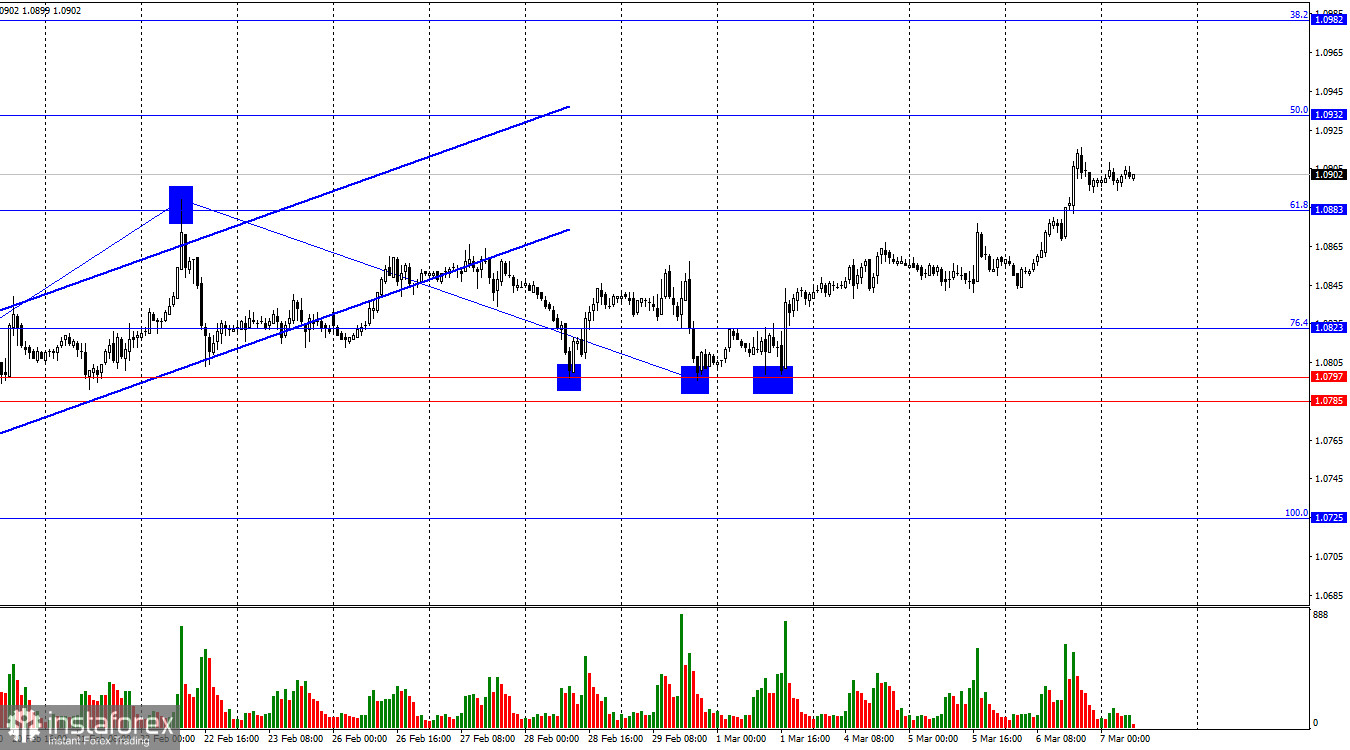

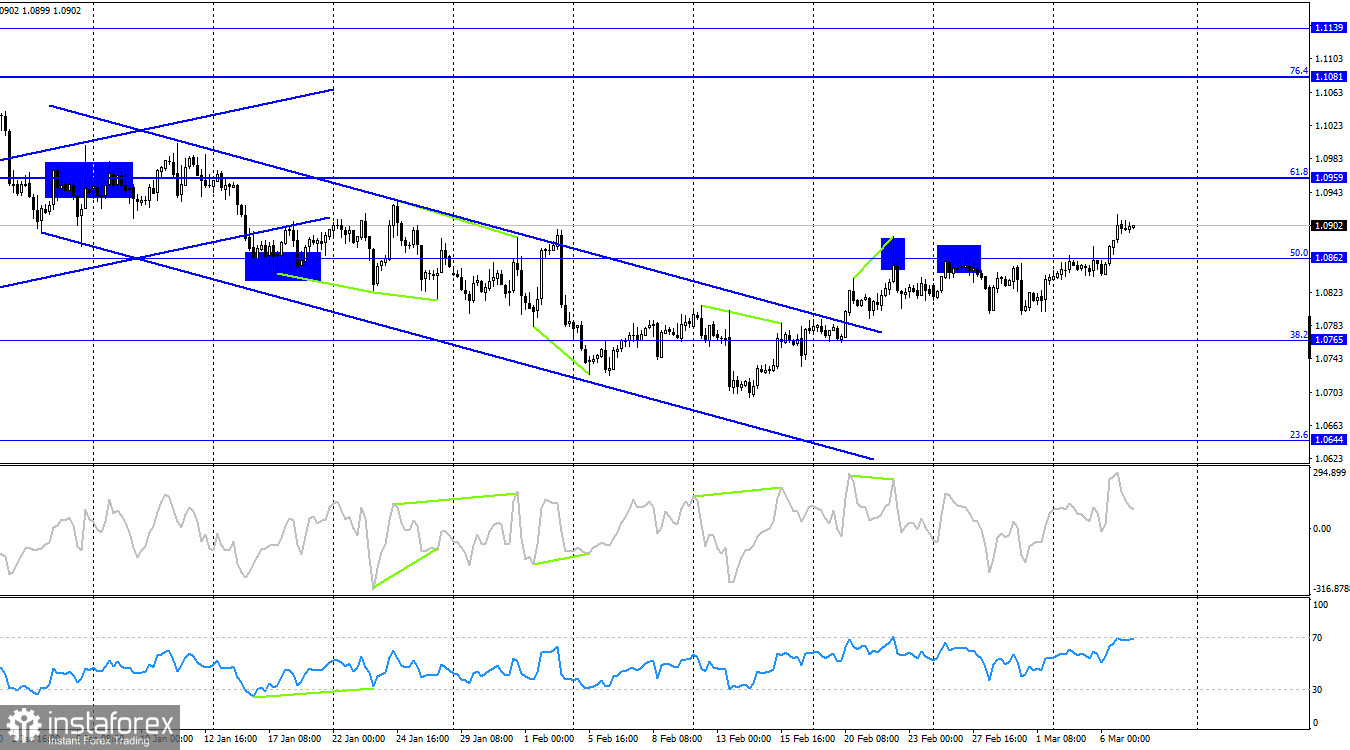

The situation with the waves remains quite clear. The latest completed upward wave confidently broke through the peak of the previous wave from February 12, while the last downward wave did not even come close to the previous low. Thus, we currently have a bullish trend with no wave indicators of its end. A close below the price channel could be seen as the first sign of a bull retreat, but bears failed to close even below the 1.0785–1.0797 area and retreated again. A new upward wave managed to break through the peak from February 22, suggesting even stronger bullish pressure soon.

Wednesday's news background was rich and interesting. The two most important reports of the day on the US labor market turned out slightly weaker than traders expected, leaving bears with no grounds for a counteroffensive. Jerome Powell also disappointed traders, though their expectations were clearly too high. Today, in a few hours, the results of the ECB meeting will be announced. The decision on rates is already known, but Christine Lagarde might make some dovish statements at the press conference, as inflation in the eurozone continues to decline. The regulator does not need to maintain a hawkish stance if inflation is nearing the target. Thus, today bears may find grounds for an attack. However, the trend remains bullish.

On the 4-hour chart, the pair has settled above the 50.0% correction level at 1.0862, suggesting a continuation of growth towards the next correction level of 61.8% at 1.0959. No emerging divergences are observed in any indicators today. A rebound from the 1.0959 level would benefit the US currency and some decline. There are no signs of bullish momentum ending at this time.

