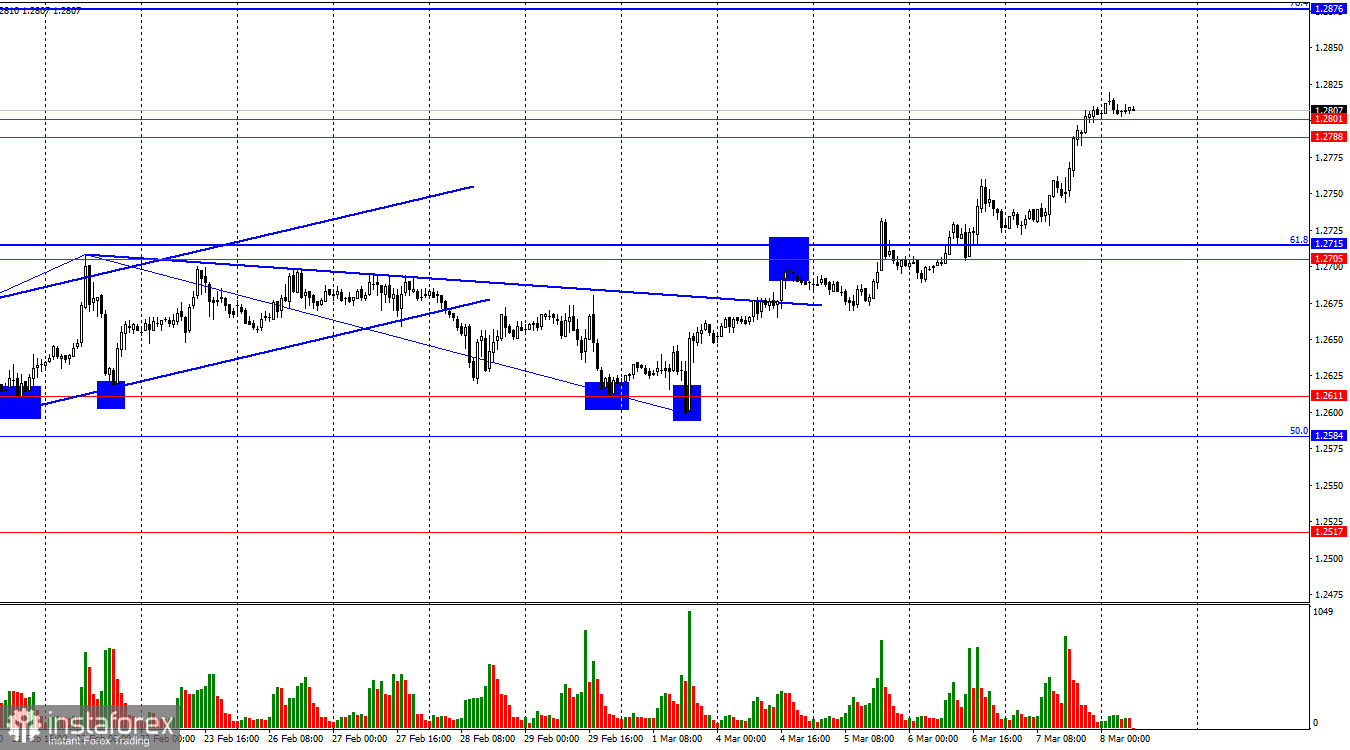

On the hourly chart, the GBP/USD pair continued its upward movement on Thursday and closed above the resistance zone of 1.2788–1.281 by the end of the day. Thus, the British pound's upward movement may now continue towards the next corrective level of 76.4%-1.2876. The pair's consolidation below the zone of 1.2788–1.281 would favor the US currency and lead to some decline towards the support zone of 1.2705–1.2715.

The wave situation has become a bit clearer. Recently, bulls have switched to an active offensive, and we have already seen three consecutive upward waves. The last upward wave managed to break the peak on February 22, so there are no signs of a trend change to "bearish" at the moment. The sideways movement seems to be complete, as the British pound has risen above all the peaks of the last few months. However, there is still a risk of a resumption of the sideways movement if bears switch to offensive from the current levels. In any case, in the current circumstances, a decline of the pair below the support zone of 1.2584–1.2611 will be required for me to say about a trend change to "bearish."

