EUR/USD

Higher Timeframes

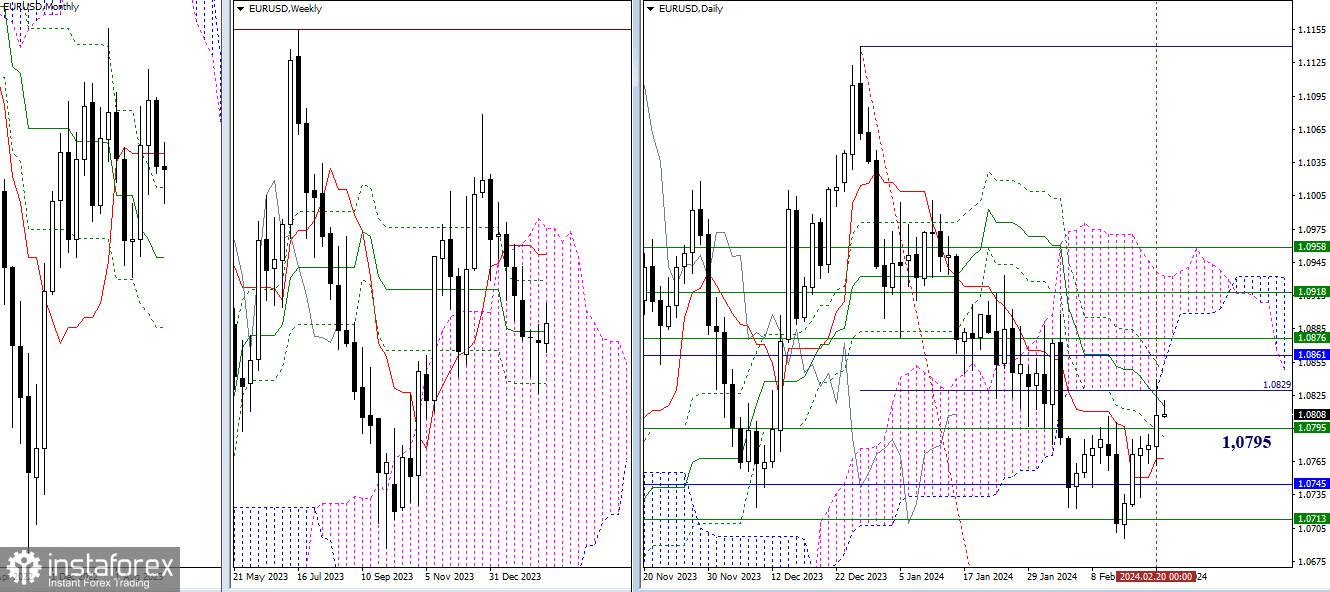

Yesterday, the bullish players breached the weekly medium-term trend (1.0795) and tested the daily cloud. Today, daily levels have shifted, so the bulls will first need to eliminate the daily death cross (1.0815-42) before making plans to enter the daily cloud. The lower boundary of the daily cloud (1.0855) is now reinforced by monthly (1.0862) and weekly (1.0876) resistances. The weekly medium-term trend (1.0795) is currently acting as a support level on lower timeframes in the current conditions.

