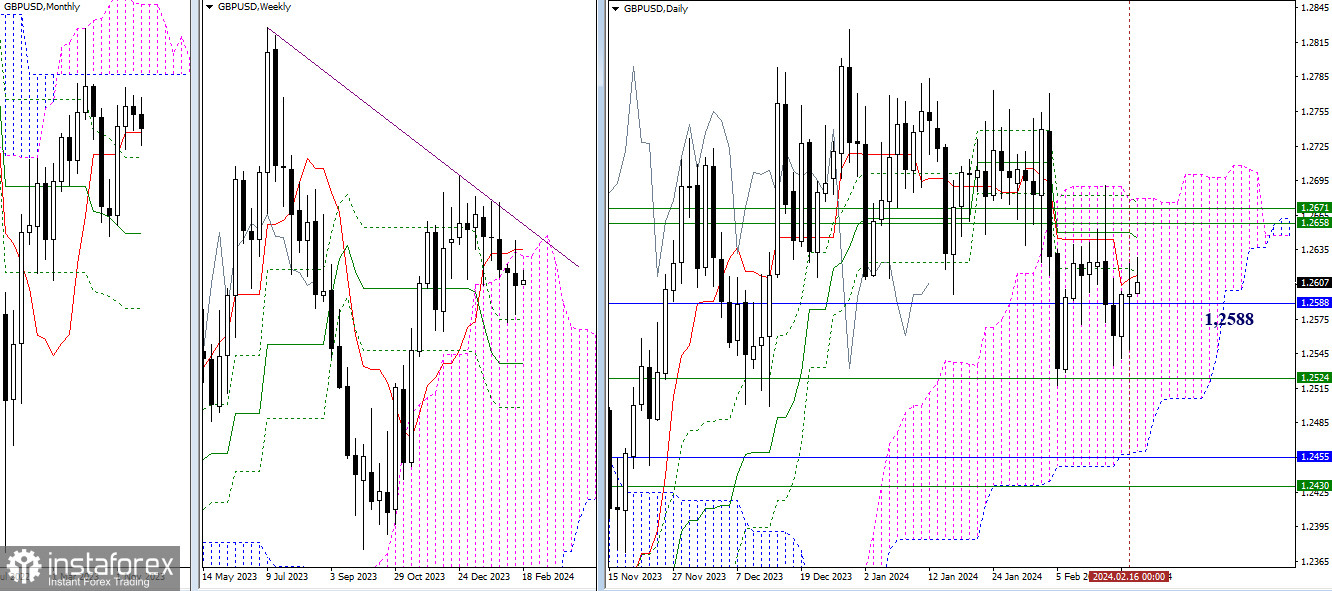

Higher Timeframes

On higher timeframes, the center of attraction continues to be the monthly short-term trend (1.2588), with the nearest resistance coming from daily levels (1.2615-13). To change the current situation and move on to implementing new plans, the market must test and, if possible, move beyond the benchmarks that are currently on the path of development. For bulls, it is crucial to consolidate in the bullish zone relative to the daily and weekly clouds, eliminate the downward daily cross, and capture support for the weekly short-term trend (1.2658-71-75 – 1.2680). For bears, it is necessary to go beyond the low (1.2517), reinforced by weekly support (1.2524).

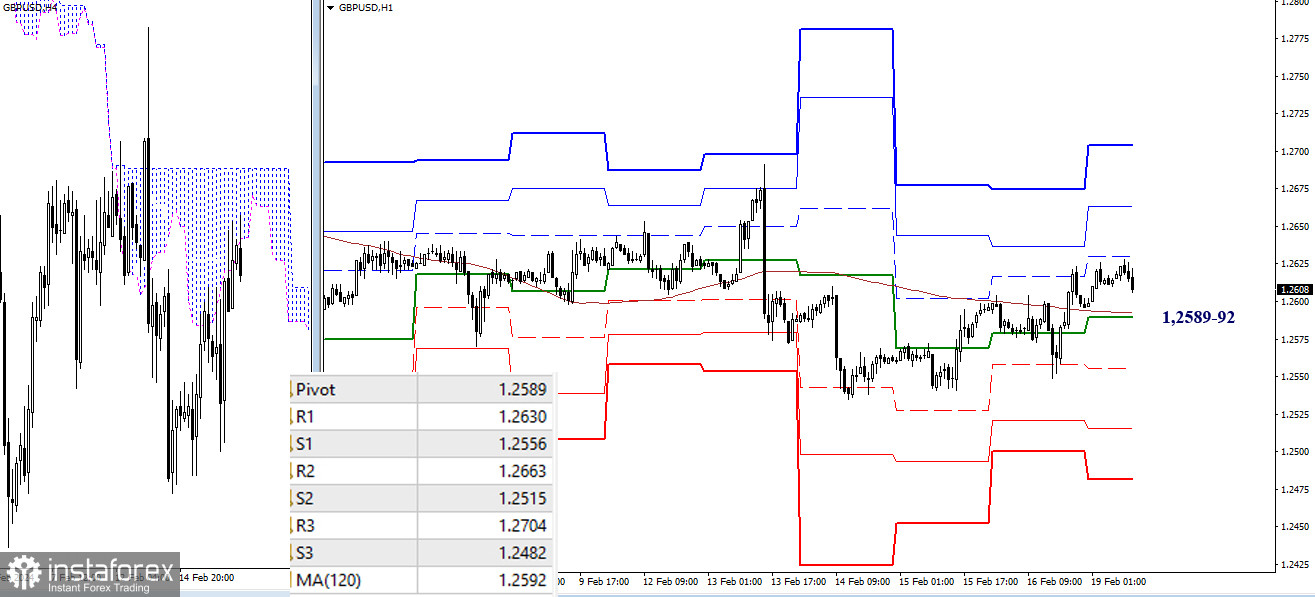

H4 – H1

On lower timeframes, the pair is trading above the key levels 1.2589-92 (central pivot point + weekly long-term trend), so the balance of power is on the bulls' side. Targets for the development of the ascent within the day are set today at 1.2630 – 1.2663 – 1.2704 (classic pivot points). If key levels are lost and the priority becomes strengthening bearish sentiments, benchmarks for the development of the decline will be the supports of classic pivot points (1.2556 – 1.2515 – 1.2482).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)