Each generation has its idols. If at the end of the 20th century, everyone was crazy about gold, then at the beginning of the 21st century, digital assets took its place. The rapid rise of Bitcoin to record highs since 2021 has overshadowed the appeal of precious metals. In the ETF market, there is a capital shift towards cryptocurrencies, and speculators are getting rid of their gold positions. For example, by the week of February 20th, long positions on COMEX decreased by 1,802 to 98,840 contracts, and shorts decreased by 1,7549 to 48,917 contracts.

While Bitcoin is still very young, and investors cannot clearly determine the factors shaping its dynamics, it's a different story with precious metals. They have been traded for decades, and the relationship between XAU/USD, the U.S. dollar exchange rate, and real yields on Treasury bonds has been studied. Gold is considered an inflation hedge. However, in reality, the intermediate link is the monetary policy of the Federal Reserve System.

Dynamics of Gold and U.S. Treasury Bond Yields

During periods of rising federal fund rates, precious metals usually lose their appeal as the dollar strengthens simultaneously with the increase in U.S. Treasury bond yields. However, in 2022–2023, when these processes were occurring, gold showed remarkable resilience. This was due to record central bank purchases that overshadowed the capital outflow from ETFs.

In 2024, bulls on XAU/USD were in an upbeat mood. If the tightening of the Federal Reserve's monetary policy is supposed to lead to a decline in quotes, its easing should be a reason for purchases. Optimistic forecasts were abundant, with figures reaching $2,400 per ounce and even $3,000. Unfortunately, the actual start was disappointing. Gold briefly dropped below $2,000 per ounce, but managed to recover.

Dynamics of Gold and the U.S. Dollar

As winter comes to an end, market forecasts regarding the federal fund rate align with FOMC's December estimates. This means that the U.S. dollar has lost its main advantage, theoretically giving the green light to gold. In reality, gold is not rushing to rise because the U.S. economy is robust, and Federal Reserve officials increasingly talk about lowering the federal fund rate only by the end of 2024.

If expectations for the start of the Federal Reserve's monetary policy easing shift from June to a later period, the U.S. dollar will gain a new growth driver, negatively impacting XAU/USD. Clues may come from the release of U.S. inflation data in the form of PCE, eagerly awaited by the markets. Acceleration in the personal consumption expenditures index could revive the idea of monetary restriction, which is bad news for precious metals.

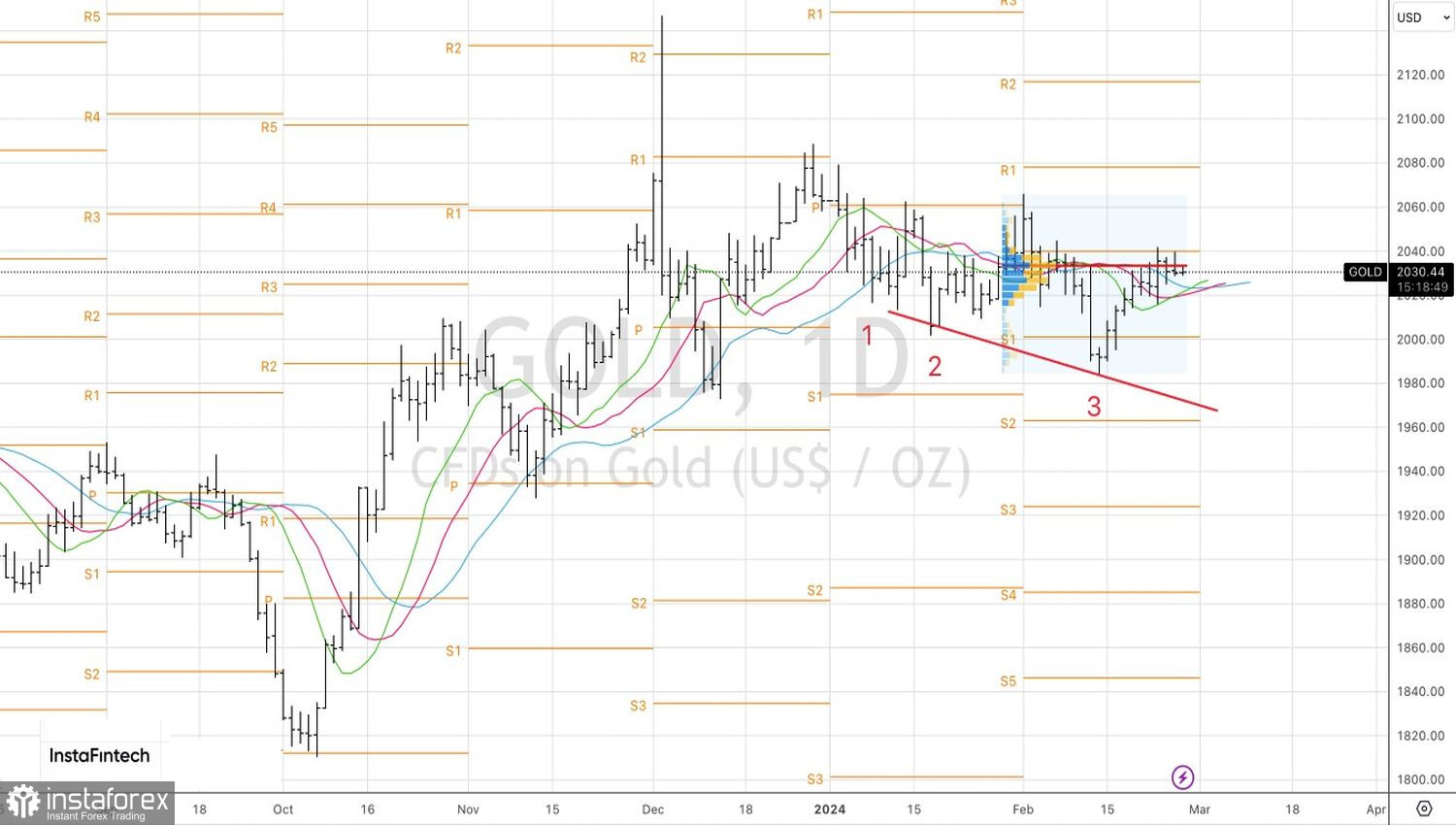

Technically, on the daily chart of gold, consolidation near the fair value at $2,034 per ounce is taking place. A drop in quotes below support at $2,025 would allow gold to form a reversal pattern 1-2-3. Its combination with the Three Indians pattern would provide a basis for medium-term purchases on a bounce from the $2,000–2,010 range.