H4 – H1

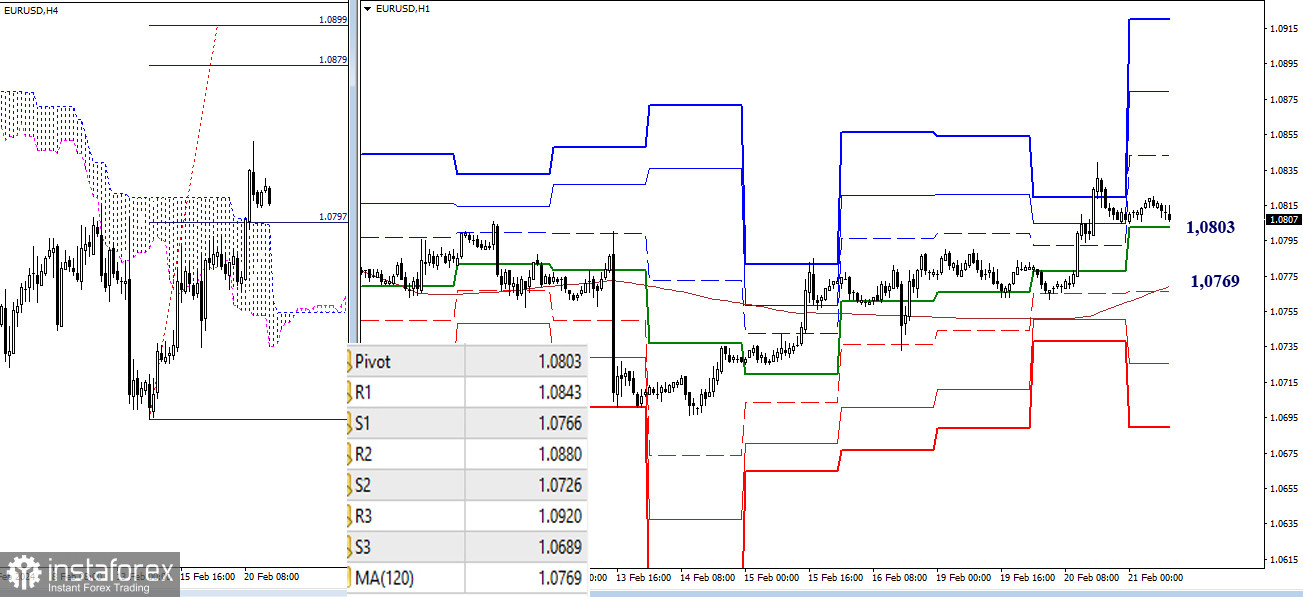

On lower timeframes, the advantage currently belongs to the bullish players. Reference points for the intraday ascent today are located at 1.0843 – 1.0880 – 1.0920 (resistances of classic pivot points). Key levels at the moment form supports at 1.0803 (central pivot point of the day) – 1.0769 (weekly long-term trend) in case of a downward correction. Consolidation below the weekly long-term trend (1.0769) could change the current balance of power. To strengthen bearish sentiment after an intraday breakthrough, interests will shift to supports of classic pivot points (1.0726 – 1.0689).

