Who will be the first to start cutting interest rates? The Fed or the ECB? Much depends on the answer to this question for the fate of EURUSD. Each of them has its arguments in favor of easing monetary policy, but who will take the first step? Before the release of data on the February business activity of the currency bloc, markets believed it would be the European Central Bank. They were betting on April, but now they only give a 25% probability that this significant event will take place in mid-spring. This is good news for the euro.

According to the head of the Bank of Austria, Robert Holzmann, Christine Lagarde will let Jerome Powell pass on the road of monetary expansion. According to him, historically, the first step has always been taken by the Fed, and about half a year later, the ECB followed suit. One of the main "hawks" of the Governing Council sees no reason for anything to change in 2024. In reality, there may be a reason for the ECB to start earlier if inflation data in the eurozone for February show further slowdown.

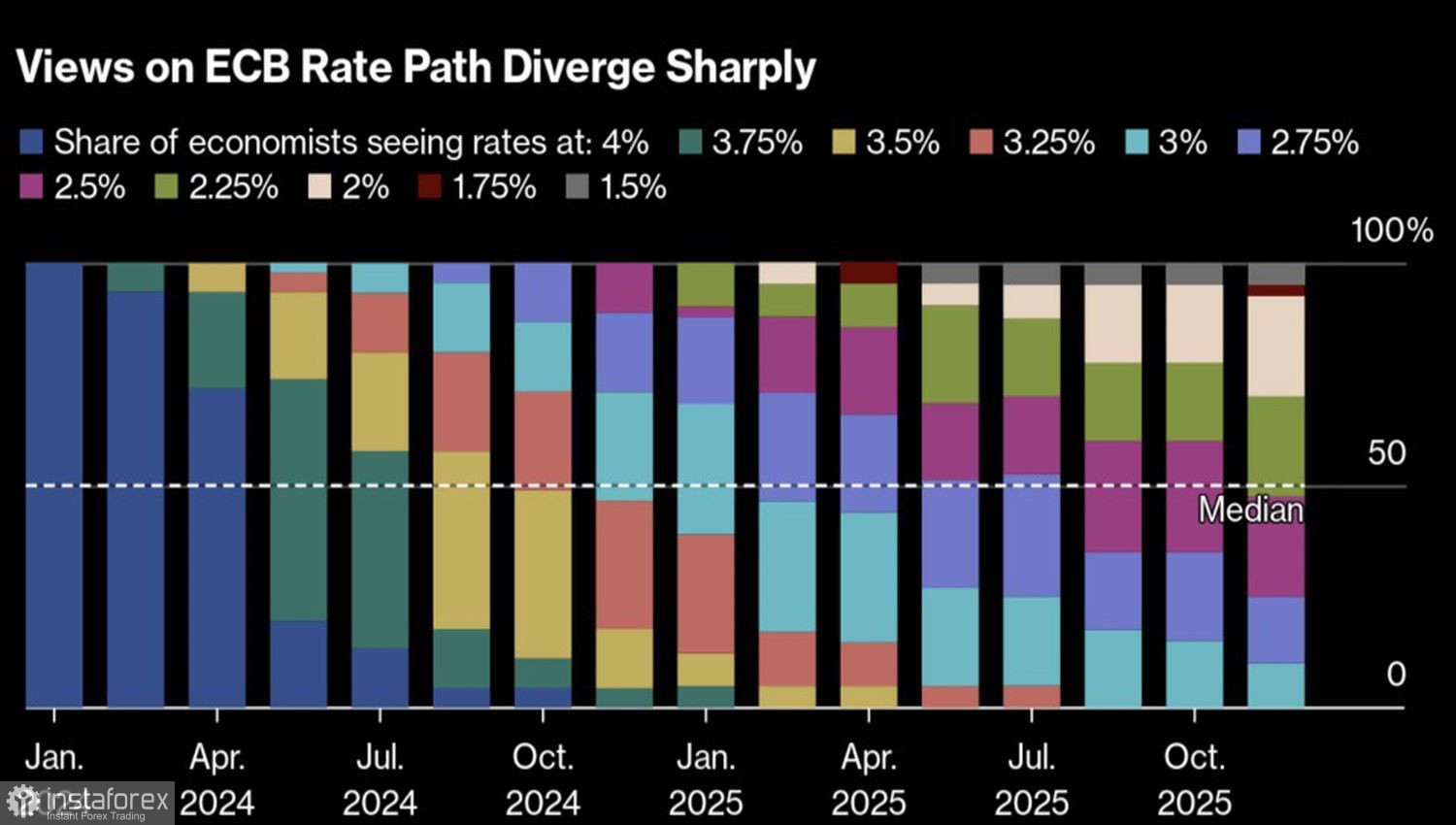

Experts' forecasts for the ECB deposit rate

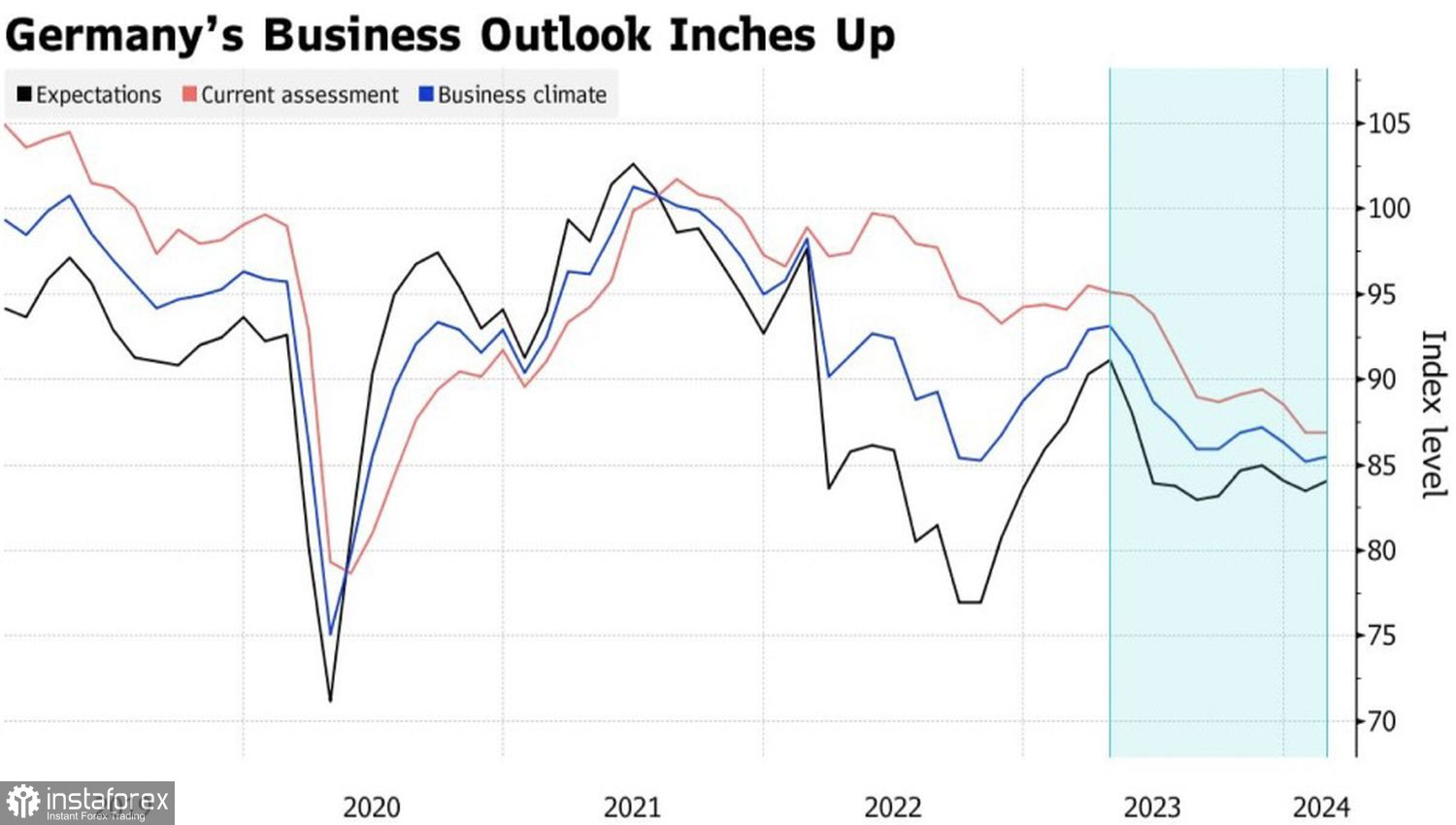

Bloomberg experts predict a slowdown in the growth rate of consumer prices from 2.8% to 2.5%, and basic inflation from 3.3% to 3%. The indicators are approaching the target of 2%, and the ECB does not necessarily have to wait until this happens. The deposit rate at 4% is too high for the currency bloc. It is not surprising that it constantly balances on the edge of recession and stagflation. Confirmation is the persistently depressed state of the business climate in Germany.

In theory, a slowdown in inflation should return the chances of the European Central Bank starting monetary expansion in April and put pressure on EUR/USD. However, in any pair, there are always two currencies. Just as expectations of a slowdown in the growth rate of consumer prices weigh on the euro, forecasts of a slowdown in the January Personal Consumption Expenditures (PCE) Index in the U.S. from 2.6% to 2.4% YoY do not let the U.S. dollar breathe.

