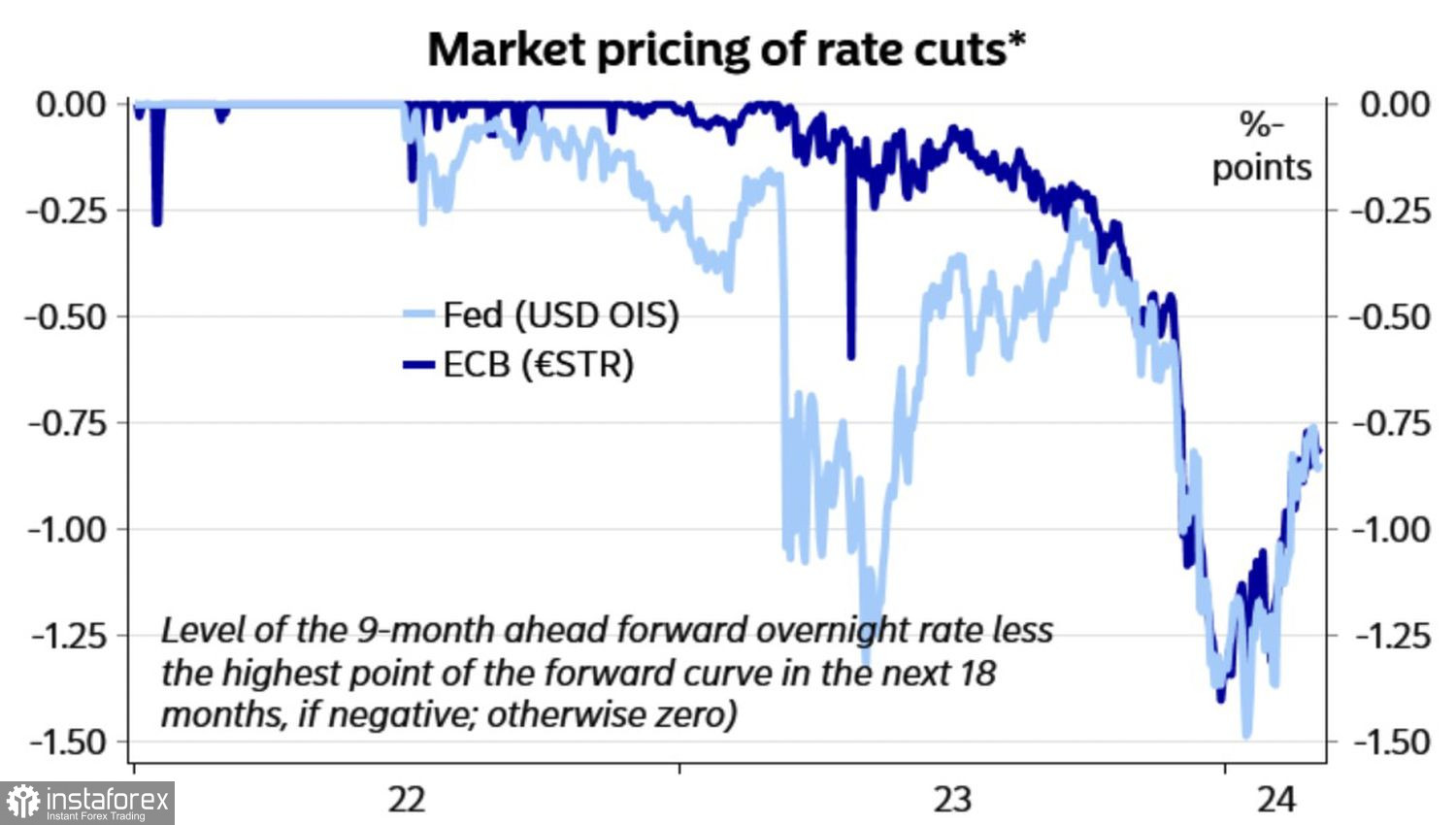

The central banks have successfully accomplished their goal by explicitly expressing their reluctance to promptly reduce interest rates. This strategic move has compelled the financial markets to comply with their stance. Investors are anticipating both the Federal Reserve System and the European Central Bank (ECB) to ease monetary policy in June, taking three progressive steps in this direction throughout 2024.