***

GBP/USD

Higher Timeframes

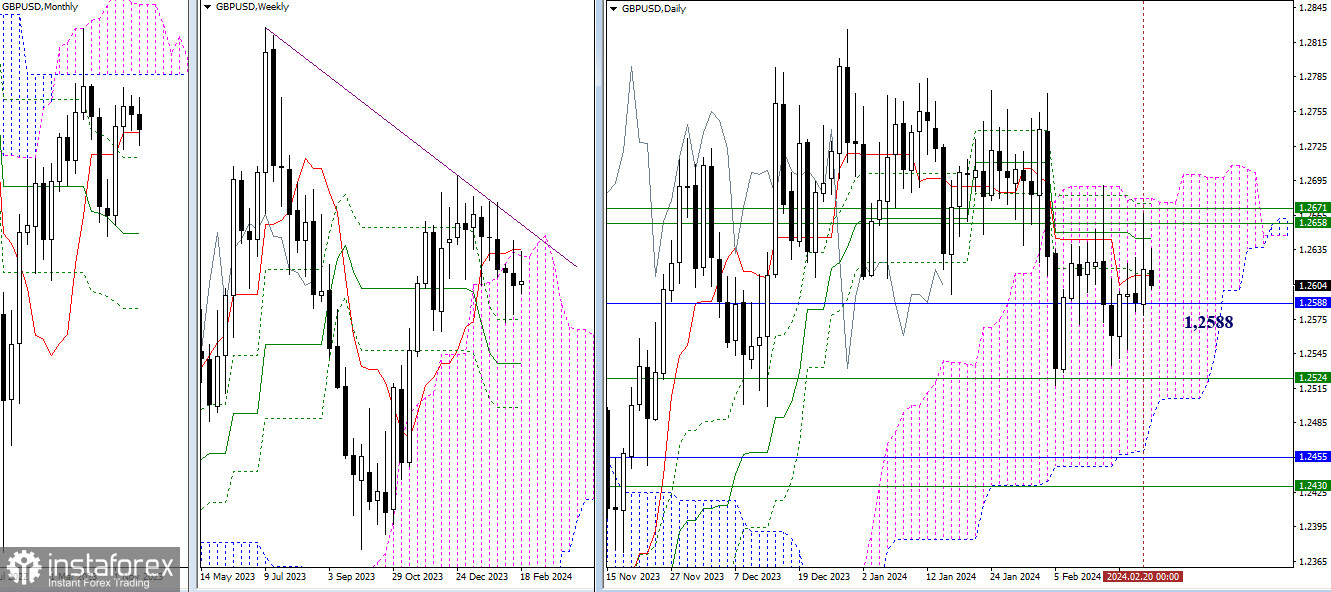

Yesterday, bullish players were able to quickly rise and test the most important resistance zone of 1.2658 – 1.2680 (weekly resistances + upper boundary of the daily cloud). The testing concluded with a long lower shadow on the daily candle. Returning to this resistance zone and its breakthrough could open new prospects for the bullish players. It should be noted that the monthly short-term trend (1.2588) continues to exert influence and attraction in the current situation. Its breakthrough is now the primary task for the bearish players.

H4 – H1

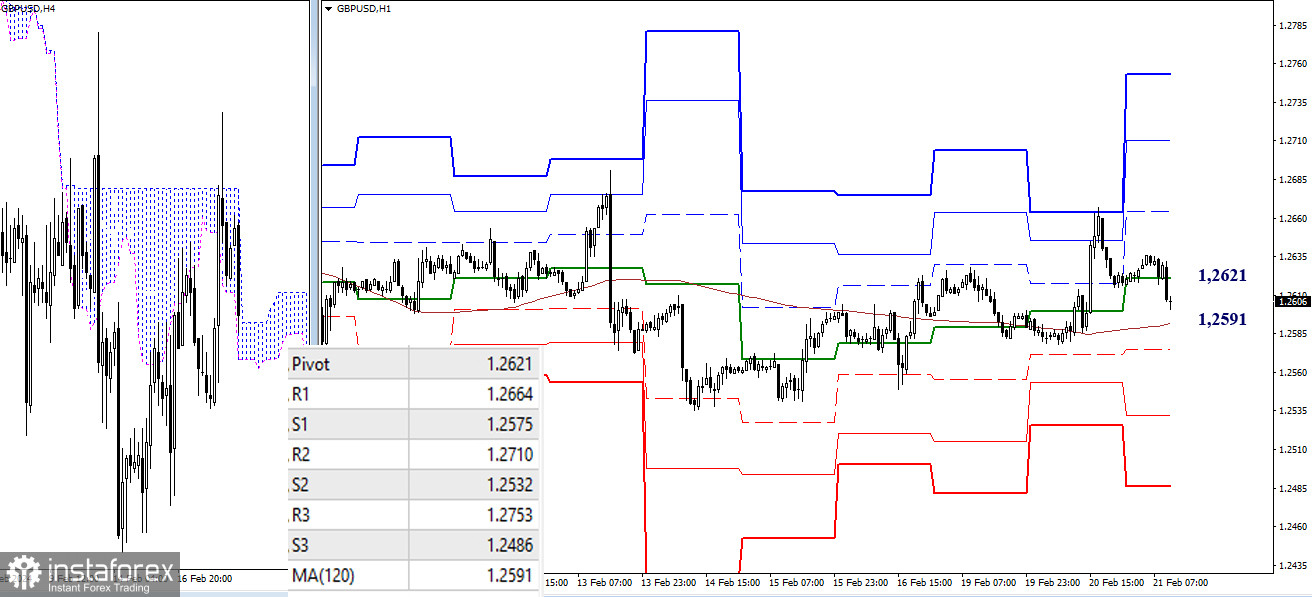

On lower timeframes, bulls are currently losing their positions. As a result, the market is seeking to return to the support of the weekly long-term trend (1.2591) – the equilibrium level. Trading above the weekly long-term trend gives the advantage to the bulls, with intraday targets at 1.2664 – 1.2710 – 1.2753 (resistance of classic pivot points). Placement and trade below the moving average (1.2591) will contribute to the strengthening of the bearish players. Reference points for the development of a decline within the day are the supports of classic pivot points (1.2575 – 1.2532 – 1.2486).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)