Despite experiencing the highest level of volatility since the beginning of the week, the situation for the GBP/USD pair has not changed significantly. If the dollar lost its positions in the first half of the trading day, it returned to its initial values in the second half. The scale of fluctuations was not as significant. In general, such an outcome was quite predictable, considering the absence of any economic data. The second estimate of the United States GDP for the fourth quarter was published, which coincided with the first estimate. So this report did not bring anything new. Moreover, today, we expect the pair to remain flat. The report on initial jobless claims is unlikely to have any impact since the total number is expected to increase by only 12,000, which is a rather symbolic change. In addition, the number of continued claims is likely to increase by 3,000. They have much greater significance than initial claims. Thus, the market will continue to tread water.

Following the euro, the GBP/USD pair headed downwards, where speculators locally covered about 50 pips. After the process of restoring long positions, based on which the quote almost returned to the opening price of the day.

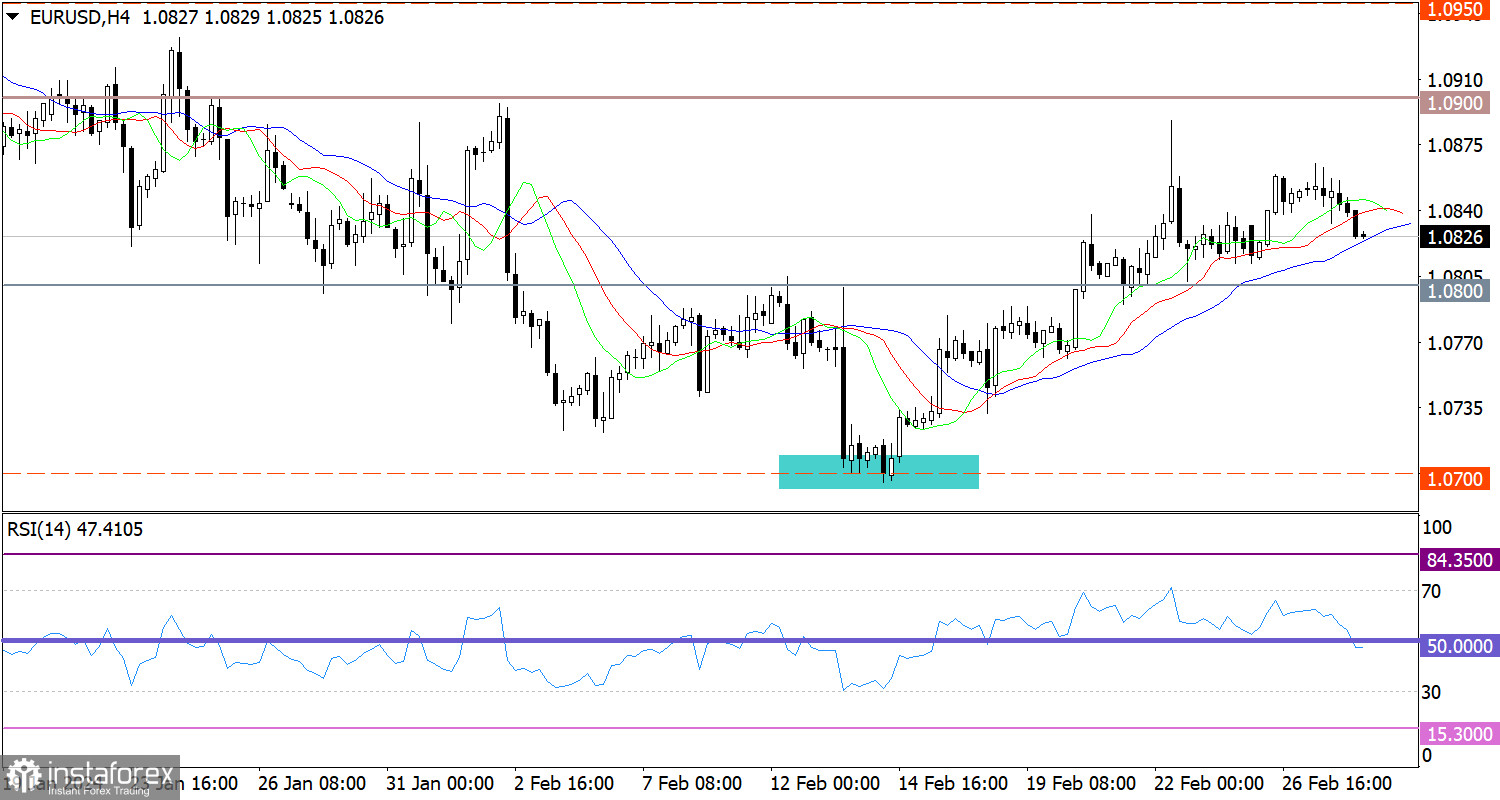

On the four-hour chart, the RSI technical indicator is hovering along the 50 mid level, indicating a stagnant process.

On the same time frame, the Alligator's MAs are intersecting each other, also indicating a flat phase.

Outlook:

Based on the process of restoring positions in the British pound, we can assume that the bullish sentiment still prevails in the market. However, in order to strengthen long positions, the price must settle above the level of 1.2700. Until then, the price could fluctuate between the levels of 1.2600/1.2700.

The complex indicator analysis points to a flat phase in the short-term and intraday periods due to the fluctuation.