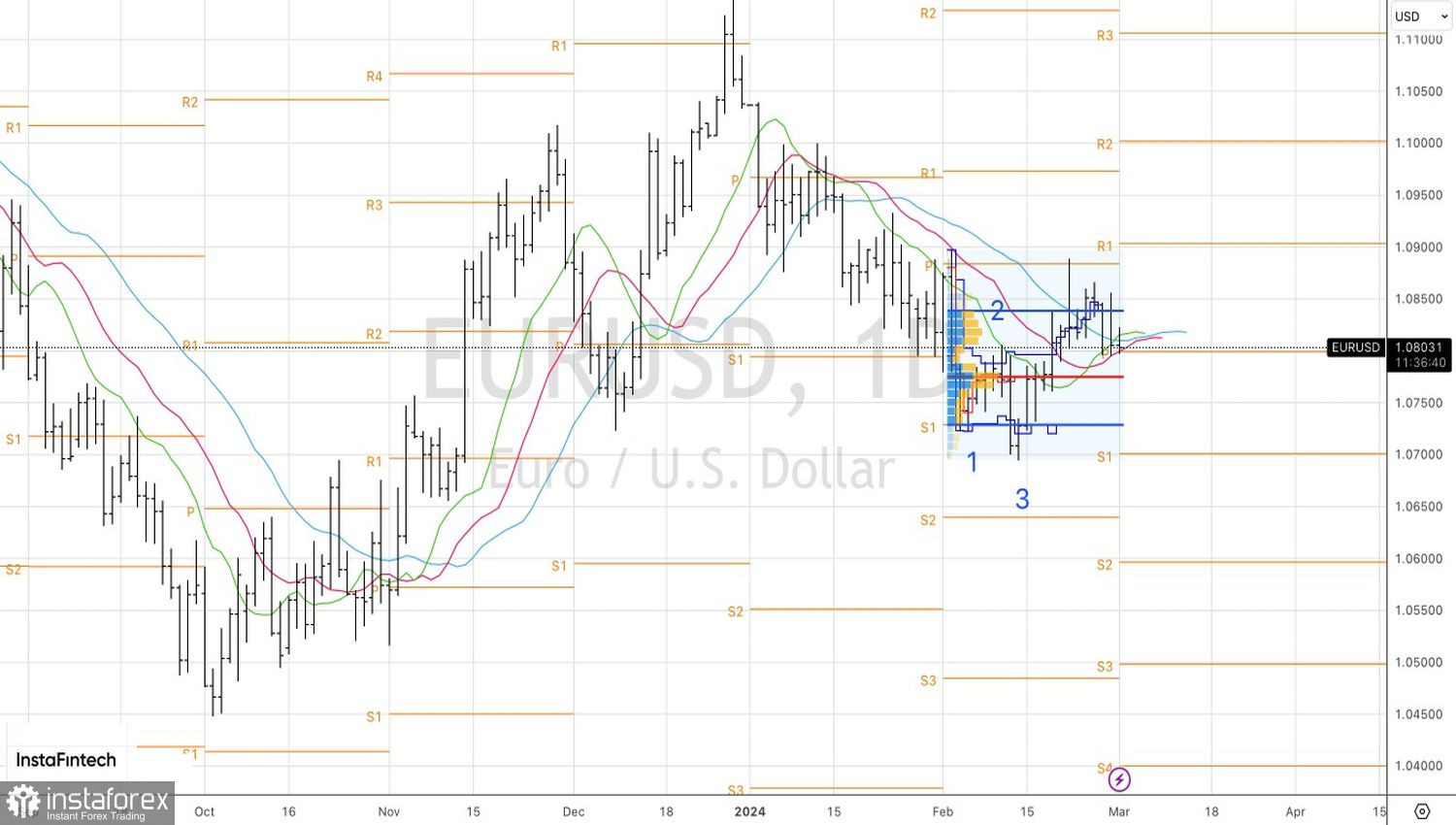

This circumstance does not give an advantage to either the bulls or the bears on EUR/USD. The fact that the primary currency pair is confined within a narrow trading range comes as no surprise. It is awaiting developments that have the potential to stir up traders. What might serve as the catalyst? The ECB meeting, Jerome Powell's speech, or statistics on U.S. employment?

Dynamics of market expectations for Fed and ECB rates

If your policy depends on data, why talk about lowering rates in June? This is what ECB officials are guilty of. Their American colleagues issue more vague comments. New York Federal Reserve Bank President John Williams expressed the most coherent position. He emphasized twice in a few days that tightening monetary policy is a thing of the past, and the federal funds rate will fall later this year.