Business Climate Dynamics in Germany

Thus, the week by March 1 will be a test for both "bulls" and "bears" on the main currency pair, which increases the risks of forming a consolidation range and periodically occurring American bumps. Based on new data, investors will try to determine whether Powell will graciously let Lagarde pass on the road to easing monetary policy, or will the ECB still take note of the historical experience of lagging in monetary stimulus, as Holzmann wants? The puzzle is still there. It will definitely not be boring!

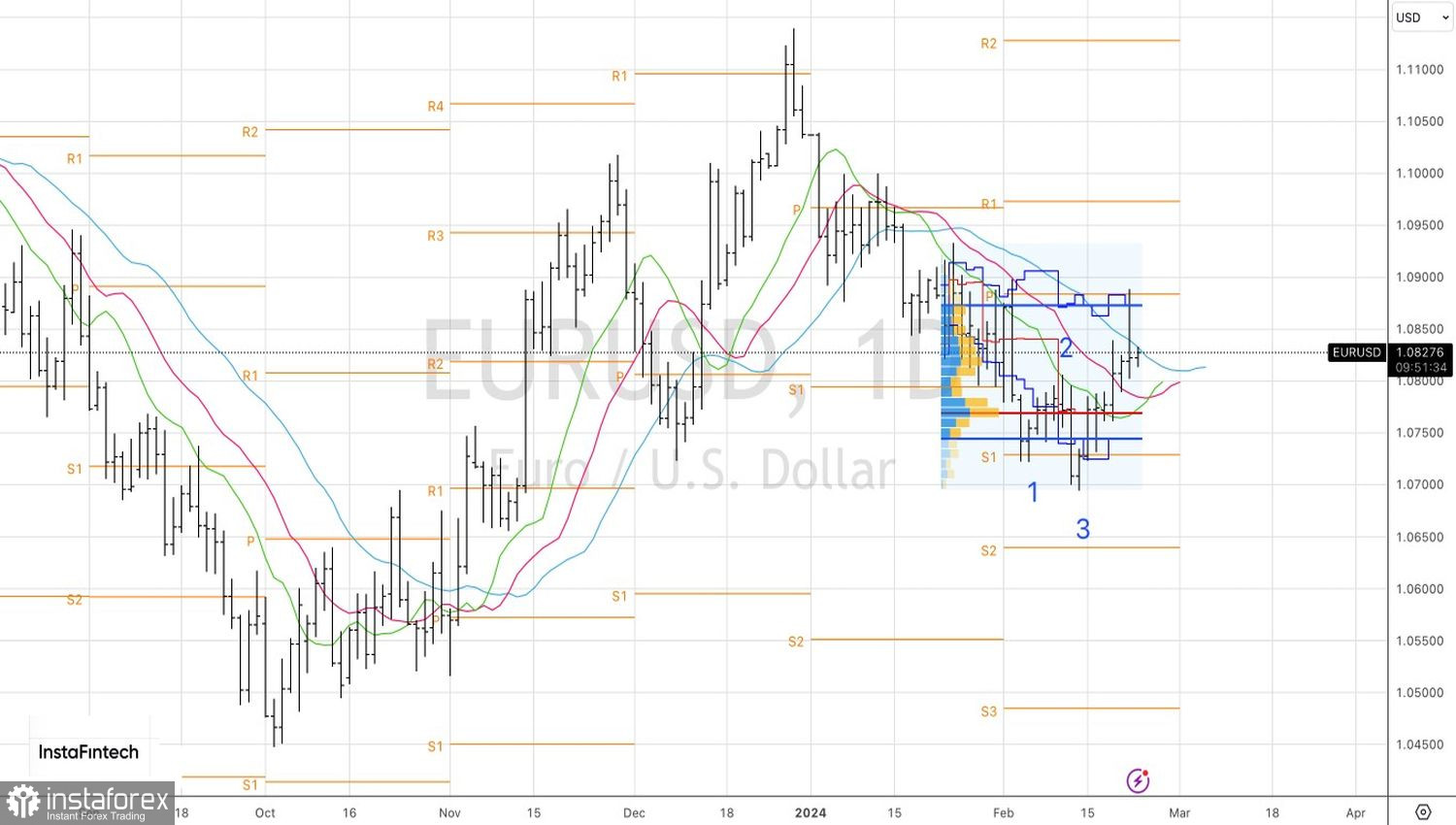

Technically, on the daily chart of EUR/USD, the formation of a pin bar with a long upper shadow indicates some weakness of the bulls. They failed to push quotes beyond the fair value range of 1.074–1.088 on the first attempt. Maybe it will work on the second attempt? As long as the pair is trading above the base of the pin bar at 1.08, the emphasis should be on buying. Only a drop below this level will be a reason to sell.