EUR/USD

Higher Timeframes

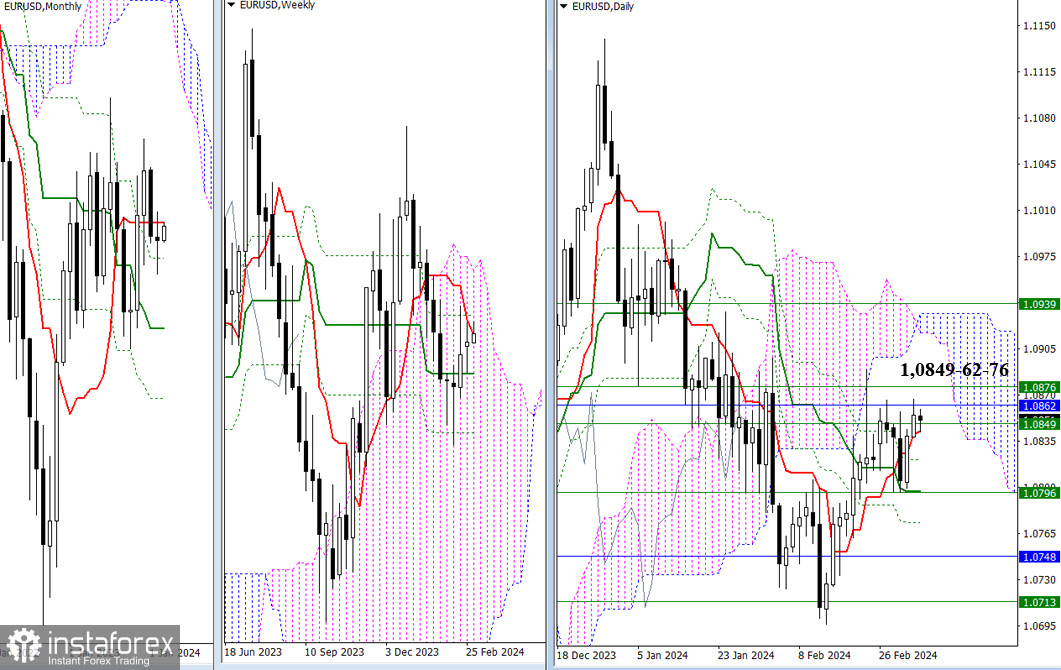

Euro continues to work with the encountered resistance zone of 1.0849-62–76 (weekly levels + monthly short-term trend). Breaking through and securing consolidation above this zone is crucial for further upward movement. In the subsequent development of bullish sentiments, the main reference points on this chart segment will be the Ichimoku clouds.

If bulls enter the bullish zone relative to the daily (1.0917–32) and weekly (1.0939) clouds, new prospects will open up for them. Failure and inability to overcome the tested resistances will bring the market back into the responsibility zone of the daily Ichimoku cross, with support noted today at 1.0842 – 1.0821 – 1.0797 – 1.0793, and will set the task of conquering the weekly medium-term trend (1.0796).

H4 – H1

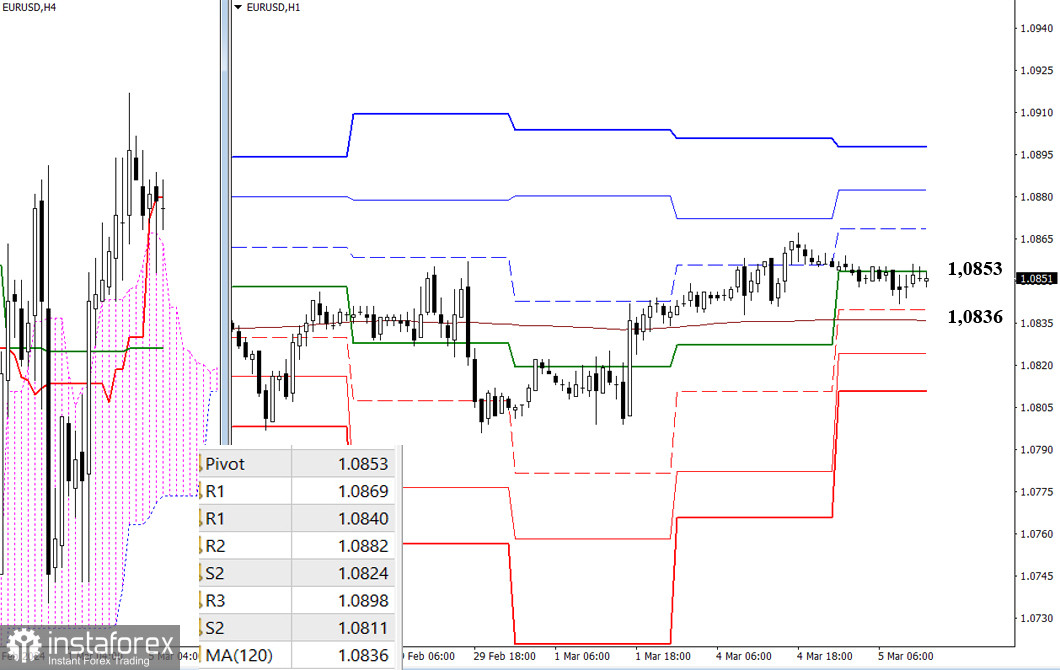

Bullish players are losing positions as the opponent forces them to decline. Currently, the central pivot point of the day (1.0853) exerts attraction and influence, and below lies the most significant support of lower timeframes – the weekly downward correction (1.0836). Additional reference points in case of renewed market activity today could be the classic pivot points; for bullish players, these are resistances at 1.0869 – 1.0882 – 1.0898, and for bearish players, supports at 1.0824 – 1.0811.

