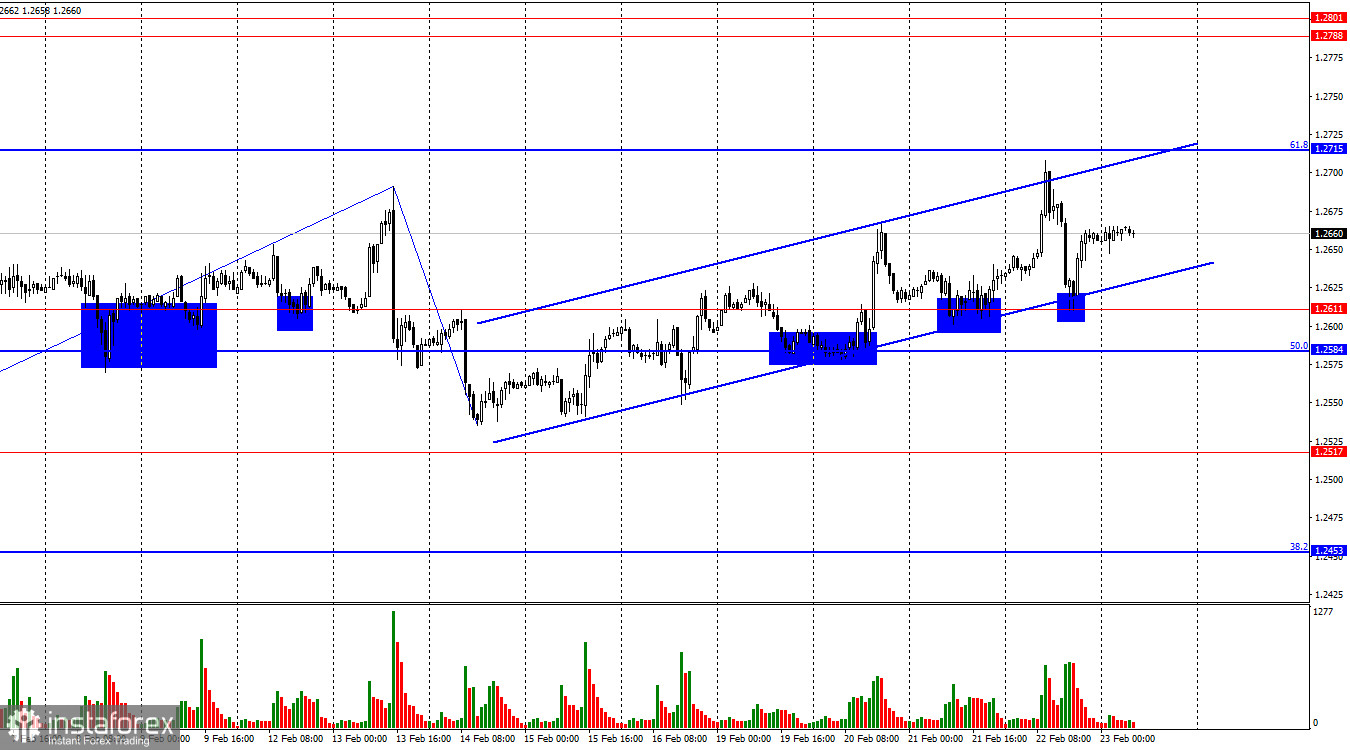

On the hourly chart, the GBP/USD pair started Thursday with growth, then executed a retracement to the level of 1.2611, bounced off it, and resumed the upward process towards the corrective level of 61.8% (1.2715). Thus, today, the British pound may make another attempt to rise when there are no substantial reasons for it. Only after consolidation below the ascending trend channel will I expect a decline in the pound. Moreover, to count on a significant drop, it is also necessary to consolidate below the support zone of 1.2584–1.2611.

