The end of the current week could be explosive for both the euro and the dollar. In previous reviews, I've already listed events that could lead to a sharp increase in market activity, which has been notably lacking in strong movements recently. With the U.S. reports, things are more or less clear: values above market expectations will likely support the U.S. currency and vice versa. Regarding Federal Reserve Chair Jerome Powell's speeches, it's also more or less understood: his rhetoric is unlikely to differ significantly from the statements he has made before. However, the European Central Bank meeting and ECB President Christine Lagarde's speech might make things a bit more complicated.

To begin with, an updated inflation report has been released since Lagarde's last speech in the European Union. Euro-area headline inflation slowed down to 2.6% (2.8% in January) and core inflation to 3.1% (3.3%) in February. We can draw several conclusions based on these figures. Firstly, inflation continues to decline. And not just decline, but it is approaching the target level. It is clear that Lagarde's rhetoric may shift towards a more dovish stance.

Secondly, interest rates will remain unchanged at the March meeting. However, the ECB president must provide the market with some information about future rate changes. I would like to remind you that some ECB policymakers are against a rapid shift towards policy easing and a sharp rate cut. Lagarde herself said that there could be sufficient grounds for policy easing in early summer. The question is how the market will react if Lagarde confirms her words about the beginning of summer.

In my opinion, the beginning of summer is earlier than the market expected. Based solely on this, one can assume that the demand for the euro will continue to decline in the long term. The wave layout also tells the same story, while the eurozone macro data continue to remain subdued. I do not see substantial reasons for the market to increase demand for the euro. U.S. reports will also influence the EUR/USD this week, but overall, I expect the pair to fall. An unsuccessful attempt to break the 1.0881 level will indicate the market's readiness to sell, and the pair's direction will depend on the U.S. reports.

Wave analysis for EUR/USD:

Based on the analysis of EUR/USD, I conclude that a bearish wave set is being formed. Wave 2 or b is complete, so in the near future, I expect an impulsive downward wave 3 or c to form with a significant decline in the instrument. An internal corrective wave is currently being formed, which may end this week. I am considering short positions with targets around the level of 1.0462, which corresponds to 127.2% according to Fibonacci retracement.

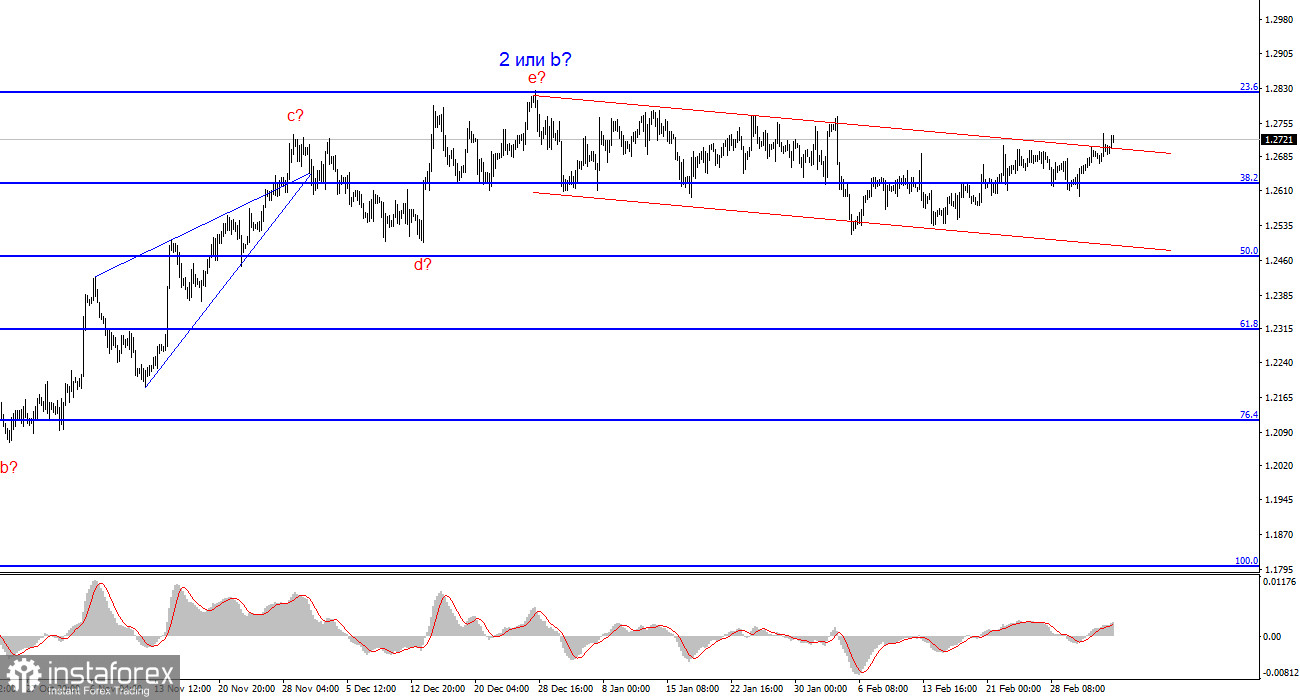

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will gain momentum sooner or later. A successful attempt to break through the 1.2627 level generated a sell signal, but at the moment, I can also identify a new sideways trend with the lower boundary at the 1.2500 level. In my opinion, this level currently acts as a limit for the pound's decline. I can also highlight a descending channel, which suggests a decline in quotes. The price has already overcome the channel, so the pound may continue to rise for some time, which is another internal wave within the sideways movement.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.