On Thursday, there was little news for the British pound, but bulls continued to buy it alongside the euro. Thus, the information background yesterday did not provide any support to buyers, which did not prevent them from holding their line. Today, much will depend on US statistics. Reports on wages, unemployment, and the labor market (nonfarm payrolls) can bring bulls back to earth, but strong values of indicators in the US and at least some activity from bears will be required for this. If sellers continue to take such a passive position, then no important data from the US will help them.

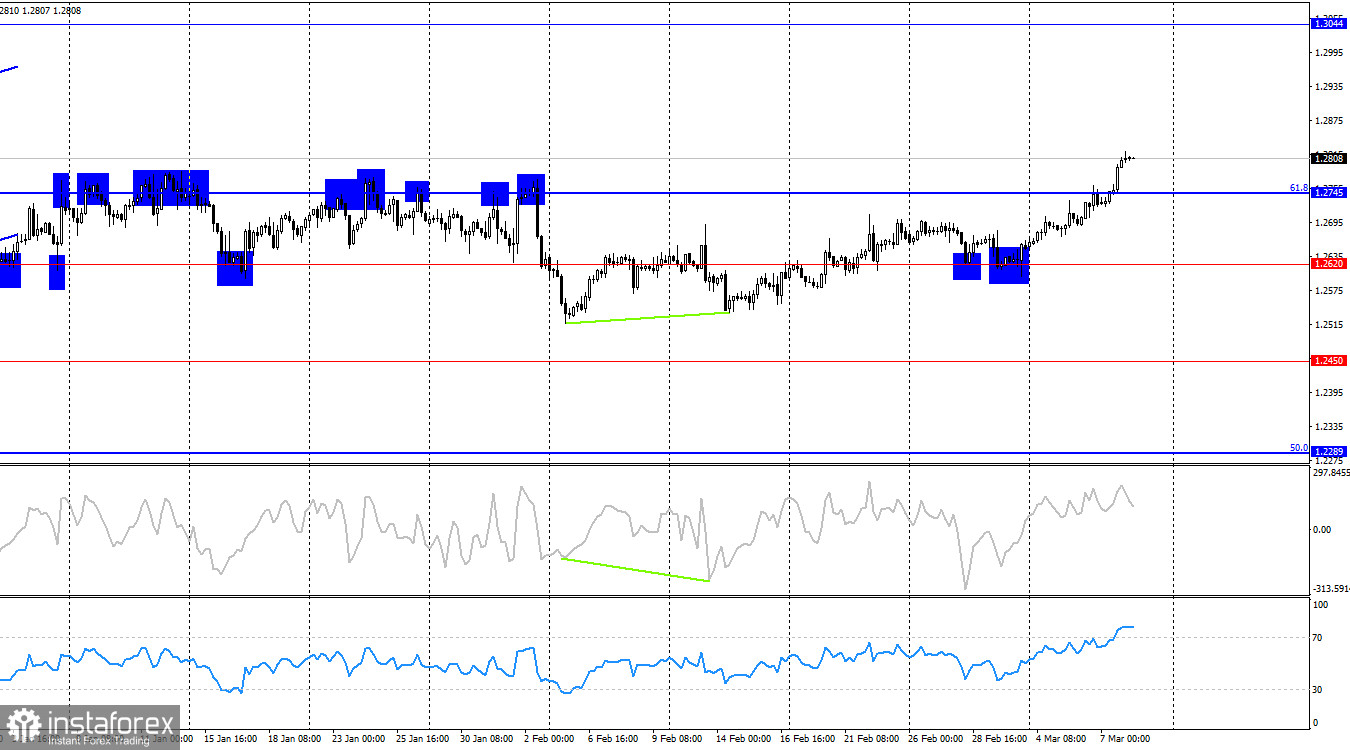

On the 4-hour chart, the pair consolidated above the corrective level of 61.8%-1.2745. This consolidation allows counting on further growth towards the level of 1.3044, but I believe that the risk of sideways movement still exists. The British pound has risen in recent weeks, practically without informational support. The strength of bulls may be running out. There are no impending divergences observed in any of the indicators today.

