Bitcoin decided to take a break despite the rapid rally of U.S. stock indices led by chip manufacturer NVIDIA. Thanks to strong corporate earnings, the company's stocks jumped by 16%, increasing its market capitalization by a record $276 billion in a day, surpassing Meta's previous peak of $204 billion. This led to record highs not only for American but also for European stock indices.

After a 6-month rally of BTC/USD, investors are wondering: what new drivers are needed to continue the upward trend? Markets believe that these drivers will be the Bitcoin halving, the subsequent major upgrade of the Ethereum network, and finally, the launch of an ETF with Ethereum as the underlying asset. According to JP Morgan, the first two events are already priced into cryptocurrency quotes, and the chances of the latter are 50%.

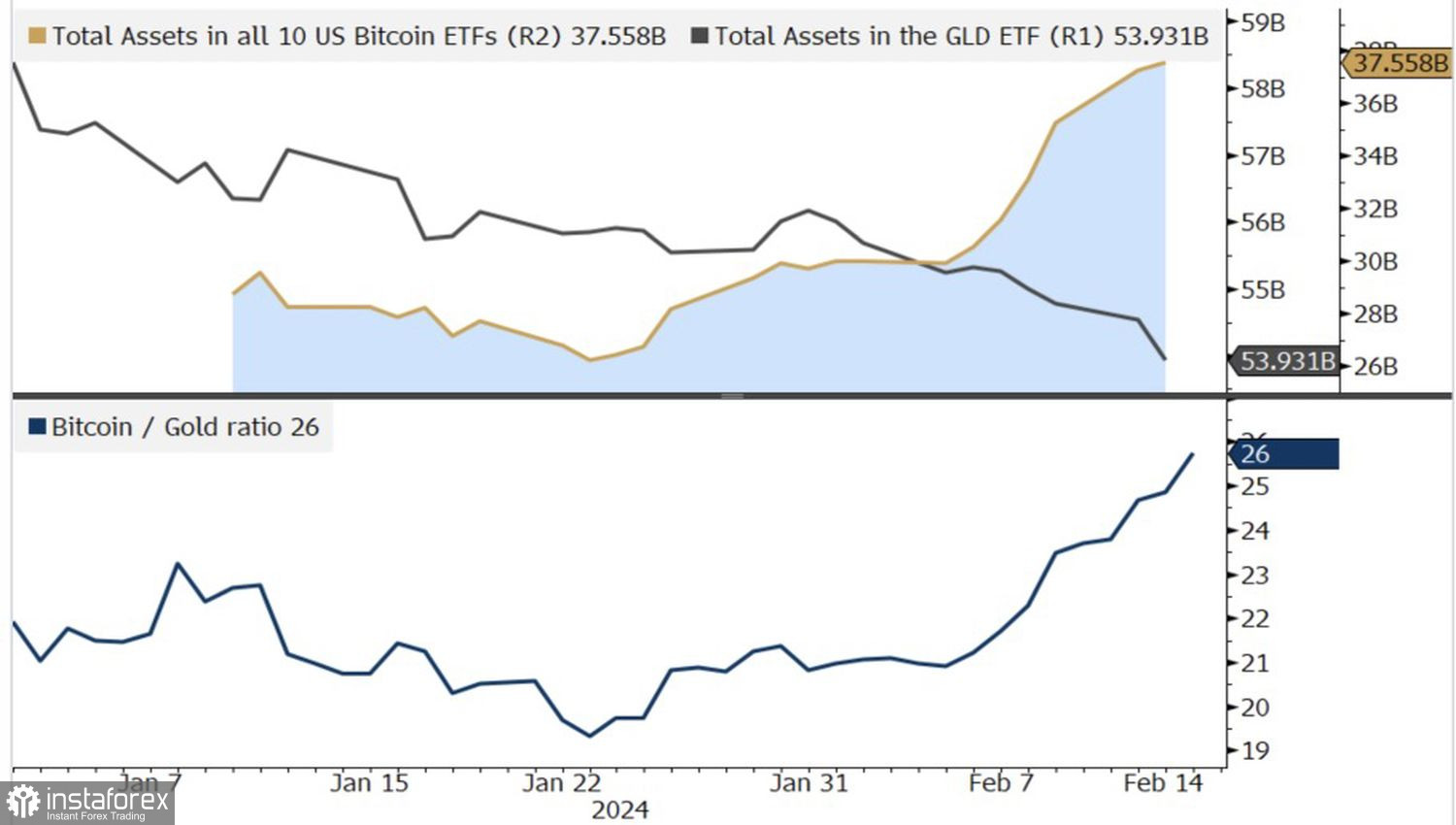

Investors are gradually recovering from the frenzy associated with the approval of a Bitcoin-based ETF by the Securities and Exchange Commission. The capital inflow is enormous, and there is an opinion in the market that money is flowing from other specialized funds, including those focused on gold.

