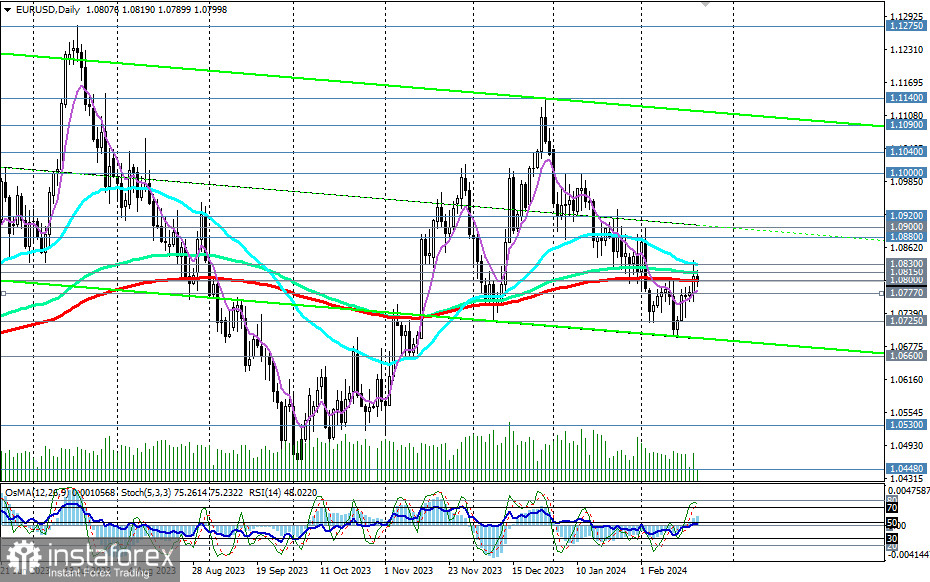

In the past few weeks, EUR/USD has been trading around the key level of 1.0800 (200 EMA on the daily chart), separating the medium-term bearish market from the bullish one.

It is evident that the price needs a new driver to confidently continue its movement in either direction. It is not excluded that today's publication of the minutes from the recent Federal Reserve meeting, as well as tomorrow's releases of the revised assessment of inflation dynamics in the Eurozone and preliminary European and American PMI indices, may serve as such a driver.

In the case of a price increase, a sequential breakout of important resistance levels at 1.0815 (144 EMA on the daily chart) and 1.0830 (50 EMA on the daily chart) will lead EUR/USD into the medium-term bullish market zone, triggering another wave of upward correction.

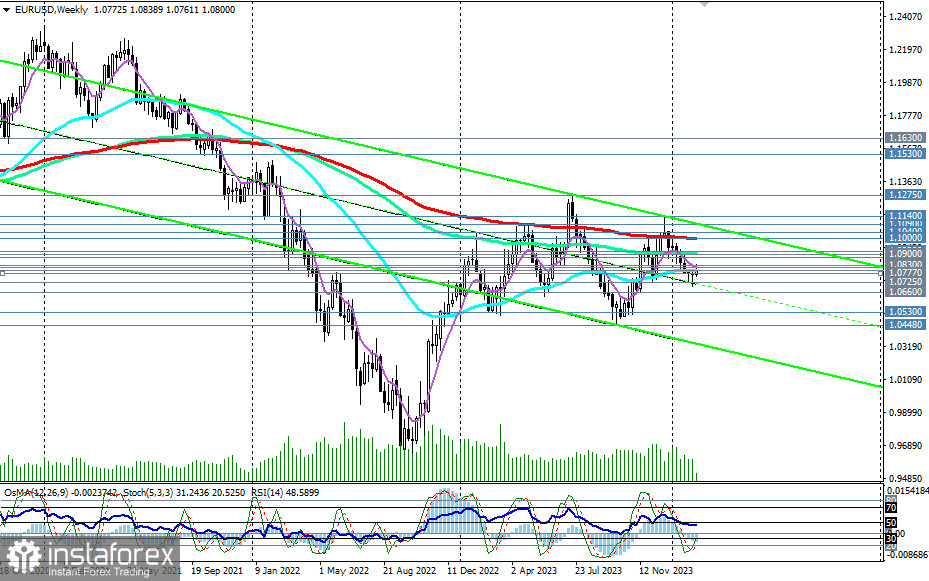

Under more favorable circumstances for EUR/USD, a breakout of the key resistance level of 1.1000 (200 EMA on the weekly chart) and further growth will bring the pair into the long-term bullish market zone.