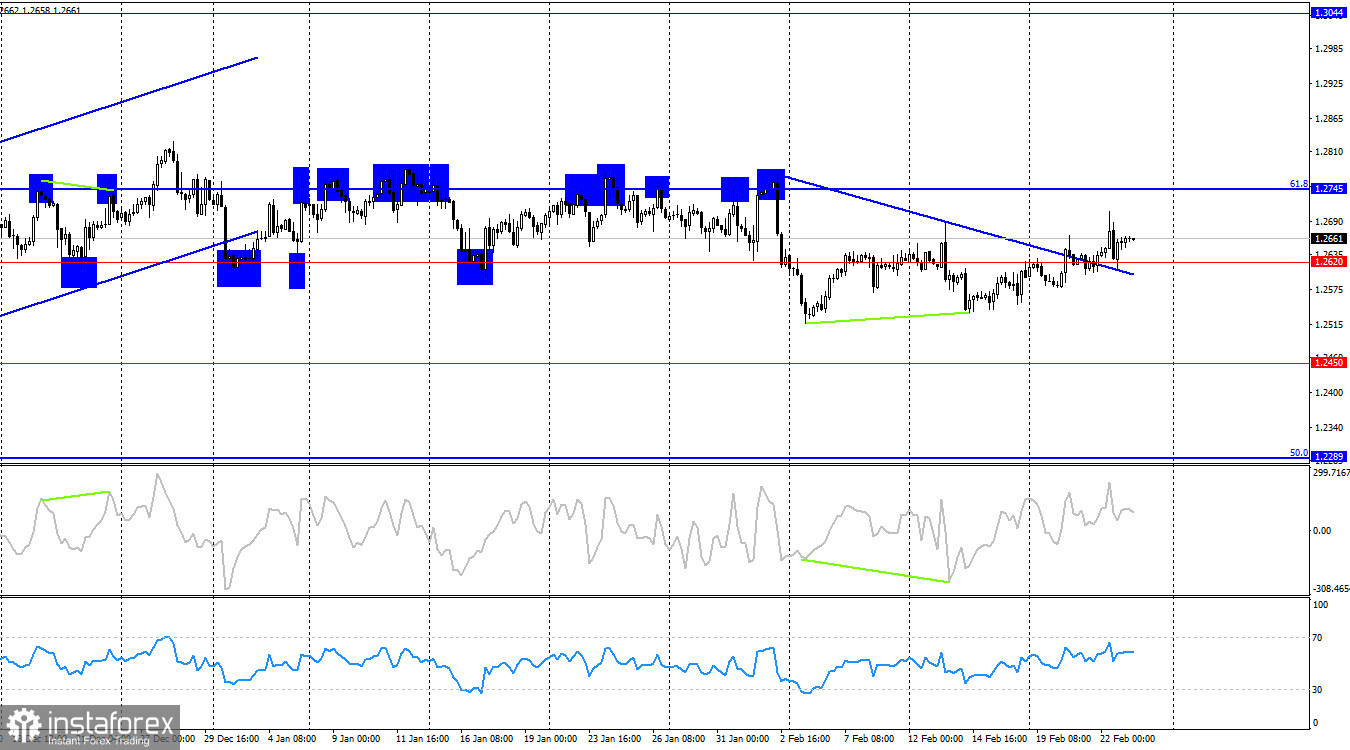

The wave situation remains very ambiguous. For a long time, we observed horizontal movement, during which single waves or triplets were almost constantly forming, alternating with each other and having approximately the same size. The flat is complete, and we continue to see the same single waves and triplets. And even confidence in the completion of the flat decreases every day. Currently, we observe the formation of another upward triplet, which is unlikely to lift the British pound to the sky. In the near future, I expect a takeover by bears.

Yesterday, business activity indices were released in the UK. Both indices did not show strong growth, disappointing buyers who were actively buying the pound before their publication. In America, business activity indices were also not the most positive. In the service sector, a decline from 52.5 to 51.3 was recorded, and in the manufacturing sector, growth from 50.7 to 51.5. I can say that neither British nor American statistics supported their respective currencies. Also, in America, the report on initial jobless claims was released, the number of which was less than traders' expectations. Sales of new homes slightly exceeded forecasts. In the second half of the day, the dollar could show stronger growth, but the level of 1.2611 once again did not allow bears to develop local success.

On the 4-hour chart, the pair consolidated above the trend line and above the level of 1.2620, which allows counting on the continuation of growth towards the corrective level of 61.8% (1.2745). However, at this time, it is not worth counting on a new "bullish" trend. On all charts, a horizontal vector of movement is now perfectly visible. Near the level of 1.2745, all the pressure from the bulls may end. It may end even earlier if, on the hourly chart, bears close below the ascending corridor.

