Long positions on USD/JPY:

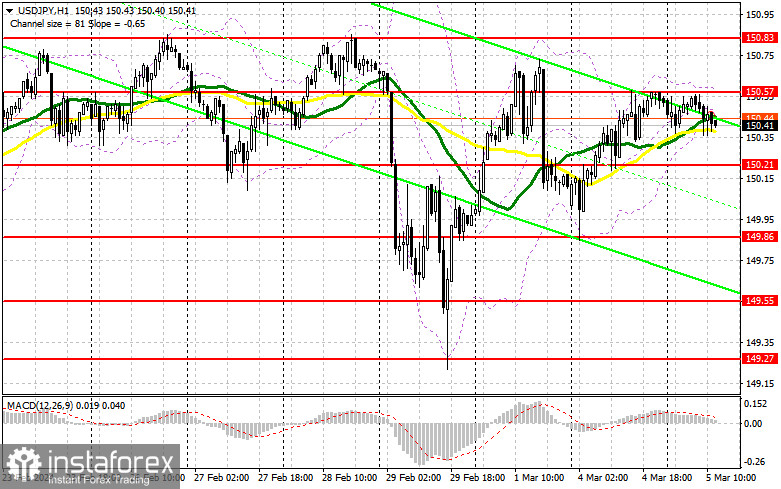

We have important data coming up from the US regarding economic activity, which could influence the positions of dollar buyers. Figures on the ISM services sector index and the composite PMI are expected. Weak data could support yen buyers, leading to a correction that I plan to benefit from. I aim to act around the 150.21 support level. A false breakout there would provide a suitable entry point for buying to reach the 150.57 resistance area. A breakthrough and consolidation above this range would allow buyers to strengthen their positions in the market, opening opportunities for long positions targeting 150.83. The ultimate goal would be the high at 151.21, where I plan to take profits. If the pair declines in the second half of the day without buyer activity at 150.21, and a dovish statement from a Federal Reserve official increases, pressure on the pair will rise. In such a case, I would attempt to enter the market around 149.86, but only a false breakout would be a suitable condition for opening long positions. I plan to buy the pair on a rebound only from 149.55, allowing an intraday correction of 30-35 pips.

Short positions on USD/JPY:

Sellers seem to remain in the market, but no significant activity has been observed on their part yet. Given that the technical picture has not changed, in case of an increase in USD/JPY, I expect bears to appear around 150.57. A false breakout there would provide a good entry point for selling with a move toward the 150.21 support, where the moving averages are slightly higher. A breakthrough and a retest from below to above this range would deal a more serious blow to the bulls' positions, leading to the triggering of stop orders and opening the way to 149.86, which would be a significant success for sellers. The next target would be the 149.55 area, where I plan to take profits. If the pair rises and there is no bear activity at 150.57 in the second half of the day, buyers will strengthen their positions. Therefore, it would be best to postpone sales until testing the next resistance at 150.83. In the absence of a downward movement there as well, I will sell the pair immediately on a rebound from 151.21, anticipating an intraday correction of 30-35 pips.

Subscribe to my Telegram channel

Indicator signals:

Moving Averages

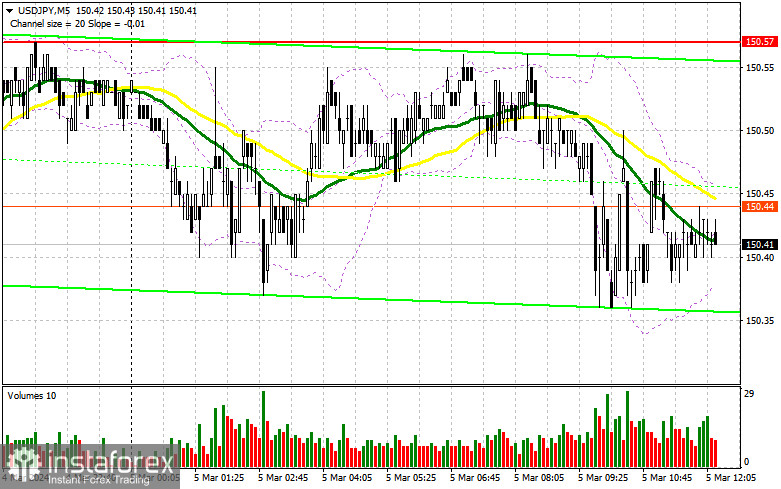

Trading is taking place around the 30-day and 50-day moving averages, indicating a sideways market trend.

Note: The author considers the period and prices of moving averages on the H1 hourly chart, which differs from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands

In case of a decrease, the lower boundary of the indicator around 150.40 will act as support.

Descriptions of indicators

- Moving Average shows the current trend by smoothing out volatility and noise. Period 50. Marked in yellow on the chart.

- Moving Average shows the current trend by smoothing out volatility and noise. Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20.

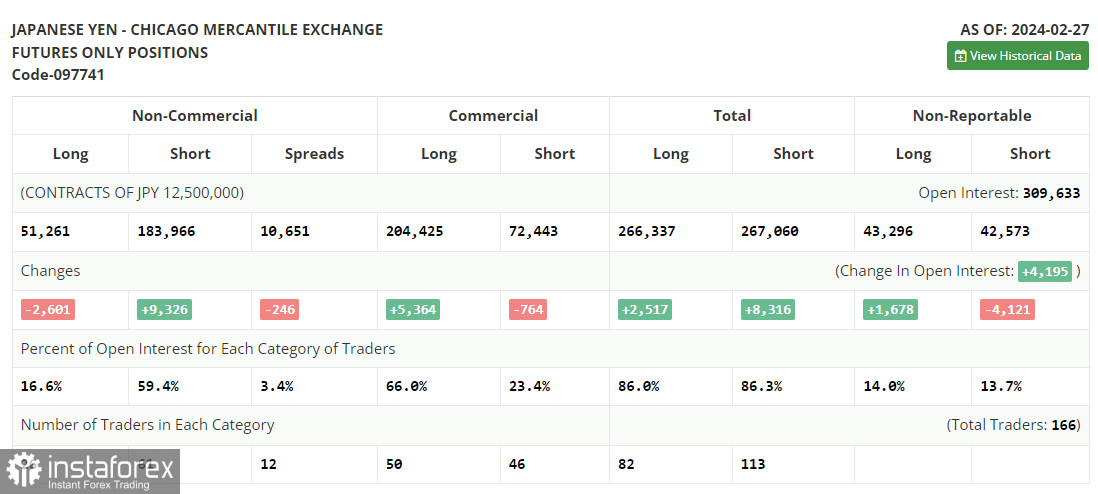

- Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain criteria.

- Long non-commercial positions represent the total long open positions of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- Total net non-commercial position is the difference between the short and long positions of non-commercial traders.