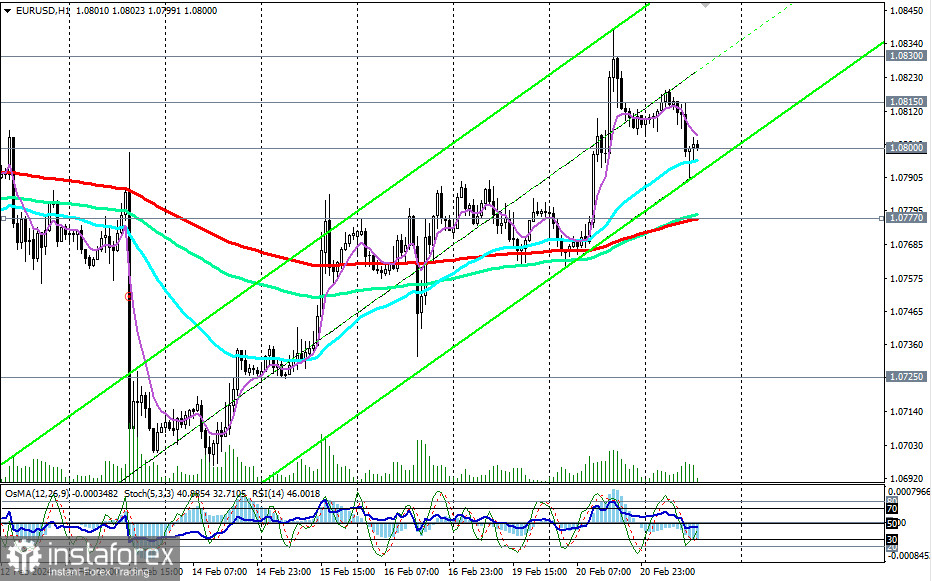

In the primary scenario, we expect a break below the short-term support level at 1.0795 (200 EMA on the 15-minute chart) and a resumption of decline. A break below the important short-term support level at 1.0770 (200 EMA on the 1-hour chart) will be a confirming signal in this case.

The nearest targets are at local support levels 1.0725, 1.0700, 1.0660, and more distant ones at local support levels 1.0530, 1.0450, and then the marks 1.0400, 1.0300, near which the lower boundary of the downward channel on the weekly chart passes.

Support levels: 1.0800, 1.0795, 1.0770, 1.0725, 1.0700, 1.0660, 1.0600, 1.0530, 1.0500, 1.0450, 1.0400, 1.0300

Resistance levels: 1.0815, 1.0830, 1.0880, 1.0900, 1.0920, 1.1000, 1.1040, 1.1090, 1.1100, 1.1140, 1.1200, 1.1275, 1.1300, 1.1400, 1.1500, 1.1530, 1.1600, 1.1630

Trading Scenarios

Main Scenario: Sell Stop 1.0775. Stop-Loss 1.0835. Targets 1.0725, 1.0700, 1.0660, 1.0600, 1.0530, 1.0500, 1.0450, 1.0400, 1.0300

Alternative Scenario: Buy Stop 1.0835. Stop-Loss 1.0775. Targets 1.0880, 1.0900, 1.0920, 1.1000, 1.1040, 1.1090, 1.1100, 1.1140, 1.1200, 1.1275, 1.1300, 1.1400, 1.1500, 1.1530, 1.1600, 1.1630

'Targets' correspond to support/resistance levels. This also does not mean that they will necessarily be reached, but can serve as a guide in planning and placing your trading positions.