EUR/USD

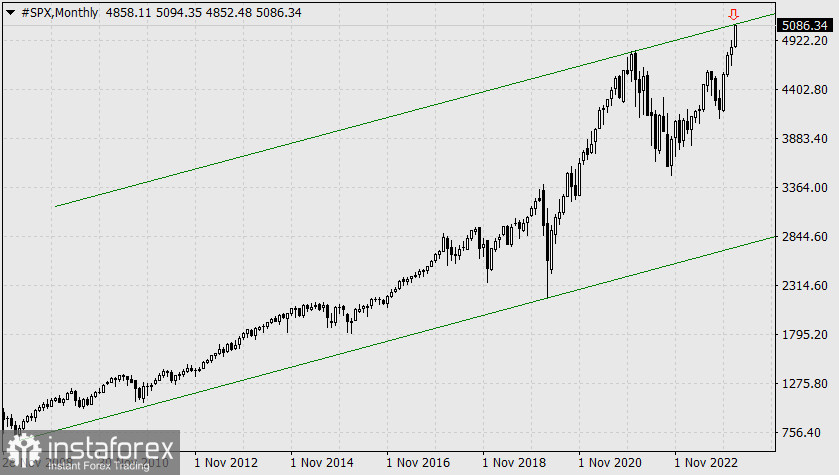

Yesterday, the S&P 500 soared by 2.11%, almost reaching the upper boundary of the global price channel that began in March 2009.

The reason behind this was a good report from Nvidia, as its shares were up by 16.32%. As a result, the Nasdaq rose by 2.96%. The euro responded to the surge by gaining 70 pips. The single currency began to rise earlier in the day with the release of good data on business activity in France; the Manufacturing PMI for February increased from 43.1 to 46.8, and the Services PMI from 45.4 to 48.0. However, Germany had weak indices, so in the end, the eurozone indices looked like this: Manufacturing PMI 46.1 versus 46.6 in January, Services PMI 50.0 versus 48.4. The euro closed the day up by only 3 pips. But the main thing is the stock market, which grew on private news. We expect a reversal of the stock market by today or on Monday.

On the daily chart, the euro pierced the resistance of the MACD indicator line and rolled back below the level of 1.0825, where activity is currently slowing down. The Marlin oscillator is still in force. If the price closes the day with a black candle, it will be a good signal for further decline. To continue the upward movement, as yesterday clearly showed, the price needs to settle above the MACD line, above 1.0870.

A divergence that is not so strong has formed on the 4-hour chart. The price is stuck at the level of 1.0825. To develop a downward movement, the price must settle below the MACD line, below the level of 1.0788.