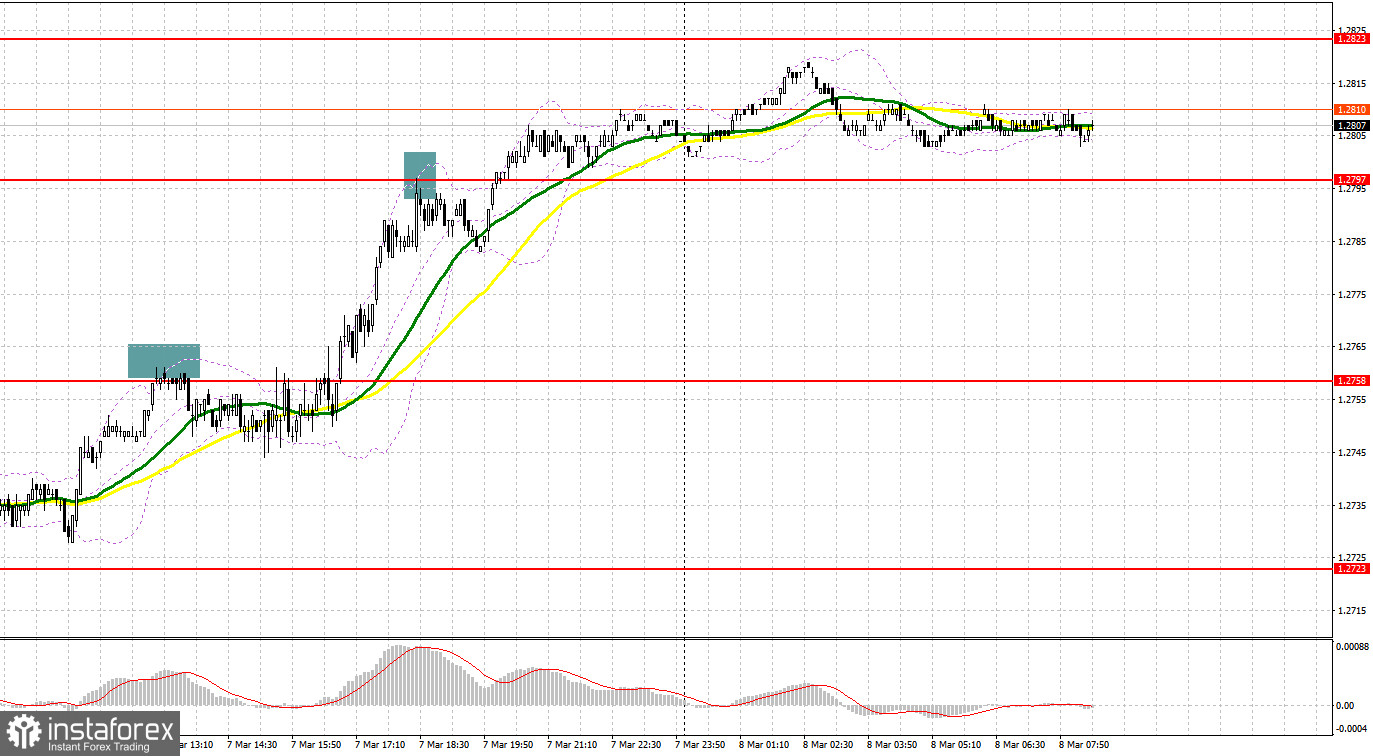

Yesterday, traders received several signals to enter the market. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.2758 as a possible entry point. A rise and false breakout there led to a sell signal, which sent the pound down by 15 pips. In the second half of the day, an unsuccessful consolidation above 1.2797 also led to a corrective move by 15 pips, and the upward movement continued.