Dynamics of capital flows in ETFs and the ratio of the price of bitcoin and gold

However, the reserves of money market funds at $6 trillion remain stable. It was expected that a reduction in the federal funds rate would trigger a capital outflow from these financial institutions, which would help Bitcoin-based ETFs and BTC/USD bulls. However, the Federal Reserve is delaying the start date of monetary expansion, restraining cryptocurrency buyers.

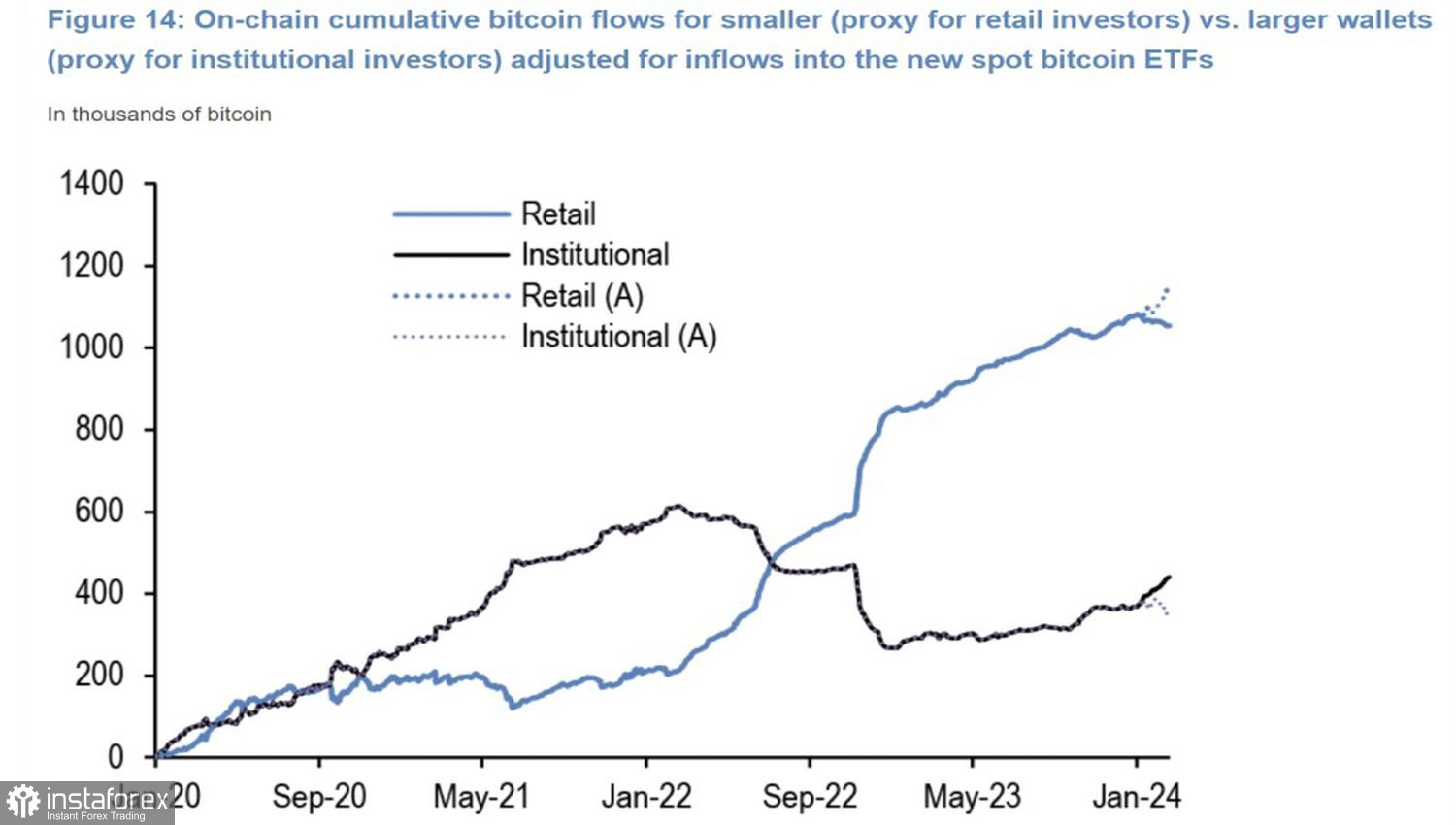

This is especially true for large investors who closely monitor the state of the U.S. economy and the monetary policy of the Federal Reserve. In contrast, retail investors impressed by the BTC/USD rally have already actively jumped into new specialized exchange-traded funds.

