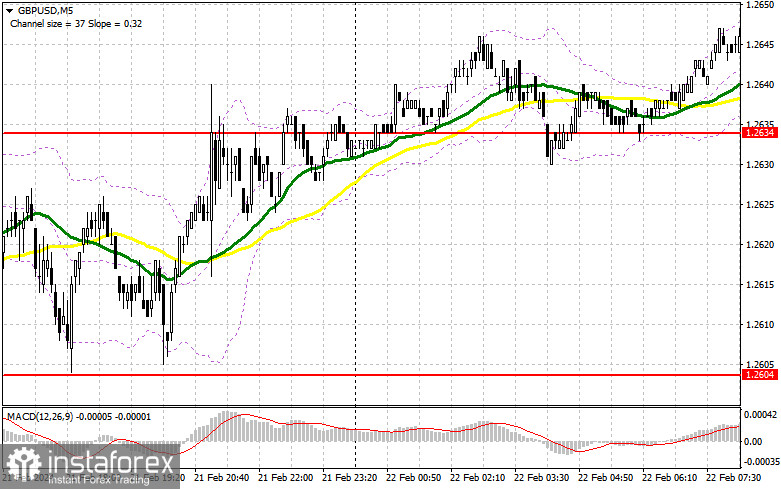

Despite the high volatility, I didn't find any market entry points yesterday. Now let's look at the 5-minute chart and try to figure out what actually happened. In my morning forecast, I indicated the level of 1.2665 and planned to make decisions on entering the market from there. The pair breached 1.2665, but I didn't wait for the upward retest, so I didn't manage to get a good entry point. In the afternoon, the pound sharply fell amid strong US data, and we did not get any good entry points either.

For long positions on GBP/USD:

Strong US PMI data put pressure on the pound, preventing buyers from reaching the weekly high. Today, Bank of England MPC member Megan Greene will speak, and we don't expect her speech to help buyers improve the situation. I would like to remind you that not long ago, BoE Governor Andrew Bailey said that interest rates could be lowered even if inflation targets are not met. This may negatively affect the pound and its growth prospects.

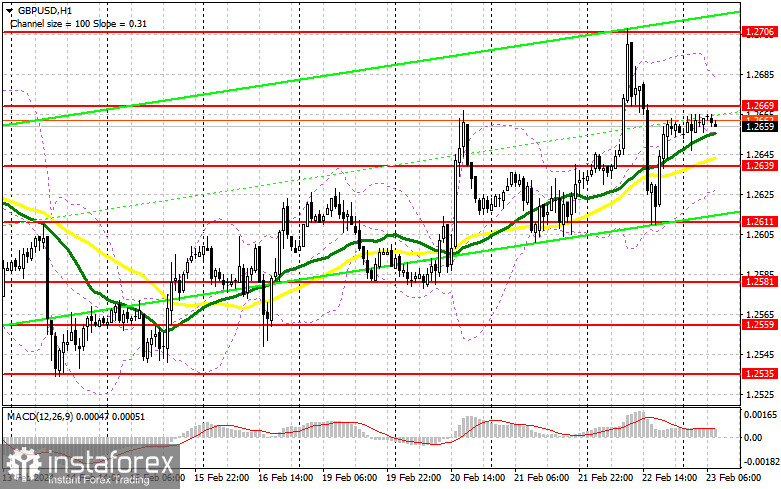

In case the pressure on the pair returns after Green's speech during the European session, I plan to buy on a decline near 1.2639. This is in line with the bullish moving averages. A false breakout of this level would serve as a buy signal, aiming for a recovery towards the area of 1.2669. A breakout and consolidation above this range will strengthen the demand for the pound and open the way to 1.2706, which will strengthen buyers' position in developing a new bullish trend. The ultimate target will be the 1.2730 high where I intend to take profit. In a scenario where GBP/USD falls and there are no buyers at 1.2639, we might see another pound sell-off. In this case, only a false breakout near the next support at 1.2611 would provide an entry signal. I would immediately go long on a bounce from the 1.2581 low, bearing in mind an intraday correction of 30-35 pips.

For short positions on GBP/USD:

Given the pressure after yesterday's growth, major players haven't gone anywhere. I expect them to be involved in the first half of the day. In case GBP/USD attempts to recover, I plan to sell only after forming a false breakout near the new resistance at 1.2669. This would create a sell signal with the purpose of breaking the upward correction and give the bears a chance to move the price down to the area of 1.2639 - a support, for which I expect an active struggle. A breakout and a retest from below will deal a blow to the bulls' positions, leading to the removal of stop orders and open the way to 1.2611, where I anticipate big buyers to show up. The next target will be 1.2581, where I plan to take profits. If GBP/USD grows and there are no bears at 1.2669, the bulls will continue the upward correction. In such a case, I will postpone sales until the price performs a false breakout at 1.2706. If there is no downward movement there, I will sell GBP/USD on a bounce right from 1.2730, considering a downward correction of 30-35 pips within the day.

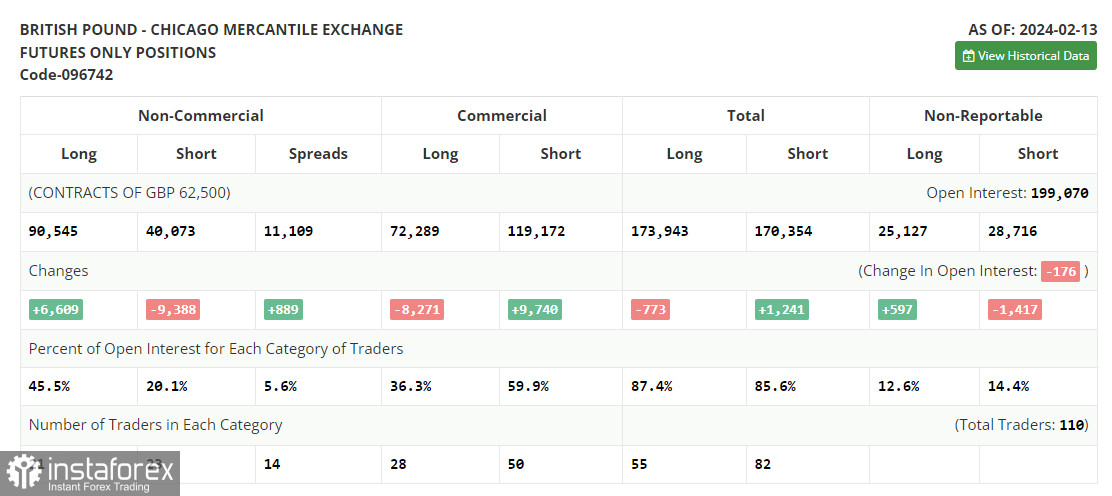

COT report:

In the COT report (Commitment of Traders) for February 13, we find an increase in long positions and a decrease in short ones, which means that market balance is preserved even after a series of fundamental reports pointed to the challenges that the Bank of England has to deal with. These challenges include high inflation and the delicate UK economy, teetering on the edge of recession. So now we should closely pay attention to the stance of the Bank of England representatives, as a lot depends on this. The latest COT report showed that long non-commercial positions rose by 6,609 to 90,545, while short non-commercial positions decreased by 9,388 to 40,073. As a result, the spread between long and short positions increased by 889.

Indicator signals:

Moving Averages

The instrument is trading above the 30 and 50-day moving averages. It indicates that GBP/USD is likely to rise further.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If GBP/USD falls, the indicator's lower boundary near 1.2625 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.