The US dollar has risen by 2.6% since the beginning of the year against major world currencies, marking its best performance since 2015. If at the end of 2023, the dollar was almost written off due to the Federal Reserve's dovish pivot and expectations of a 150 basis points rate cut to 4%, now, market sentiment has shifted. The strong economy, continued consumer spending, and stock indices near record highs have led to a change in perspective. The question arises: why not continue selling EUR/USD?

In the forex market, there is a prevailing belief that the rally in the USD index is based on American exceptionalism. The robust expansion of the U.S. GDP by 4.9% in the third quarter and 3.3% in the fourth quarter contrasts with the situations in other major countries. Investors are fleeing China due to the real estate market crisis and a $7 trillion market capitalization loss from its peak in early 2021.

China is facing the most serious deflation since the 1990s, indicating a significant slowdown in consumption and GDP. Germany, Japan, and Britain have experienced a technical recession, and the Eurozone constantly teeters on the edge of decline and stagflation. Does the U.S. dollar simply have no competitors?

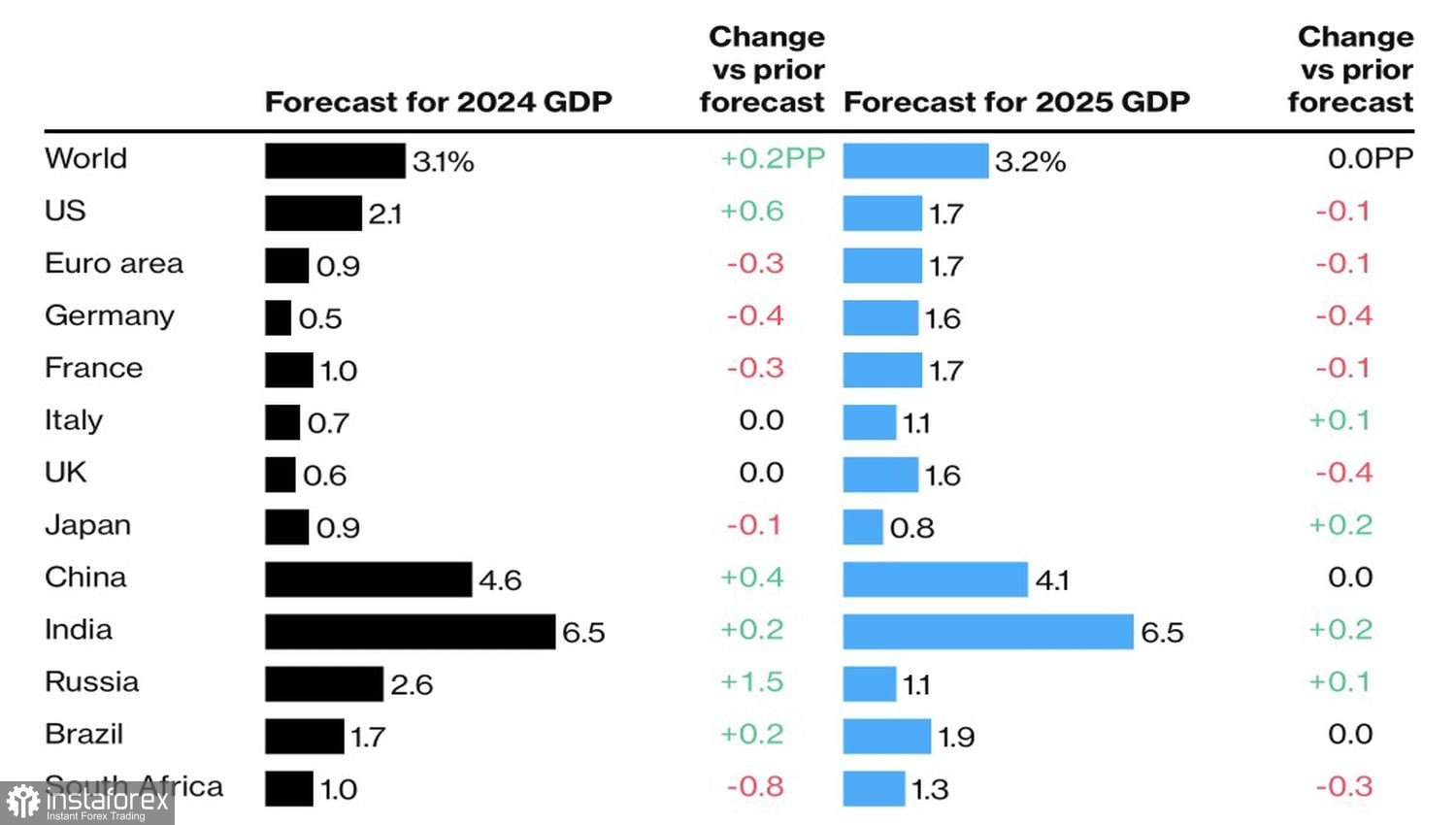

IMF forecasts for the world's leading economies

In reality, the strength of the American economy serves as a buffer for others. The IMF has rightly raised the forecast for global GDP growth in 2024 from 2.9% to 3.1%. However, this cannot continue indefinitely. In the era of globalization, either the United States will help everyone else, and the U.S. dollar will lose its trump card of American exceptionalism, or, conversely, a slowdown in the world's leading economy will reduce the divergence in GDP growth with the Eurozone, leading to an increase in EUR/USD quotes.

