Yesterday was another confirmation that if it's a holiday in the United States, the markets are generally at a standstill. And in theory, today, the single currency should start moving. However, market participants will have to look for a reason to fuel this movement somewhere else, not in the economic calendar, as it is completely empty, just like yesterday. In general, the same is expected for tomorrow. So, unless we receive any kind of news that is unexpected and, most importantly, loud, the euro will likely move sideways.

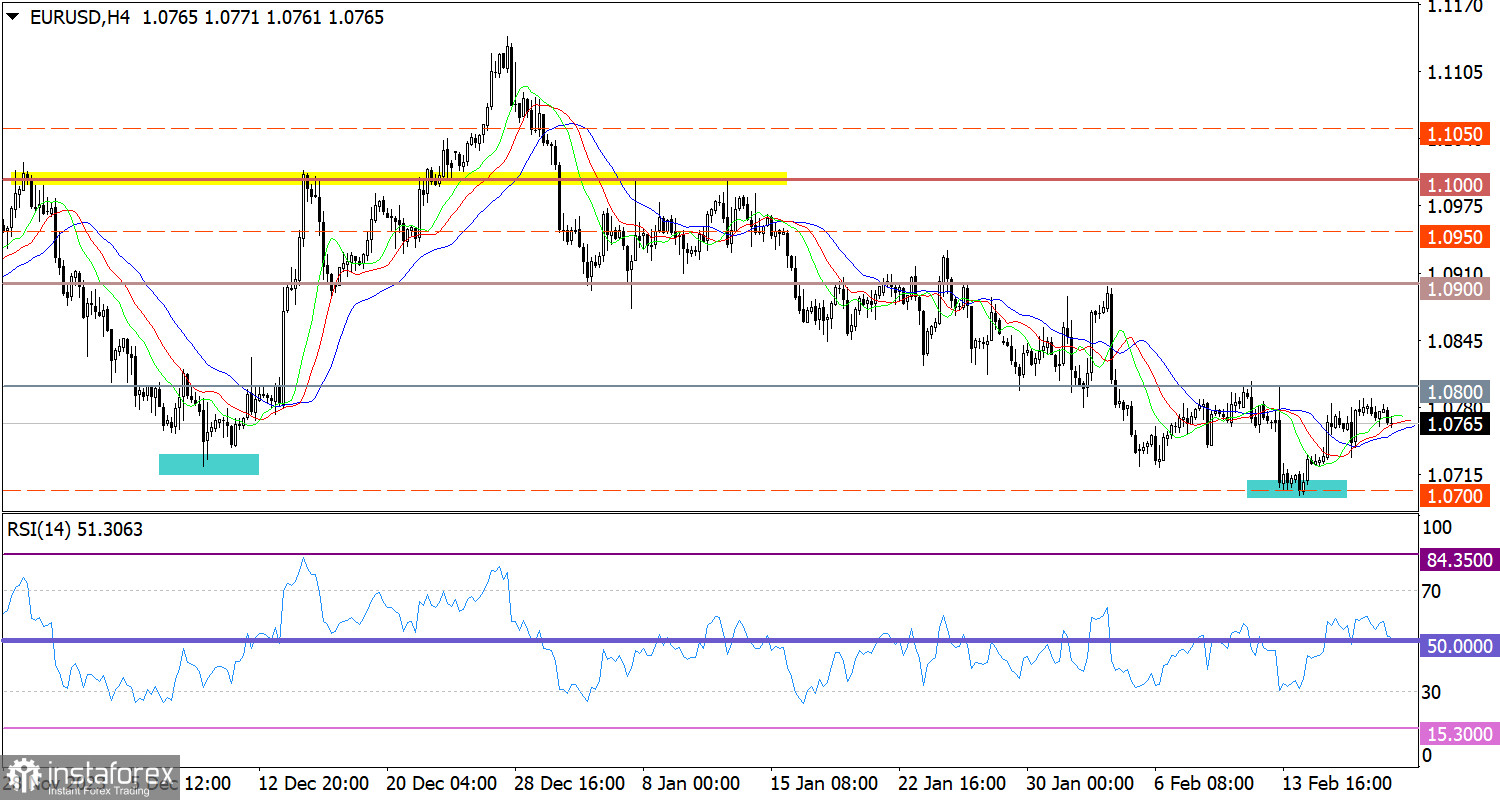

Due to the absence of the main player in the financial market, the trading week started with a flat phase. The EUR/USD quote had a range of less than 30 pips, which is about 0.26%. The level of 1.0800 serves as resistance on the way of buyers.

On the four-hour chart, the RSI technical indicator is hovering in the upper area, indicating a pullback cycle from the support level of 1.0700.

On the same time frames, the Alligator's MAs are headed upwards, corresponding to the quote's movement.

Outlook

The volume of long positions is expected to increase after the price stays above the level of 1.0800 during the day. Otherwise, this level may act as resistance, reinforcing short positions towards 1.0700.

In terms of the complex indicator analysis, we see that in the short-term period, technical indicators are pointing to a flat phase. Meanwhile, in the intraday period, the indicators are reflecting a pullback.