Dynamics of investor demand for ETFs with Bitcoin as the underlying asset

According to MicroStrategy's research, demand due to recently launched ETFs is 10 times greater than the number of newly issued tokens, allowing cryptocurrencies to grow. If the interest of large players increases, the BTC/USD rally will continue.

Bitcoin enthusiasts believe that if gold failed to occupy a significant niche in the classic 60/40 investor portfolio, where 60% is allocated to stocks and 40% to bonds, then it is within the capabilities of the digital asset. If its share grows to 5%, the value of one coin will jump to $1 million. However, this is about long-term prospects, and for now, the token has decided to take a pause.

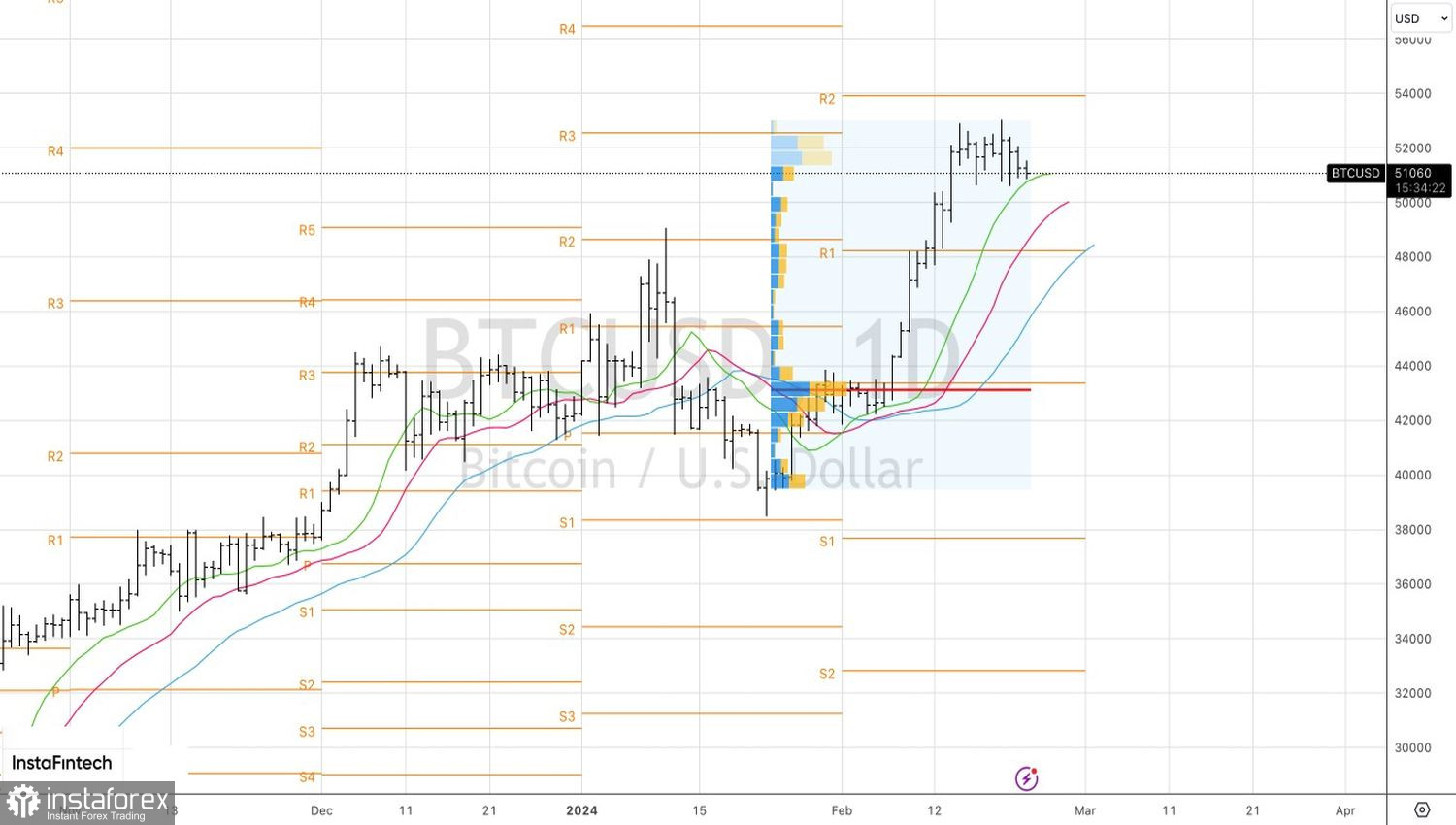

Technically, on the BTC/USD daily chart, there is a "Double Top" pattern. A decline in quotes below $50,600 would activate it and serve as the basis for short-term sales towards $48,500. To confirm this strategy, a close below the $50,600 level is required on the daily chart.