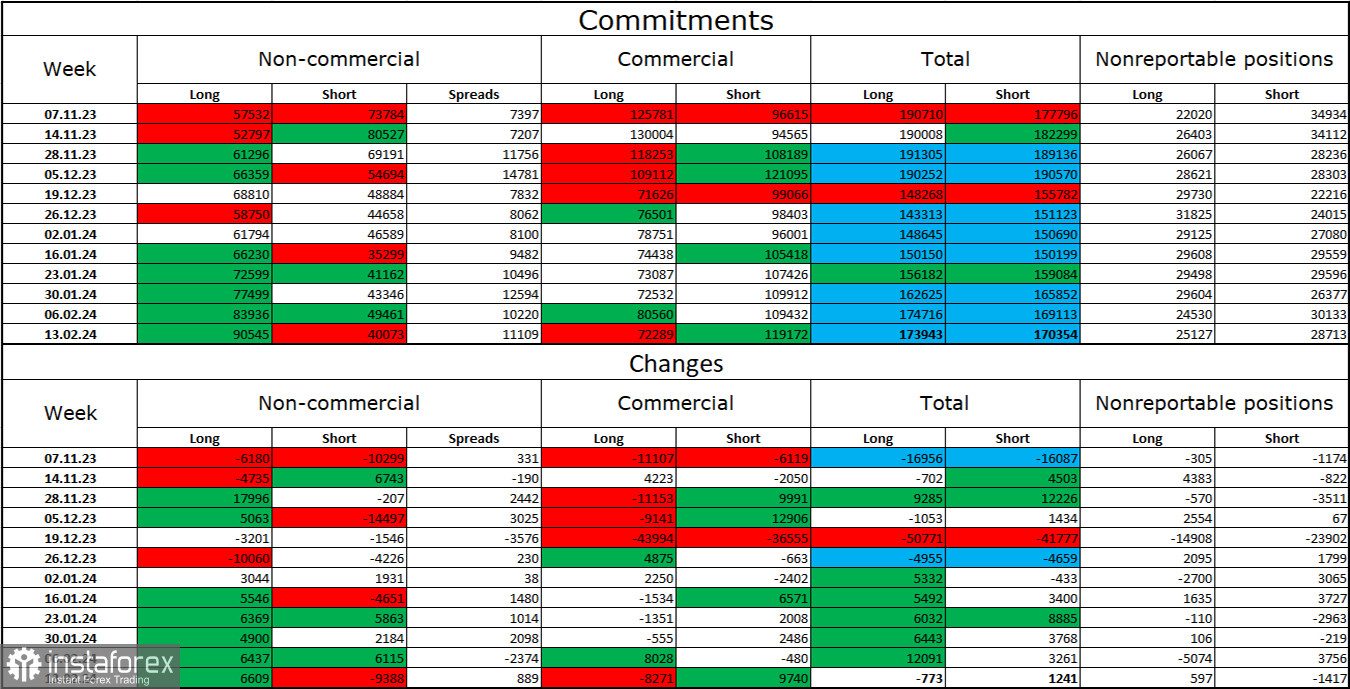

Commitments of Traders (COT) report:

The mood in the "non-commercial" trader category changed quite significantly over the last reporting week. The number of long contracts in speculators' hands increased by 6609 units, while the number of short contracts decreased by 9388 units. The overall sentiment of major players remains "bullish" and continues to strengthen, although I do not see any specific reasons for this. There is more than a two-fold gap between the number of long and short contracts: 90 thousand versus 40 thousand.

In my opinion, the British pound still has excellent prospects for a decline. I believe that over time, bulls will start getting rid of buy positions, as all possible factors for buying the British pound have already been worked out. For two months, bulls have failed to push the level of 1.2745, but bears also do not rush to go on the offensive and are generally very weak now.

US and UK news calendar:

On Friday, the economic events calendar does not contain any entries. The impact of the news background on market sentiment will be absent today.

GBP/USD Forecast and Trader Tips:

Today, you can consider selling if the pair consolidates below the ascending trend corridor on the hourly chart with a target of 1.2517. Purchases were possible when closing above the trendline on the 4-hour chart with a target of 1.2715. This target was almost reached yesterday. New purchases were possible on a rebound from the level of 1.2611 with the same target.