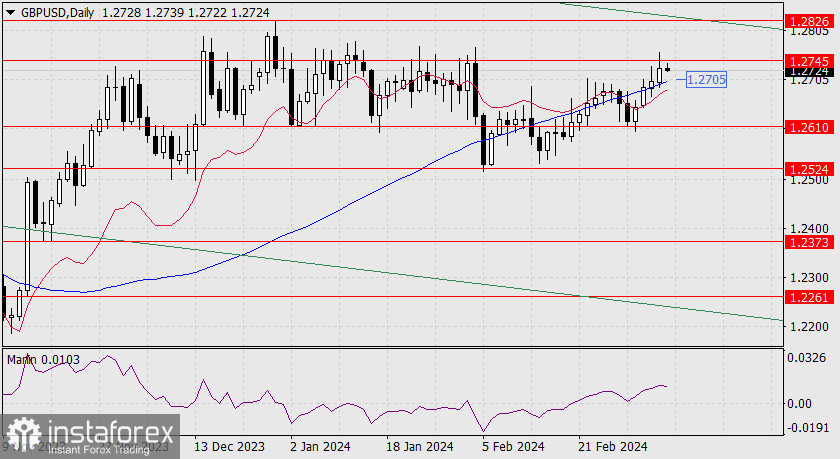

GBP/USD

The British pound consolidated above the daily MACD indicator line as it closed yesterday's trading session. The pair couldn't rise further due to the resistance level of 1.2745. Now it needs to settle above this mark in order to grow more confident in reaching the target of 1.2826, the peak on December 28, which coincides with the upper boundary of the channel.

The level of 1.2745 is not that simple; it represents the upper boundary of a two-month range, and, clearly, substantial stop orders are located here. Therefore, the pound needs a strong external impetus. In this case, today's European Central Bank meeting may provide the help it needs. If the ECB does not soften its stance, the pound is capable of reaching the target of 1.2826 in the coming days. However, if the ECB softens its rhetoric, the pound will return below the MACD line (1.2705), and the target will be the support level at 1.2610, the lower boundary of the range. The Marlin oscillator is rising but at an extremely slow pace, with a risk of moving downward.

On the 4-hour chart, the price hesitated before the resistance at 1.2745, and Marlin is in a slightly confused state, indicating that it is ready to fall if suitable conditions arise. Below the daily MACD line (1.2705) is the 4-hour MACD line (1.2689), and its support coincides with yesterday's low. This level (1.2689) is crucial – a breakthrough will reverse the trend into a medium-term decline.