Analysis of GBP/USD 5M

GBP/USD edged down on Monday. We have already mentioned that in recent weeks, the pair's movements have been quite random, often showing a sideways pattern. Therefore, it is difficult to expect logical and consistent movements now. There were no important or interesting events in the UK, and it was a holiday in the US. The price dropped to the Kijun-sen line during the day, and since there are signs of a new downtrend, we can expect the price to consolidate below this line and attempt to continue the downward movement. However, we would like to remind you once again that the flat phase persists.

Previously, the pair traded in the 1.2611-1.2787 range. Now, the range is 1.2516-1.2644. There are no clear boundaries, and the sideways direction is clearly evident. We still believe that there is no reason for the pound to rise, and there is no reason for it to stay so high against the dollar. Therefore, we expect the downward movement to resume in almost any scenario, under any fundamental and macroeconomic background. Of course, if Bank of England Governor Andrew Bailey and the other BoE officials soften their rhetoric, this could help the pound start the decline it deserves. This week, Bailey is scheduled to speak. Let's hope that he shows a slightly softer rhetoric.

Formally, a sell signal was formed yesterday in the area of 1.2605-1.2620. It could be worked out, but obviously, the profit could not exceed 10 pips. It made no sense to close a short position based on this signal, as it was more reasonable to set a Stop Loss and wait for the pound to fall with 1.2516 as the target. As the price moves down, the Stop Loss can be set to breakeven.

COT report:

COT reports on the British pound show that the sentiment of commercial traders has frequently changed in recent months. The red and blue lines, which represent the net positions of commercial and non-commercial traders, constantly intersect and, in most cases, remain close to the zero mark. According to the latest report on the British pound, the non-commercial group opened 6,600 buy contracts and closed 9,300 short ones. As a result, the net position of non-commercial traders increased by 15,900 contracts in a week. Despite the fact that the net position of speculators is growing again, the fundamental background still does not provide a basis for long-term purchases of the pound sterling.

The non-commercial group currently has a total of 90,500 buy contracts and 40,000 sell contracts. The bulls' advantage is almost twofold. However, in recent months, we have repeatedly encountered such situations: the net position either increases or decreases, the advantage passes from bulls to bears and vice versa. Since the COT reports do not provide an accurate forecast of the market's behavior at the moment, we need to pay close attention to the technical picture and economic reports. The technical analysis suggests that there's a possibility that the pound could show a pronounced downward movement (but there are no clear sell signals yet), and for a long time now, the economic reports have also been significantly stronger in the United States than in the United Kingdom, but this has not benefited the dollar.

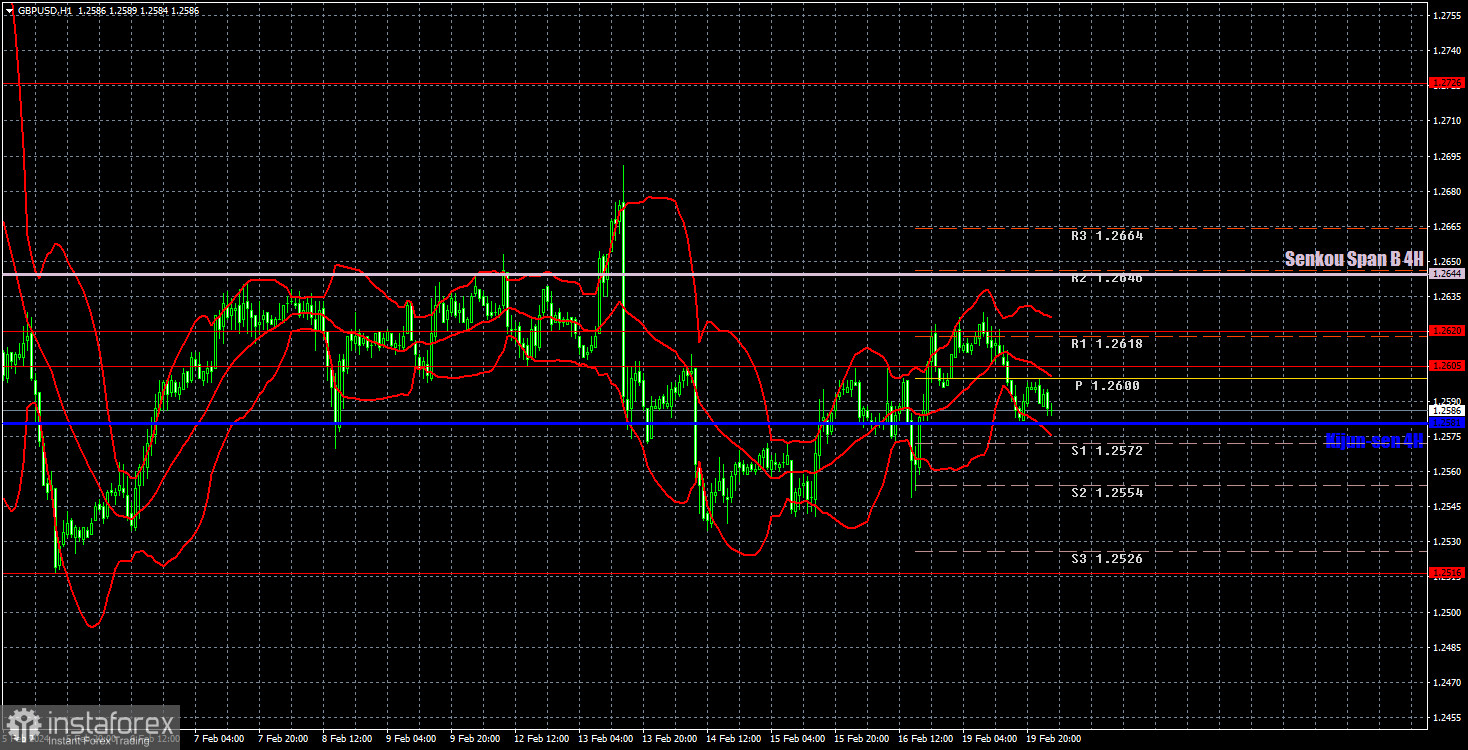

Analysis of GBP/USD 1H

On the 1H chart, GBP/USD left the sideways channel and it may be on track to form a downtrend. However, recently, we've noticed that the market is not in a rush to sell the pound. The price has been moving sideways instead of moving upwards or downwards. The British pound is still a currency that tends to move sideways, trading in a somewhat illogical and confusing manner.

As of February 20, we highlight the following important levels: 1.2215, 1.2269, 1.2349, 1.2429-1.2445, 1.2516, 1.2605-1.2620, 1.2726, 1.2786, 1.2863, 1.2981-1.2987. Senkou Span B (1.2644) and Kijun-sen (1.2581) lines can also serve as sources of signals. Don't forget to set a Stop Loss to breakeven if the price has moved in the intended direction by 20 pips. The Ichimoku indicator lines may move during the day, so this should be taken into account when determining trading signals.

On Tuesday, Bailey will speak. We do not expect a sharp change in his rhetoric either towards a hawkish or a dovish stance. Therefore, most likely, the market will not have much to react to after his statements. Nevertheless, it is worth taking note of this event.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.