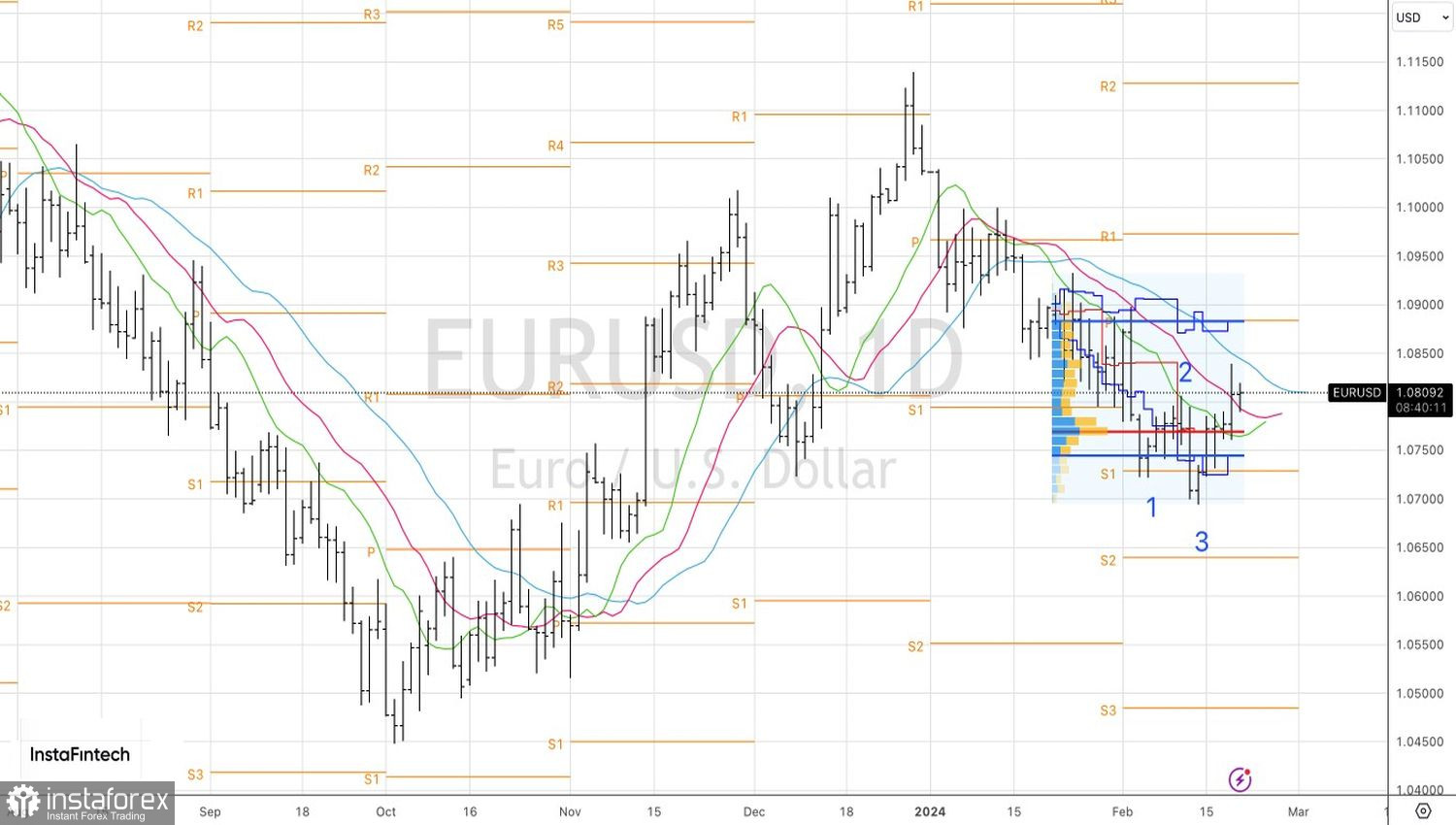

The global economy is cyclical, and the euro is a pro-cyclical currency—sensitive to the acceleration or deceleration of global GDP growth. Therefore, China's unprecedented support for its stock market, including substantial monetary stimulus from the People's Bank of China, has sparked optimism among investors. As a result, the main currency pair soared to 1.084, quickly achieving the first target for long positions.

Subsequently, EUR/USD bulls retreated, fearing that the hawkish rhetoric in the minutes of the January FOMC meeting would revive interest in the U.S. dollar. I don't believe this will happen. Let's recall what happened at the end of the first month of 2024. The Federal Reserve actively tried to convince the markets that monetary expansion would not start until March. Now, investors are not only convinced of this, but also believe that it will not happen before June. The Fed has nothing to scare the markets with. The euro is likely to withstand the test.

Technically, on the daily chart, thanks to the implementation of the reversal pattern 1-2-3, a long position in EUR/USD was opened. The inability of the bears to return below the red moving average indicates their weakness. Therefore, a breakthrough of local highs at 1.082 and 1.084 will be the basis for building up long positions in the euro against the U.S. dollar.