What is needed to open long positions on GBP/USD

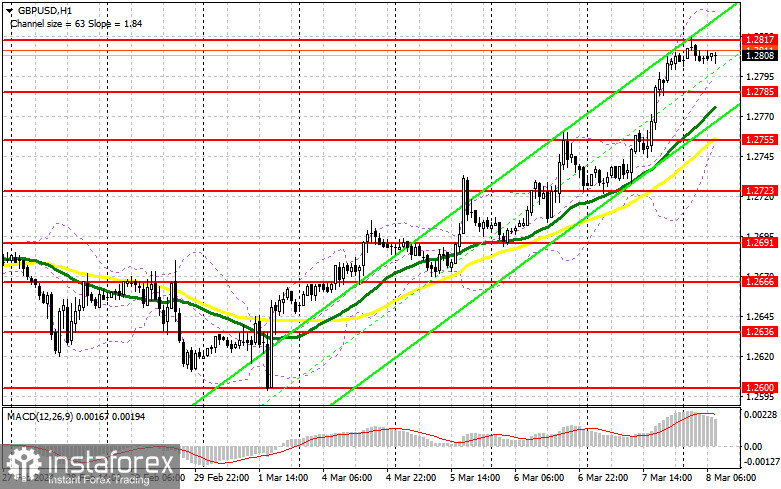

Today, the UK will not release any important reports, so the pound may continue to rise ahead of the U.S. data. We will talk more about it in the second half of the day. It is best to act on the bull market during corrective moves. In case the pair falls, I would prefer to act after a decline and a false breakdown close to the nearest support at 1.2785, formed later yesterday. This will give a good entry point for long positions in the expectation of supporting the uptrend with the prospect of testing 1.2817. It is a new resistance level, where buyers are sure to face serious problems. A breakout and consolidation above this range will strengthen the demand for the pound and open the way to 1.2853, which will boost bulls' positions, thus intensifying the uptrend. The farthest target is seen at the high of 1.2884, where I am going to take profit. In case of a decline and a lack of bullish activity at 1.2785, which is also in line with the moving averages, the pound may lose ground. In this case, only a false breakdown near the next support at 1.2755 will confirm the correct entry point. I plan to buy GBP/USD just after a rebound from the low of 1.2723, expecting a rise of 30–35 pips within the day.

What is needed to open short positions on GBP/USD

The bears felt extremely uncomfortable yesterday. Problems may arise in the first half of the day; it's enough to miss 1.2817. A false breakdown at this mark will confirm the sell signal, which will lead to selling with the target of a downward correction and a decline to 1.2785 - the support established yesterday. A breakout and an upward test of this range will deal a blow to bulls' positions, leading to the removal of stop orders and open the way to 1.2755, which is in line with the bullish moving averages. This is where I expect big buyers to show up. The farthest target will be the area of 1.2723, where they will take profits. If GBP/USD grows and there is no activity at 1.2817, buyers will feel the strength again in the expectation of an uptrend return. In this case, I will postpone selling until there is a false breakdown at 1.2853. If there is no downward movement there, I will sell GBP/USD just after a bounce from 1.2884, in anticipation of the pair declining by 30-35 pips intraday.

COT report:

According to the COT report (Commitment of Traders) for February 27, the number of both short and long positions increased. The latest inflation data and the statements of the Bank of England's officials that rates could be lowered even if inflation fails to reach the 2.0% target have become of secondary importance. Now, a lot will depend on the position of the Federal Reserve. US policymakers are concerned about the fact that inflation is no longer coming down as much as they would like, which could lengthen the cycle of high interest rates until late summer this year. This all is capping the pound's appreciation, thus boosting the US dollar. The latest COT report unveiled that long non-commercial positions rose by 4,368 to 91,970, while short non-commercial positions jumped by 4,322 to 45,612. As a result, the spread between long and short positions increased by 3,290.

Indicators' signals

Moving averages

The instrument is trading above the 30 and 50-day moving averages, which points to a possible rise in the pound.

Note: The period and prices of the moving averages are considered by the analyst on the 1-hour chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case GBP/USD goes down, the indicator's lower border near 1.2755 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.