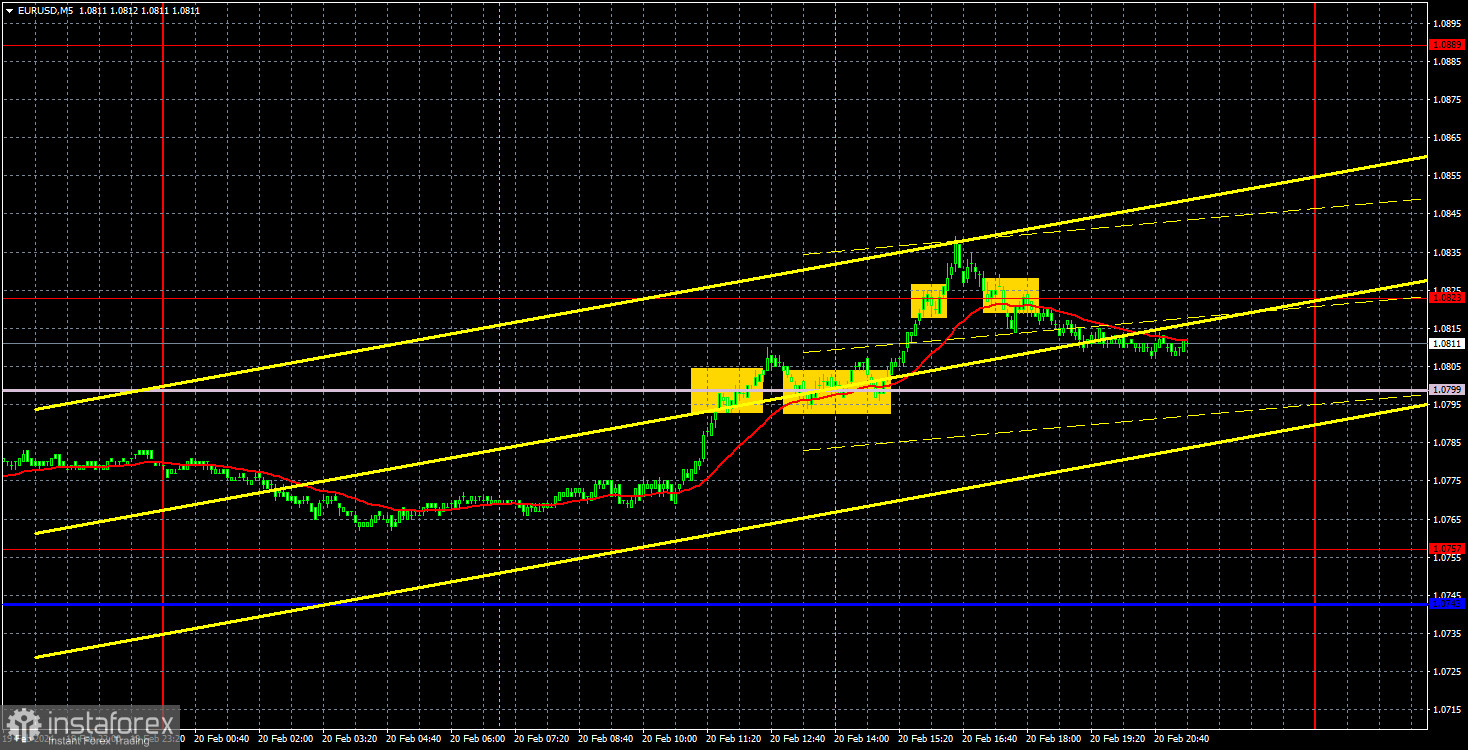

Analysis of EUR/USD 5M

EUR/USD showed quite strong movements on Tuesday. Despite the absence of any significant event in the US or the European Union, the pair managed to rise by 50 pips. A short-term uptrend was formed, and the price settled above all Ichimoku indicator lines. Therefore, from a technical perspective, traders had a reason to buy the euro. While we are not opposed to opening long positions, we would like to warn you that there's a high chance that the euro will show a corrective move.

The current challenge for the euro is that the fundamental and macroeconomic backgrounds do not support it. We clearly see a downtrend on the 24-hour timeframe, indicating that any rise is a corrective move. Corrections can be strong too, and sometimes it's impossible to predict market sentiment. Nevertheless, it is more likely for the pair to show downward movement at the moment.

This week, the macroeconomic and fundamental backgrounds will be very weak, so in most cases, the movements will be based solely on technical analysis. The technicals indicate an uptrend, suggesting that the pair may rise for some time. By the way, on the 24-hour timeframe, the pair simultaneously bounced off the Kijun-sen and Senkou Span B lines yesterday. Therefore, quotes may fall today.

Several signals were generated on the 5-minute timeframe. Traders could enter the market after overcoming the Senkou Span B line, after which two more buy signals were formed. Long positions should have been closed after consolidating below the 1.0823 level. The profit from the trade was about 10 pips. It is not much, but better than nothing. Unfortunately, the pair did not form any buy signals when the upward movement started in the morning.

COT report:

The latest COT report is dated February 13. The net position of non-commercial traders has been bullish for quite some time. The number of long positions is much higher than the number of short positions. In simpler terms, the number of long positions in the market is higher than the number of short positions. However, at the same time, the net position of non-commercial traders has been decreasing in recent months, while that of commercial traders has been increasing. This indicates a shift into a bearish bias, as speculators are building up short positions on the euro. We don't see any fundamental factors that can support the euro's growth in the long term, while technical analysis also signals the formation of a downtrend.

We have already drawn your attention to the fact that the red and blue lines have significantly diverged, often preceding the end of a trend. Currently, these lines are moving towards each other (indicating a trend reversal). Therefore, we believe that the euro will fall further. During the last reporting week, the number of long positions for the non-commercial group increased by 8,300, while the number of short positions increased by 17,700. Accordingly, the net position fell by 9,400. The number of buy contracts is still higher than the number of sell contracts among non-commercial traders by 52,000 (previously 63,000). Thus, commercial traders continue to sell the euro.

Analysis of EUR/USD 1H

On the 1-hour chart, EURUSD has formed a new uptrend, but we are skeptical about it. In our opinion, all the factors currently suggest that the dollar will strengthen. Therefore, we expect the price to consolidate below the trendline and revive the downward movement. The nearest target is the area of 1.0658-1.0669. Now we need to wait for the corrective phase to end and the price to firmly settle back below the Ichimoku indicator lines.

On February 21, we highlight the following levels for trading: 1.0530, 1.0581, 1.0658-1.0669, 1.0757, 1.0823, 1.0889, 1.0935, 1.1006, 1.1092, as well as the Senkou Span B line (1.0799) and Kijun-sen line (1.0772). The Ichimoku indicator lines can move during the day, so this should be taken into account when identifying trading signals. Don't forget to set a Stop Loss to breakeven if the price has moved in the intended direction by 15 pips. This will protect you against potential losses if the signal turns out to be false.

On Wednesday, there are no important events lined up in either the European Union or the United States. The US Federal Reserve Minutes will be released on Wednesday evening, but we do not consider this an important event.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.