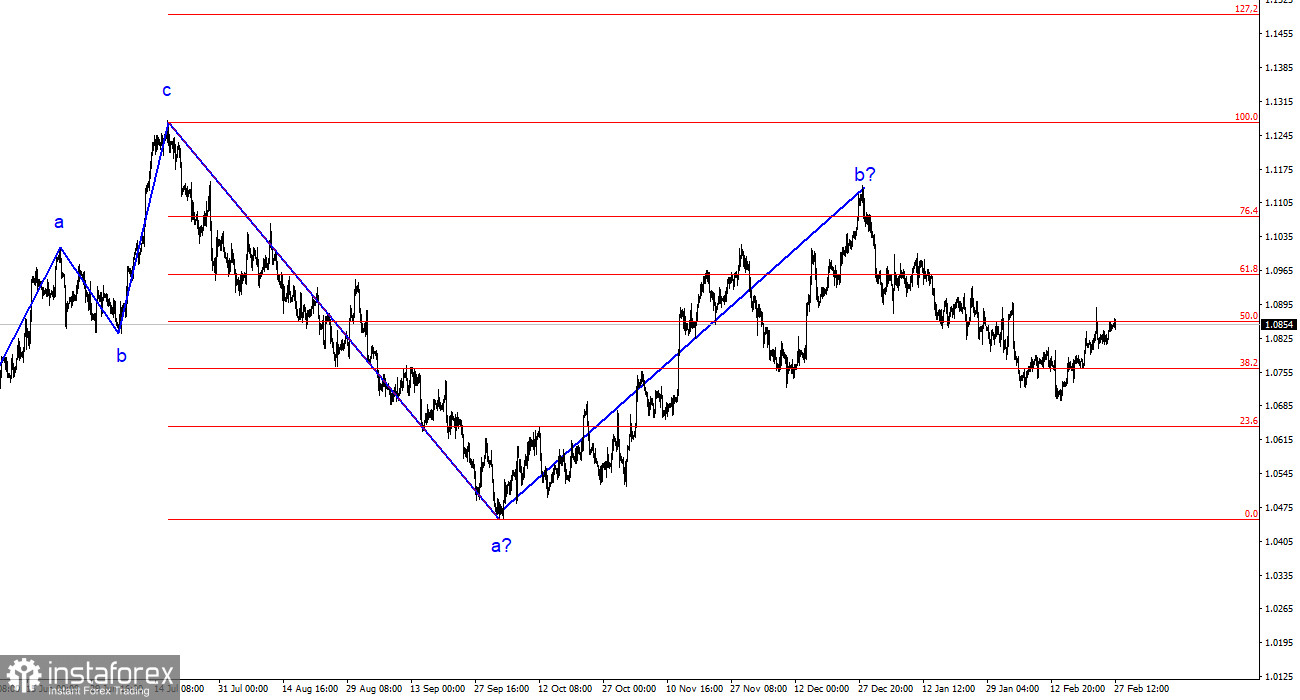

The wave analysis of the 4-hour chart for the EUR/USD pair remains unchanged. Over the past year, we have seen only three-wave structures, constantly alternating with each other. At the moment, the construction of another three-wave structure is continuing – a downward one, which began on July 18th of last year. The presumed wave 1 is completed, and wave 2 or b has complicated three or four times, but at the moment, it is also completed, as the decline in the pair has been ongoing for more than a month.

The upward trend section may still resume, but its internal structure will be unreadable in this case. I would like to remind you that I try to identify unambiguous wave structures that do not tolerate double interpretation. If the current wave analysis is correct, the market has moved on to forming wave 3 or c. At the moment, presumably, wave 2 in 3 or c is being built. If this is indeed the case, then an unsuccessful attempt to break through the 61.8% Fibonacci level may indicate the completion of this wave. In any case, the decline in the quotes of the pair should not be completed at this point. Alternatively, the wave analysis may be significantly complicated.

Euro decline may resume this week

The exchange rate of the EUR/USD pair practically did not change on Tuesday. A day earlier, we saw a slight increase in quotes, which is very difficult to correlate with any event. The news background yesterday was expressed only by Christine Lagarde's speech in the second half of the day. But precisely in the second half of the day, the pair stood still, and the increase was shown during the European session. But this is a minor detail. Today in America, literally half an hour ago, a report on the volume of orders for durable goods was released. Although the forecasts were very pessimistic, in practice, the indicator value turned out to be even worse. In January, volumes decreased by 6.1%, although the market expected losses of 4-4.5%. Orders excluding transportation also fared poorly – down 0.3%. Orders excluding defense fell by 7.3%.

Therefore, the only report of the day failed on all counts. Strangely, the market's first reaction was an increase in demand for the dollar, although there was no reason to buy the American currency today. I would even say the opposite. However, one should remember the wave pattern, which allows for a new decline in the pair from the current positions. The corrective wave may be completed, and the bearish market sentiment is extremely difficult to overcome with just one negative report. I would like to remind you that more important data (ISM, Nonfarm Payrolls, unemployment, GDP) have been positive lately. Based on all of the above, I believe that the market will continue to reduce demand for the euro and increase demand for the dollar.

General conclusions:

Based on the analysis of the EUR/USD, I conclude that the construction of a bearish set of waves continues. Wave 2 or b has taken on a completed form, so in the near future, I expect the continuation of building an impulsive downward wave 3 or c with a significant decrease in the pair. Currently, an internal corrective wave is being built, which may be completed today or tomorrow. I continue to consider only sales with targets near the calculated mark of 1.0462, which corresponds to 127.2% Fibonacci.

On the senior wave scale, it can be seen that the presumed wave 2 or b, which in length is already more than 61.8% Fibonacci from the first wave, may be completed. If this is indeed the case, then the scenario of building wave 3 or c and lowering the pair below 1.04 has begun to be implemented.