***

GBP/USD

Higher Timeframes

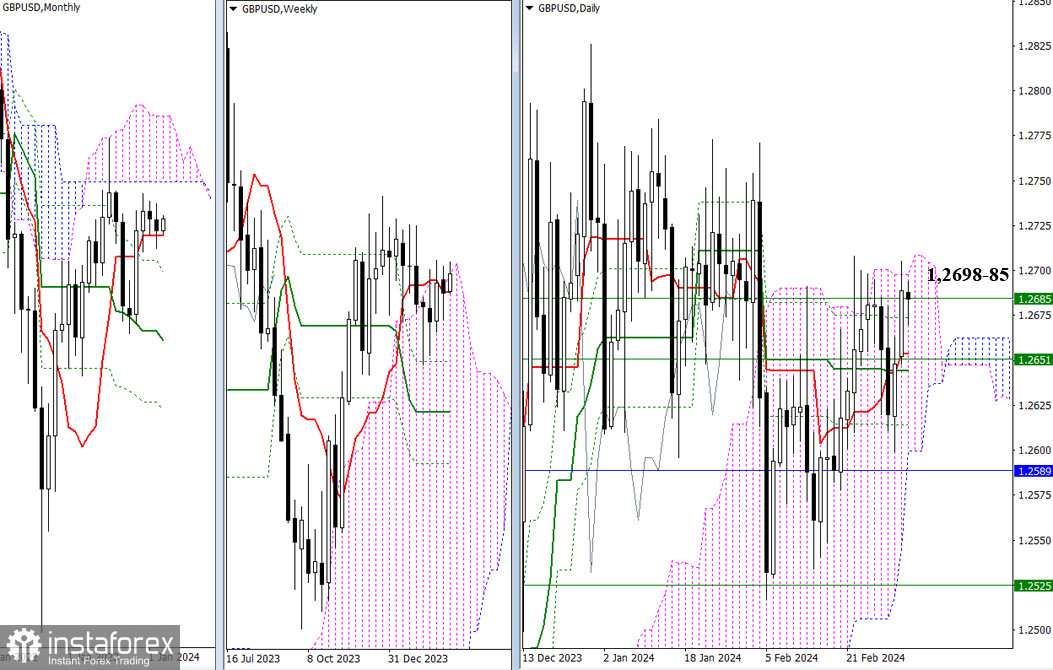

Yesterday, the market tested the upper boundaries of the daily (1.2698) and weekly (1.2685) clouds. Exiting and securely consolidating in the bullish zone beyond the Ichimoku cloud will allow for new perspectives for the development of upward movement. Shifting priorities and the return of bearish activity in the established conditions will direct attention to the main supports of the daily cross (Tenkan 1.2653 – Kijun 1.2644), reinforced by the weekly short-term trend (1.2651).

H4 – H1

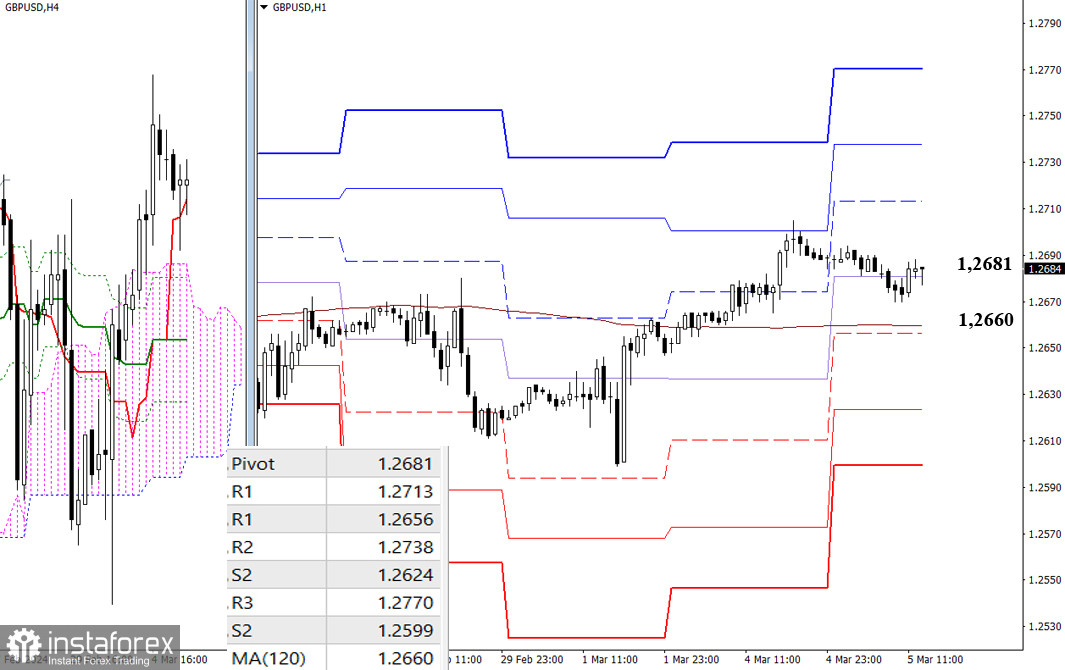

The main advantage on lower timeframes currently belongs to the bulls. However, they have long been losing positions and are currently holding around the central pivot point (1.2681). If this trend continues, they will encounter the weekly long-term trend (1.2660), which consolidation below could deprive bullish players of the advantage and change the current balance of power. Additional reference points for bearish players in case of further decline will be the supports of classic pivot points (1.2624 – 1.2599).

Suppose bullish players manage to deal with the situation and recover their position, surpassing yesterday's high of 1.2705. In that case, their landmarks for continuing the ascent within the day will be the resistances of classic pivot points (1.2713 – 1.2738 – 1.2770).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)