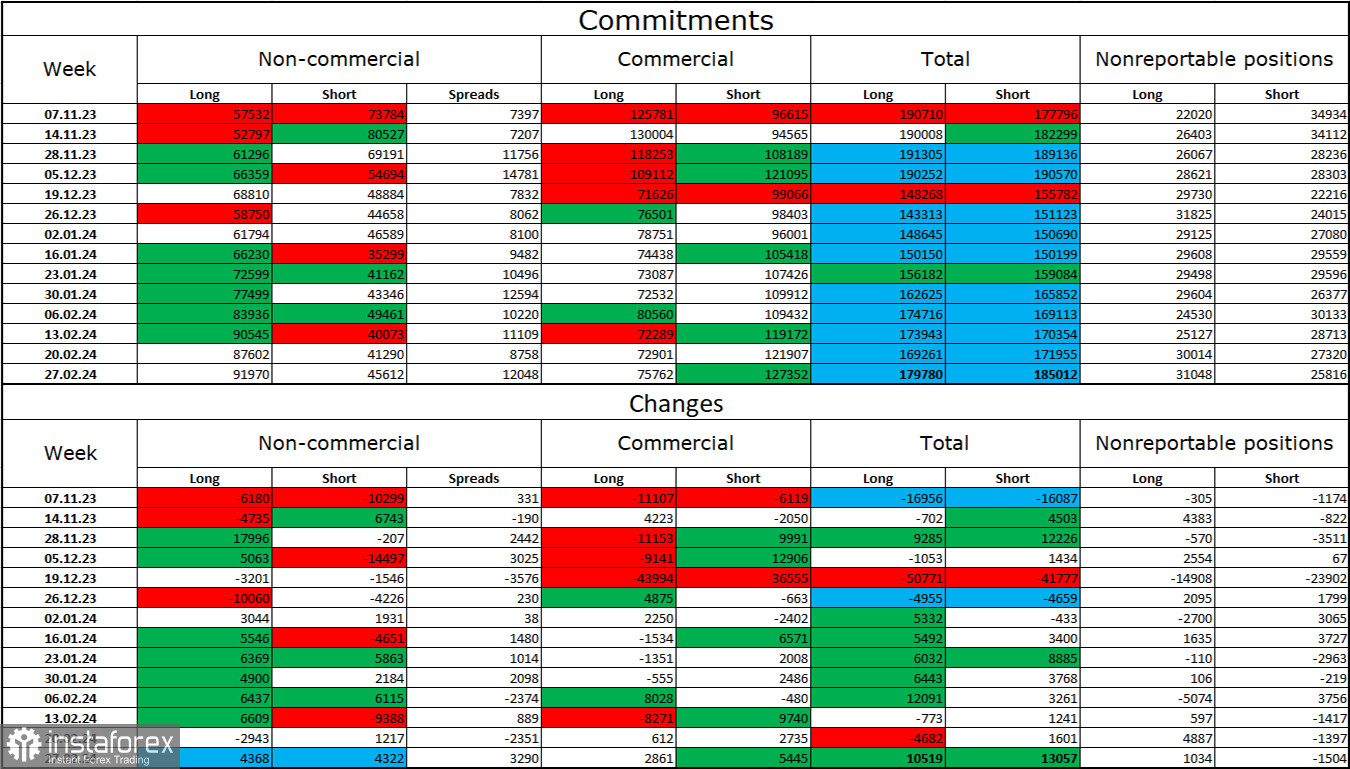

Commitments of Traders (COT) Report:

The sentiment in the "non-commercial" trader category has not changed over the past reporting week. The number of long contracts in the hands of speculators increased by 4368 units, and the number of short contracts increased by 4322 units. The overall sentiment of major players remains "bullish" and continues to strengthen, although I do not see any specific reasons for this. There is more than a twofold gap between the number of long and short contracts: 92 thousand against 45 thousand.

In my opinion, the British pound still has excellent prospects for decline. I believe that over time, bulls will start getting rid of buy positions, as all possible factors for buying the British pound have already been worked out. For three months, bulls have not been able to push the level of 1.2745, but bears also do not rush to go on the offensive and are generally very weak now. I also want to note that the total number of long and short positions has coincided for several months, indicating market equilibrium.

News Calendar for the US and the UK:

US - Nonfarm Payrolls (13:30 UTC).

US - Unemployment Rate (13:30 UTC).

US - Average Hourly Earnings (13:30 UTC).

On Friday, the economic events calendar contains three entries; all three are important. The impact of the information background on market sentiment today can be strong.

Forecast for GBP/USD and trader recommendations:

Selling the British pound can be considered when closing below the zone of 1.2788–1.281 on the hourly chart with the target zone of 1.2705–1.2715. Purchases were possible when closing on the hourly chart above the zone of 1.2705–1.2715, with a target of 1.2788–1.2801. This target has been worked out.