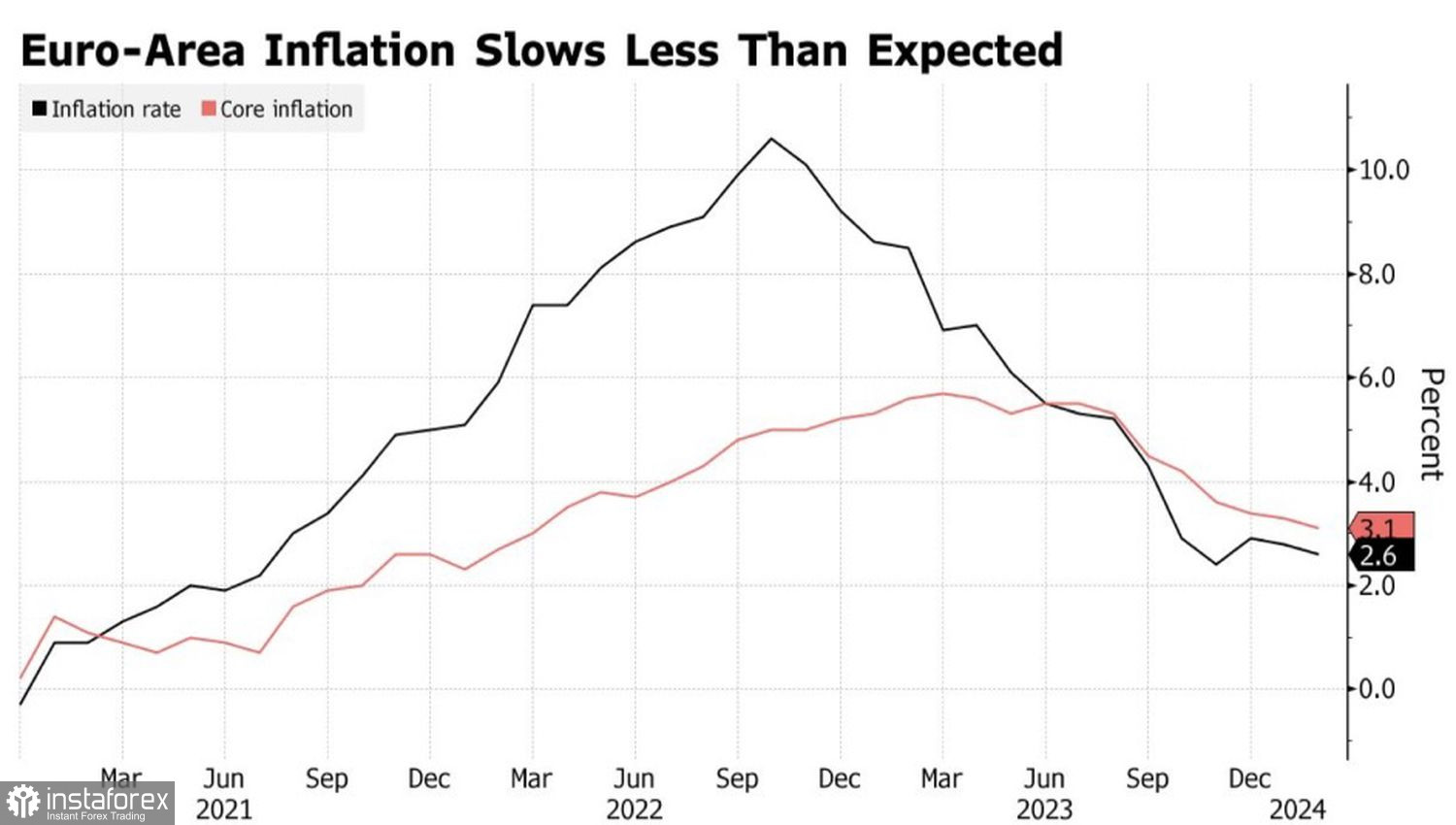

Data on American PCE confirmed his worldview. Indicators came out in line with forecasts, not surprising financial markets. On the contrary, European consumer prices in February turned out to be better than expected, rising by 2.6% and core inflation by 3.1%. Such dynamics of indicators is good news for ECB hawks. But instead of rising, EUR/USD continued to tread water.

Dynamics European Inflation

In reality, the excessively transparent monetary policy diminishes investors' autonomy. A majority of 63% of Reuters experts anticipate a reduction in the deposit rate by the European Central Bank from 4% to 3.75% in June, surpassing the 45% consensus from the previous survey. Furthermore, 17 out of 73 specialists foresee the initiation of monetary expansion in April, while another 10 expect it in the latter half of 2024. The consensus projection suggests a decline of 100 basis points, bringing borrowing costs to 3%.

The futures market mirrors analogous trends concerning the federal funds rate, projecting a decline of -75 basis points in June. Investors align with the stance of central banks, explaining the stagnation of EUR/USD.

What's next? According to Bank of America, the main currency pair will grow to 1.15 by the end of the year as the U.S. economy finally begins to slow down in the remaining part of 2024. On the contrary, the eurozone will rebound. Its GDP will recover, and the reduction in economic growth divergence will allow the euro to outsmart the dollar.

On the other hand, Nordea believes that the ECB will cut rates three times starting in June, while the Fed to conduct two reductions starting September. A slower pace of easing monetary policy is the key to a downward trend in EUR/USD.

Technically, the main currency pair continues to consolidate on the daily chart. Its upper boundary is near 1.088, and the lower one is at 1.0725. The strategy of selling EUR/USD on the inability of bulls to play out a pin bar has been successful. It makes sense to keep shorts for now.