Usually, one expects a lot of interesting reports and events from America. March begins, which means that all three central banks will hold their second meetings in 2024. Market expectations regarding interest rates are currently quite unanimous. The US and the eurozone are expected to lower rates, but according to projections, this should not happen before June. Therefore, I do not expect the key central banks to make any changes in monetary policy in March. By the way, the FOMC meeting will take place next week.

Nonetheless, the US will still have interesting events this week. On Tuesday, the ISM Non-Manufacturing PMI for February will be released. The ISM Manufacturing PMI was released on Friday, and it put pressure on the dollar as its value was significantly below market expectations. However, the services index is higher than the manufacturing one, which allows us to assume a value not lower than 51-52. According to forecasts, the ISM index is expected to fall to 53 points, but in my opinion, this is a small decline that will not have a significant impact on the economy and the dollar exchange rate.

Key reports on JOLTS (Job Openings and Labor Turnover Survey) and ADP (Automatic Data Processing) will be released on Wednesday. Federal Reserve Chair Jerome Powell will also speak. Good labor market data can support dollar buyers, but I have to remind you that there are more important reports in America (Nonfarm Payrolls, unemployment). Therefore, I believe that you should consider Powell's speech as the main event. He might say that there is no need to rush with a rate cut. In turn, the market may interpret such rhetoric as "cautiously hawkish" and slightly increase demand for the dollar. However, for obvious reasons, we cannot know in advance what Powell will talk about. Inflation in the United States has been slightly decreasing in recent months, so there is no reason to expect Powell to significantly soften his stance.

The Fed chief is also scheduled to speak on Thursday, and on Friday, we have the Nonfarm Payrolls and unemployment reports to focus on. The second speech is unlikely to differ from the first, and the dollar's dynamics on Friday will depend heavily on Nonfarm Payrolls. We don't expect weak market expectations, but Nonfarm Payrolls can bring a surprise, either pleasant or unpleasant.

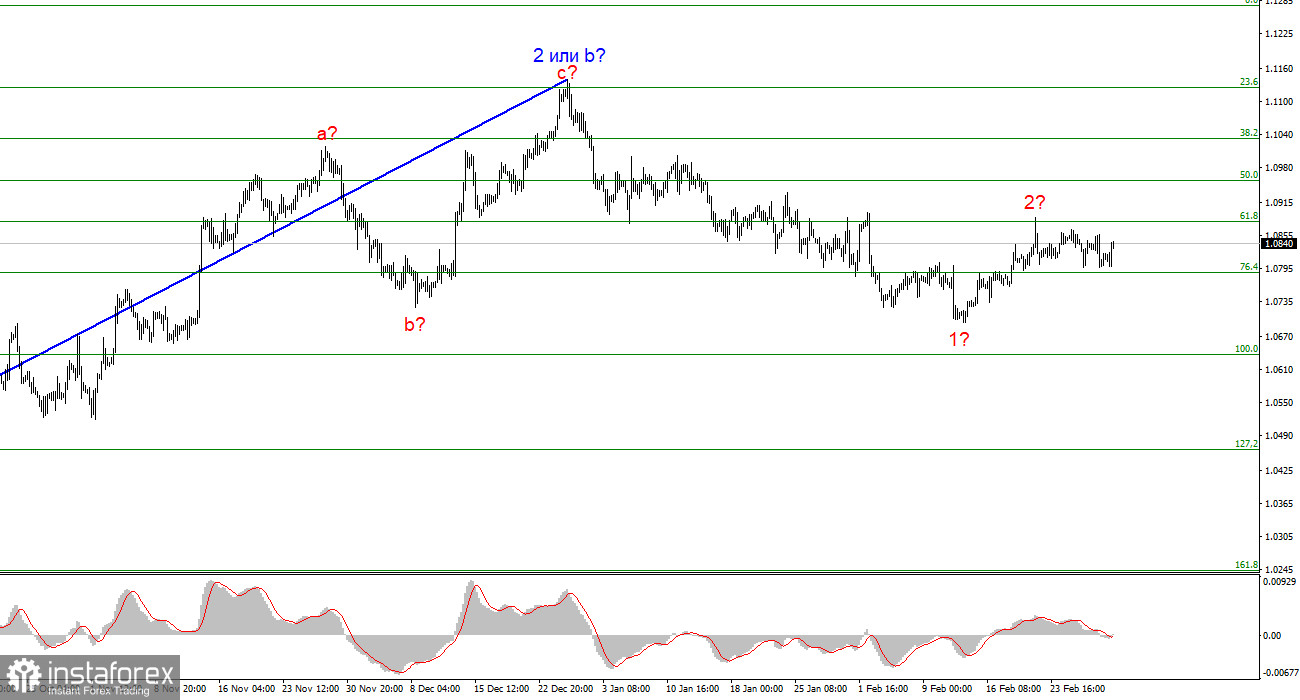

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Wave 2 or b is complete, so in the near future, I expect an impulsive downward wave 3 or c to form with a significant decline in the instrument. An internal corrective wave is currently being formed, which may already have a complete form. I am considering short positions with targets around the level of 1.0462, which corresponds to 127.2% according to Fibonacci.

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, as I believe that wave 3 or C will eventually gain momentum. A successful attempt to break through the 1.2627 level generated a sell signal, but at the moment, I can also identify a new sideways trend with the lower boundary at the 1.2500 level. In my opinion, this level currently acts as a limit for the pound's decline. I can also highlight a descending channel, which suggests a decline in quotes.