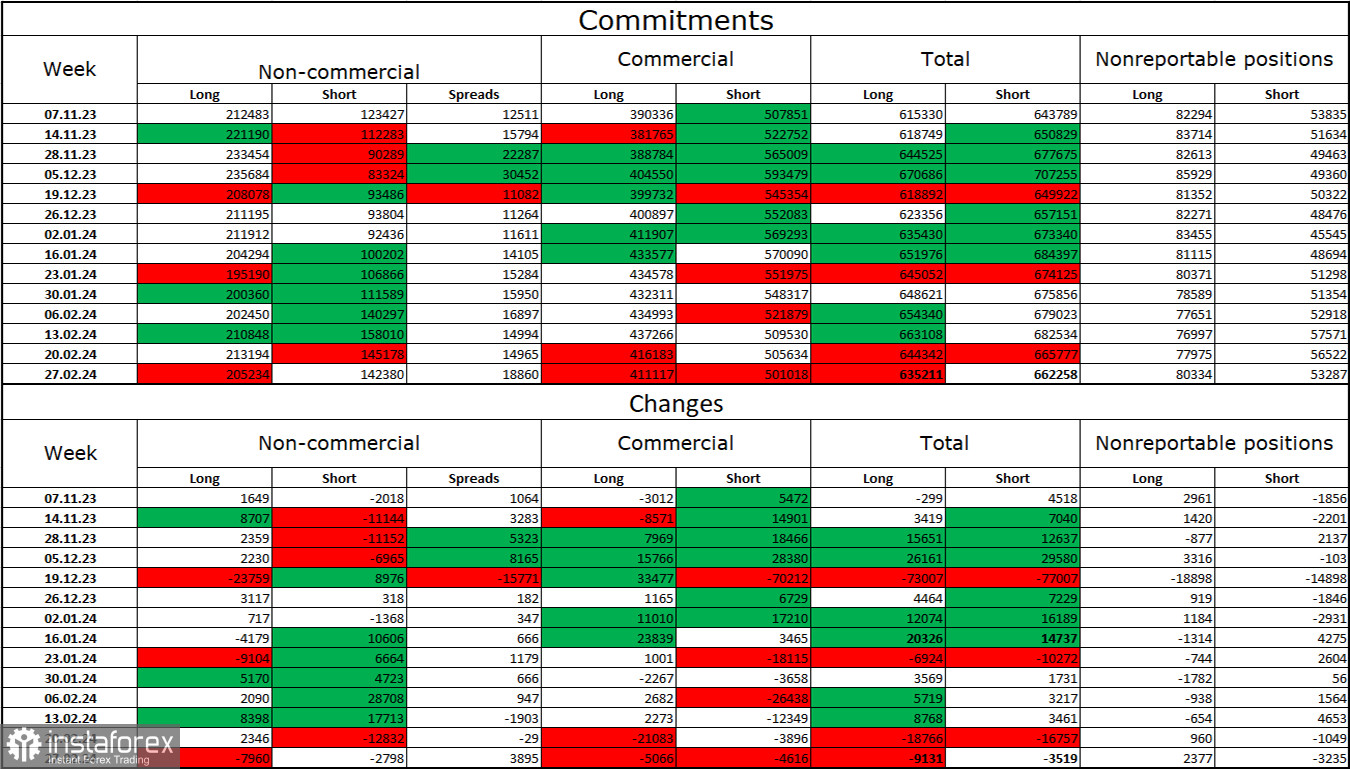

COT Report:

In the latest reporting week, speculators closed 7,960 long contracts and 2,798 short contracts. The Non-commercial group's sentiment remains bullish but continues to weaken. The total number of long contracts held by speculators now stands at 205,000, with short contracts at 142,000. I still believe that the situation will shift in favor of bears. Bulls have dominated the market for too long, and now they need a strong news background to maintain the bullish trend. Meanwhile, the total number of open Long positions is less than Short (635K vs. 662K), a situation that has persisted for quite some time.

News Calendar for the US and eurozone:

Eurozone – ECB Interest Rate Decision (13-15 UTC).

Eurozone – ECB Press Conference (13-45 UTC).

Eurozone – Speech by ECB President Christine Lagarde (15-00 UTC).

USA – Speech by Fed Chairman Jerome Powell (15-00 UTC).

March 7th's economic events calendar includes four interesting entries, with Christine Lagarde's speech standing out. Powell has already spoken in Congress yesterday, and his speech today is unlikely to differ from yesterday's. The news background's influence on traders' sentiment today could be strong.

EUR/USD forecast and tips for traders:

Selling the pair is possible upon a rebound from the 1.0959 level on the 4-hour chart with targets at 1.0883 and 1.0862. In addition, upon an hourly close below the 1.0883 level with a target of 1.0823. Purchases of the pair are possible upon securing above the 1.0862 level on the 4-hour chart with a target of 1.0932. These trades can be kept open at least until the ECB meeting.